Financial Sectors Presentation

| Introduction to Financial Sectors | ||

|---|---|---|

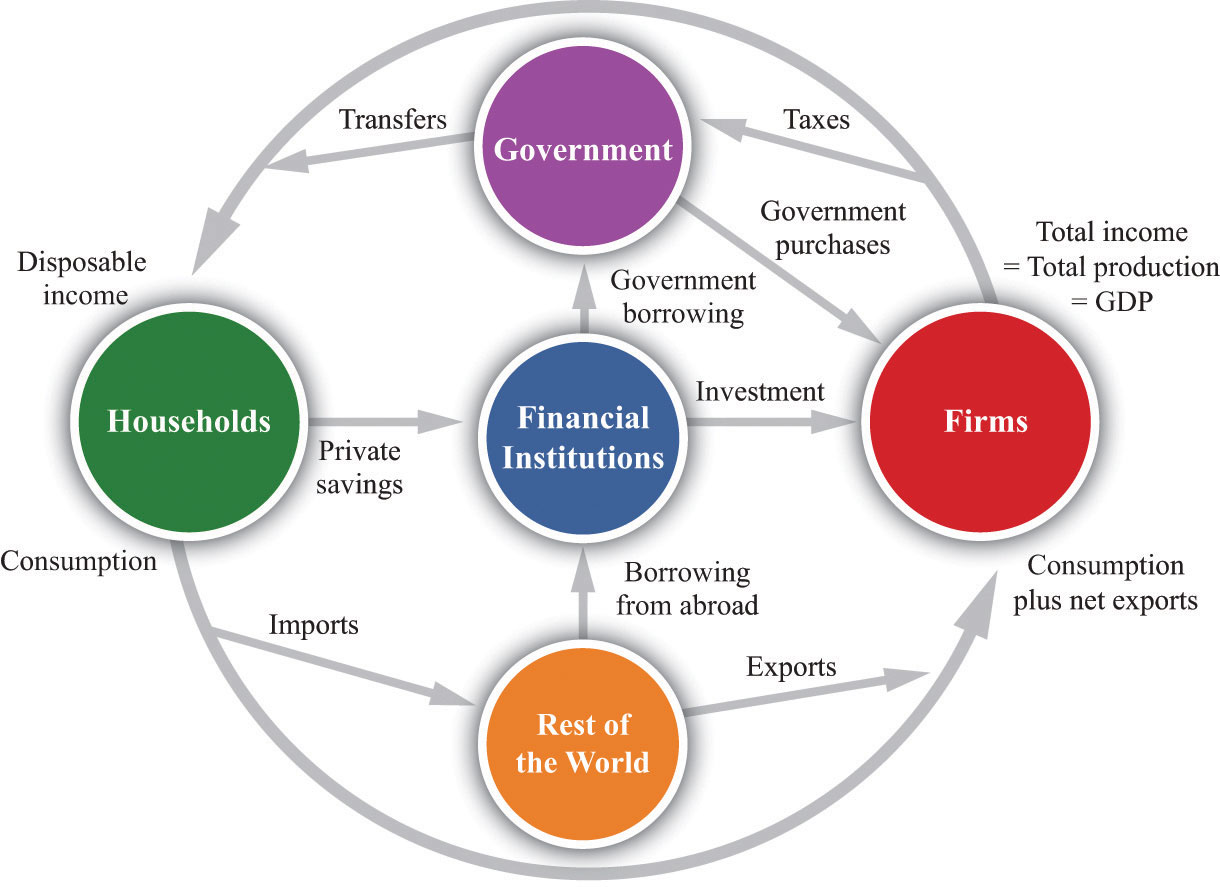

| Financial sectors are the different segments or industries within the overall financial system. They play a crucial role in facilitating the flow of funds between savers and borrowers. The financial sectors include banking, insurance, investment, and regulatory institutions. | ||

| 1 | ||

| Banking Sector | ||

|---|---|---|

| The banking sector provides financial services, such as accepting deposits, lending money, and facilitating payments. Banks are regulated by central banks and provide crucial services to individuals, businesses, and governments. Commercial banks, investment banks, and credit unions are examples of institutions within the banking sector. | ||

| 2 | ||

| Insurance Sector | ||

|---|---|---|

| The insurance sector offers protection against financial losses by providing various types of insurance policies. Insurance companies assess risks and charge premiums to provide coverage for individuals and businesses. Life insurance, health insurance, property insurance, and auto insurance are examples of products offered in the insurance sector. | ||

| 3 | ||

| Investment Sector | ||

|---|---|---|

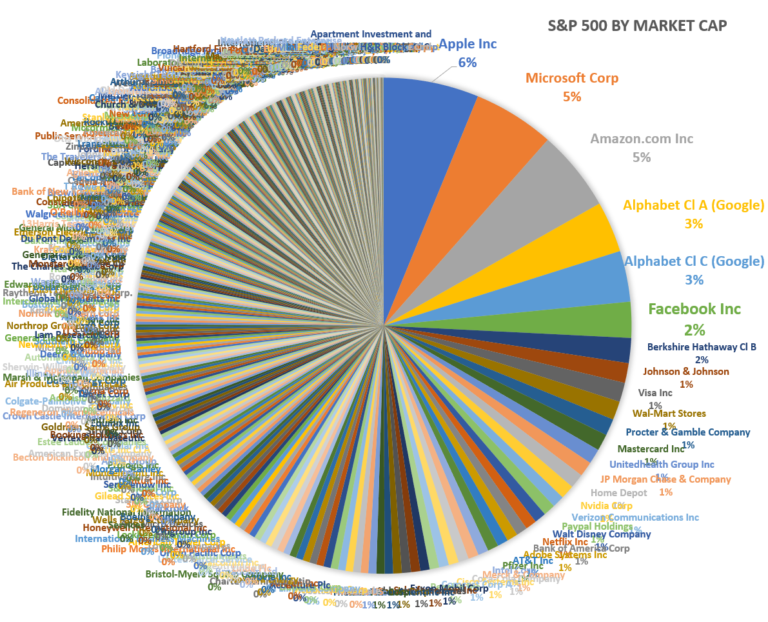

| The investment sector involves the buying and selling of financial instruments, such as stocks, bonds, and derivatives. Investment banks, asset management firms, and brokerage companies operate within this sector. The investment sector helps individuals and organizations grow their wealth by making profitable investment decisions. | ||

| 4 | ||

| Regulatory Sector | ||

|---|---|---|

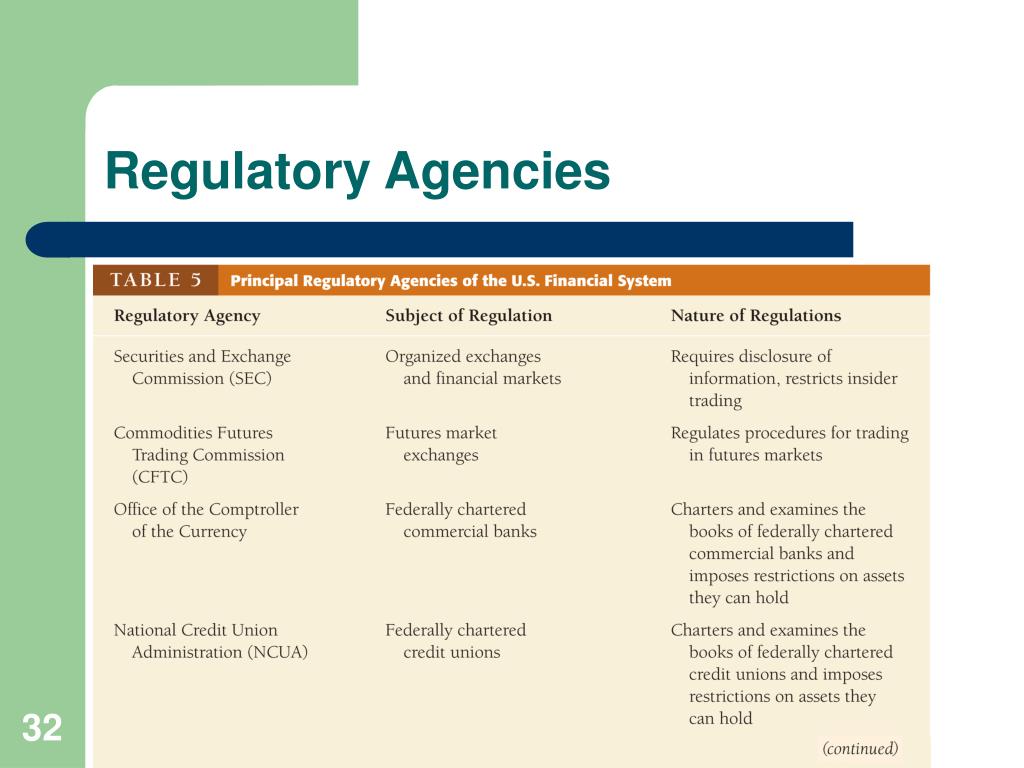

| The regulatory sector consists of government agencies and organizations that oversee and regulate the financial industry. Regulatory bodies ensure compliance with laws, protect consumers, and maintain stability in the financial system. Examples of regulatory bodies include the Securities and Exchange Commission (SEC) and the Financial Conduct Authority (FCA). | ||

| 5 | ||

| Interconnectedness of Sectors | ||

|---|---|---|

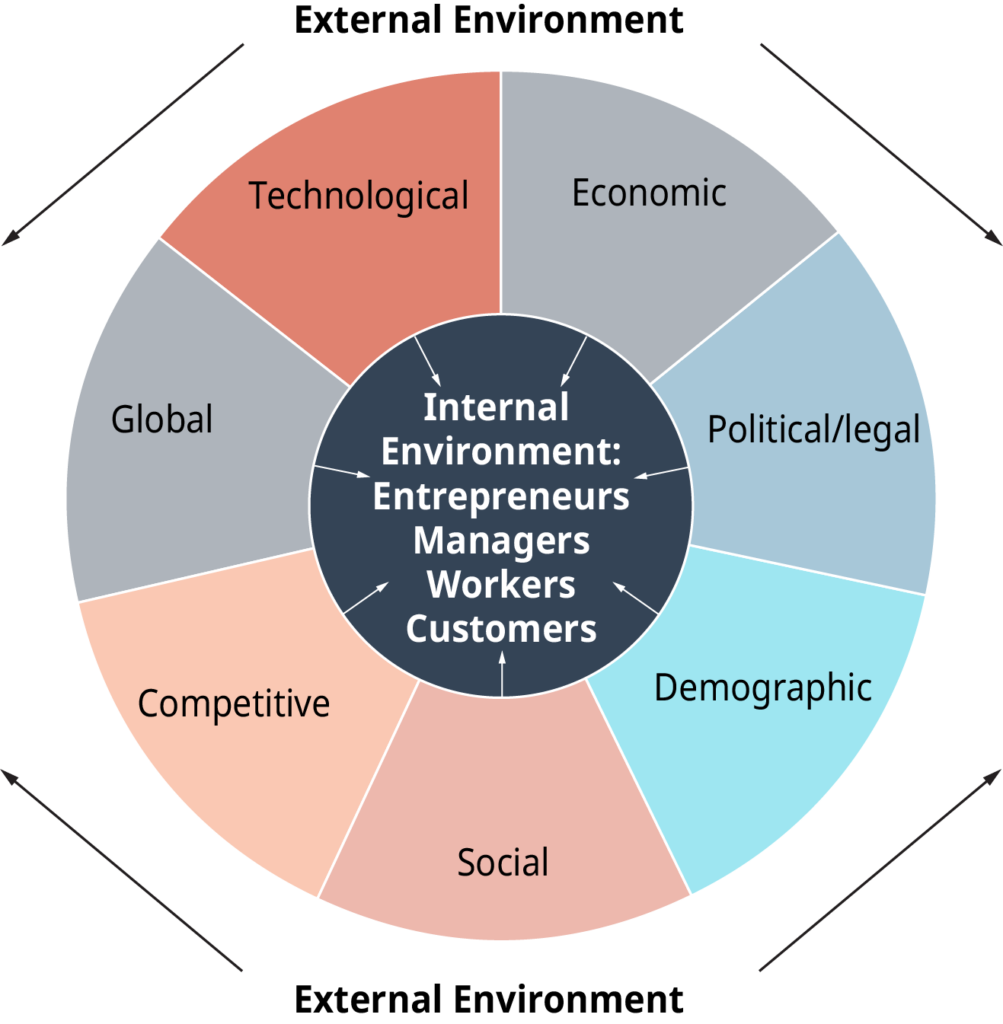

| Financial sectors are interconnected and rely on each other to function effectively. Banks rely on the investment sector for capital market activities, while investment firms rely on banks for financing. Insurance companies invest in the investment sector to generate returns and manage risk. | ||

| 6 | ||

| Importance of Financial Sectors | ||

|---|---|---|

| Financial sectors are essential for economic growth, as they facilitate capital allocation and provide financial stability. They contribute to job creation, wealth generation, and the overall functioning of the economy. Sound and well-regulated financial sectors are crucial for attracting domestic and foreign investments. | ||

| 7 | ||

| Challenges in Financial Sectors | ||

|---|---|---|

| Financial sectors face challenges such as regulatory compliance, cybersecurity threats, and market volatility. Adapting to technological advancements and digital transformation is vital for the sustainability of financial sectors. Ensuring financial inclusion and addressing income inequality are ongoing challenges within the financial sectors. | ||

| 8 | ||

| Global Financial Sectors | ||

|---|---|---|

| Financial sectors exist in every country and are interconnected globally. Global financial sectors face challenges related to international regulations, cross-border transactions, and exchange rate fluctuations. International cooperation and coordination are necessary to address global financial sector challenges effectively. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Financial sectors are crucial for the functioning of economies and play a significant role in allocating capital and managing risks. The banking, insurance, investment, and regulatory sectors work together to ensure the stability and growth of the financial system. Continuous innovation, adaptability, and effective regulation are essential for the future success of financial sectors. | ||

| 10 | ||

| References (download PPTX file for details) | ||

|---|---|---|

| Investopedia. (2021). Financial Sector Defini... World Bank. (2021). Financial Sector. Retriev... Your third bullet... |  | |

| 11 | ||