Pmjjby And Pmsby Presentation

| Introduction to PMJJBY and PMSBY | ||

|---|---|---|

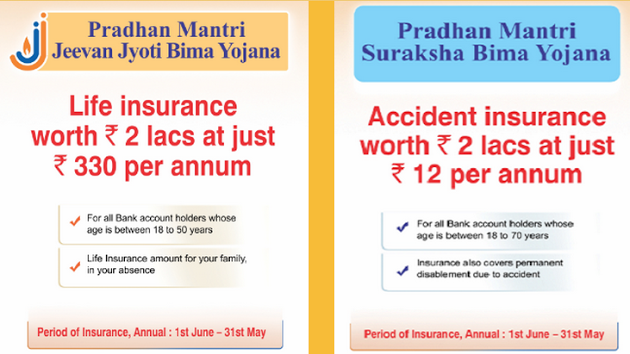

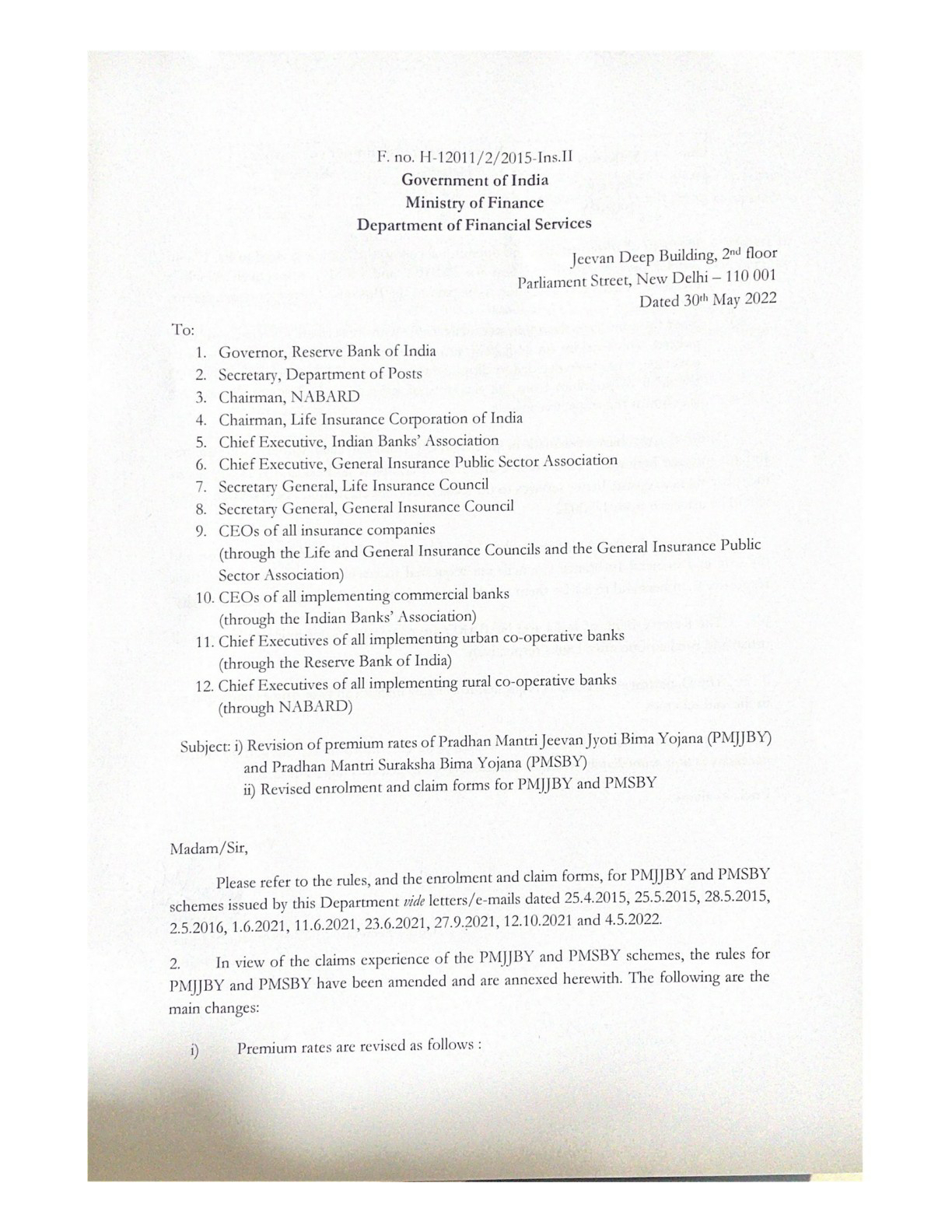

| PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana) and PMSBY (Pradhan Mantri Suraksha Bima Yojana) are social security schemes launched by the Government of India. PMJJBY provides life insurance coverage to individuals at an affordable premium. PMSBY provides accident insurance coverage to individuals at an affordable premium. | ||

| 1 | ||

| Eligibility Criteria for PMJJBY | ||

|---|---|---|

| The age group for PMJJBY is 18 to 50 years. The scheme is available to both rural and urban residents. Individuals must have a savings bank account to enroll in PMJJBY. | ||

| 2 | ||

| Benefits of PMJJBY | ||

|---|---|---|

| PMJJBY offers a life insurance coverage of Rs. 2 lakh in case of the insured person's death. The premium for PMJJBY is only Rs. 330 per annum. The scheme provides financial security to the insured person's family in case of unfortunate events. | ||

| 3 | ||

| Eligibility Criteria for PMSBY | ||

|---|---|---|

| The age group for PMSBY is 18 to 70 years. The scheme is available to both rural and urban residents. Individuals must have a savings bank account to enroll in PMSBY. | ||

| 4 | ||

| Benefits of PMSBY | ||

|---|---|---|

| PMSBY offers an accident insurance coverage of Rs. 2 lakh in case of death or permanent disability due to an accident. The premium for PMSBY is only Rs. 12 per annum. The scheme provides financial support to the insured person in case of accidental injuries. | ||

| 5 | ||

| Enrollment Process for PMJJBY and PMSBY | ||

|---|---|---|

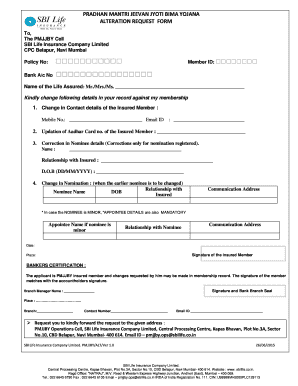

| Individuals can enroll in PMJJBY and PMSBY by filling out a simple application form. The premium for both schemes is auto-debited from the insured person's bank account. Enrollment in PMJJBY and PMSBY can be done through participating banks. | ||

| 6 | ||

| Importance of PMJJBY and PMSBY | ||

|---|---|---|

| PMJJBY and PMSBY provide affordable insurance coverage to a large population, especially those from low-income backgrounds. These schemes promote financial inclusion and help individuals safeguard their families' future. PMJJBY and PMSBY contribute to the government's vision of social security for all. | ||

| 7 | ||

| Claim Process for PMJJBY and PMSBY | ||

|---|---|---|

| In case of a claim, the nominee or legal heir of the insured person must inform the bank and submit the required documents. The claim settlement process is simple and efficient. The claim amount is directly credited to the nominee's bank account. | ||

| 8 | ||

| Success of PMJJBY and PMSBY | ||

|---|---|---|

| PMJJBY and PMSBY have witnessed significant success since their launch in 2015. Millions of individuals have enrolled in these schemes, providing them with insurance coverage and financial security. The success of these schemes highlights the importance of social security measures in India. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| PMJJBY and PMSBY are crucial social security schemes that provide affordable insurance coverage to individuals in India. These schemes help in protecting families from unforeseen circumstances and promote financial inclusion. The government's efforts to ensure social security for all are commendable through PMJJBY and PMSBY. | ||

| 10 | ||