Working Capital Management's Presentation

| Introduction to Working Capital Management | ||

|---|---|---|

| Working capital management refers to the management of a company's short-term assets and liabilities. It involves managing the cash, inventory, accounts receivable, and accounts payable of a business. Effective working capital management is crucial for maintaining a company's financial health and liquidity. | ||

| 1 | ||

| Importance of Working Capital Management | ||

|---|---|---|

| Efficient working capital management ensures that a company has enough liquidity to meet its short-term obligations. It helps in optimizing the company's cash flows and minimizing the need for external financing. Proper management of working capital can lead to improved profitability and operational efficiency. | ||

| 2 | ||

| Components of Working Capital | ||

|---|---|---|

| Cash: The most liquid asset that represents the funds available for immediate use. Inventory: The goods or materials held by a company for production or sale. Accounts Receivable: The amount of money owed to a company by its customers for goods or services provided. | ||

| 3 | ||

| Working Capital Ratios | ||

|---|---|---|

| Current Ratio: Current assets divided by current liabilities. It indicates a company's ability to meet its short-term obligations. Quick Ratio: (Current Assets - Inventory) divided by current liabilities. It measures a company's ability to pay its short-term obligations without relying on inventory sales. Cash Conversion Cycle: The time it takes for a company to convert its investments in inventory and other resources back into cash flow from sales. | ||

| 4 | ||

| Strategies for Effective Working Capital Management | ||

|---|---|---|

| Cash Flow Forecasting: Regularly monitoring and forecasting cash inflows and outflows to anticipate and address any shortfalls. Inventory Management: Optimizing inventory levels to avoid excess or shortage, reducing holding costs and improving cash flow. Credit and Collection Policies: Implementing effective credit policies, monitoring receivables, and collecting payments timely. | ||

| 5 | ||

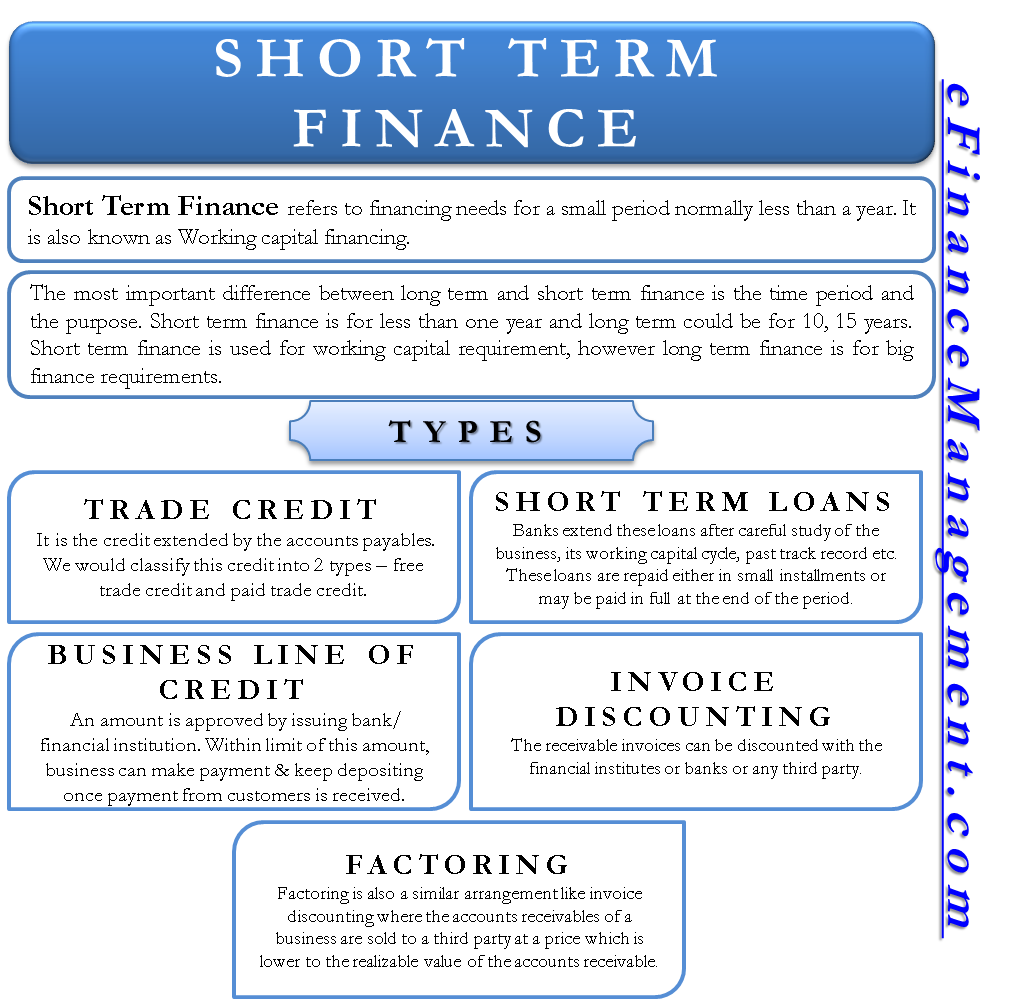

| Working Capital Financing Options | ||

|---|---|---|

| Short-Term Loans: Borrowing funds from financial institutions to meet short-term working capital needs. Trade Credit: Delaying payment to suppliers while maintaining good relationships and negotiating favorable terms. Factoring: Selling accounts receivable to a third party at a discount to receive immediate cash. | ||

| 6 | ||

| Challenges in Working Capital Management | ||

|---|---|---|

| Seasonal Variations: Businesses with seasonal fluctuations may face challenges in managing cash flow and inventory levels. Economic Conditions: Changes in the economic environment can impact customer demand, payment behavior, and access to financing. Supply Chain Disruptions: Disruptions in the supply chain can affect inventory availability and impact working capital management. | ||

| 7 | ||

| Best Practices for Working Capital Management | ||

|---|---|---|

| Regular Monitoring: Continuously tracking and analyzing key working capital indicators to identify potential issues or areas for improvement. Efficient Cash Conversion Cycle: Streamlining processes to reduce the time it takes to convert inventory and receivables into cash. Effective Cash Flow Forecasting: Utilizing accurate and reliable forecasting techniques to anticipate cash flow needs and plan accordingly. | ||

| 8 | ||

| Case Study Example | ||

|---|---|---|

| XYZ Company reduced its inventory holding period by implementing a just-in-time inventory management system. ABC Company improved its cash flow by renegotiating payment terms with suppliers and implementing stricter credit policies. DEF Company optimized its working capital by implementing automated invoicing and collections processes, reducing payment delays. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Effective working capital management is vital for the financial health and success of a business. It involves managing cash, inventory, receivables, and payables to optimize liquidity and profitability. By implementing best practices and strategies, businesses can improve their working capital management and achieve sustainable growth. | ||

| 10 | ||

| References (download PPTX file for details) | ||

|---|---|---|

| Jain, P. K. (2016). Working Capital Managemen... Deloof, M. (2003). Does Working Capital Manag... Eljelly, A. M. (2004). Liquidity-profitabilit... |  | |

| 11 | ||

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)