Types Of Cost Presentation

| Types of Cost | ||

|---|---|---|

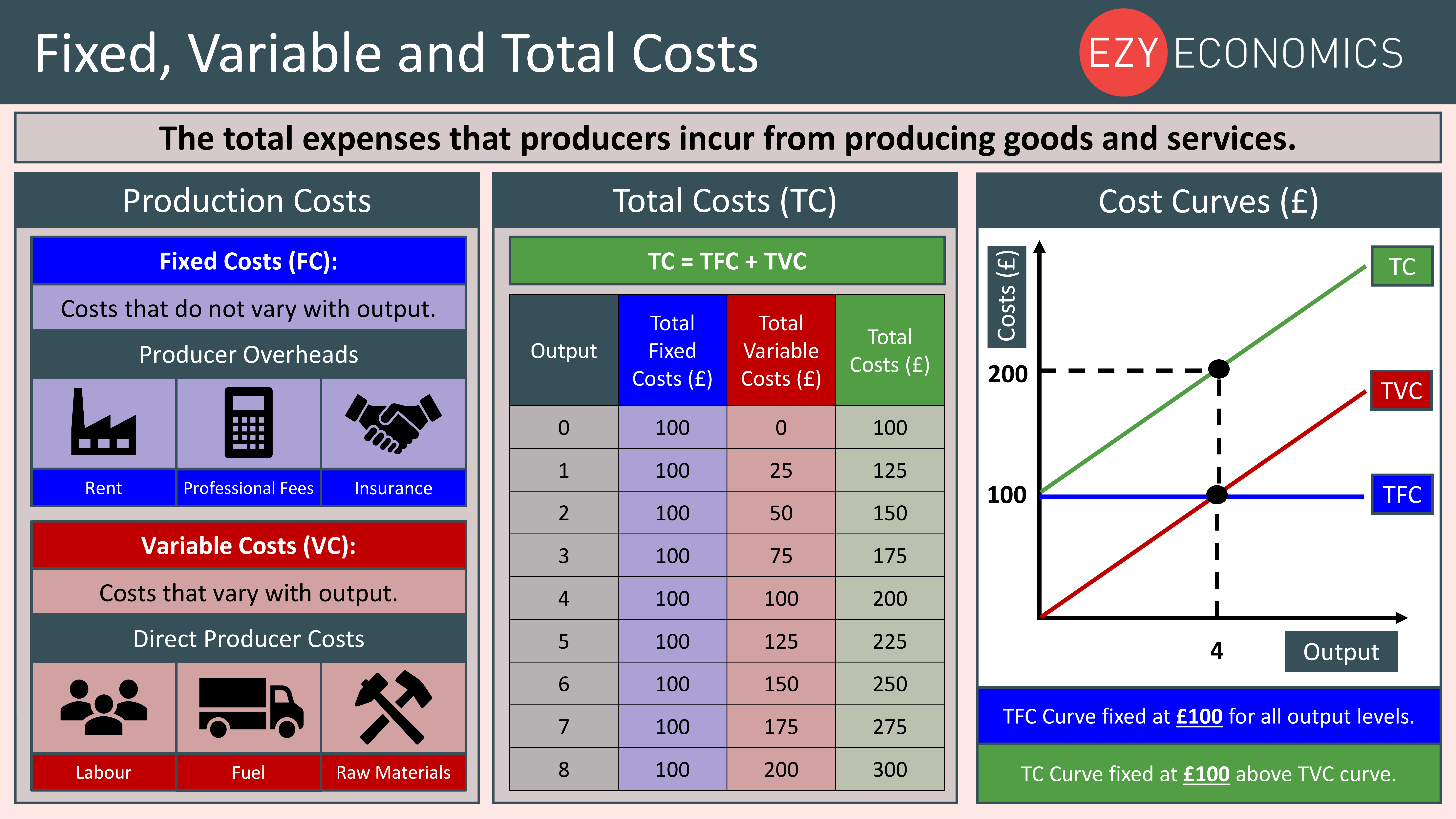

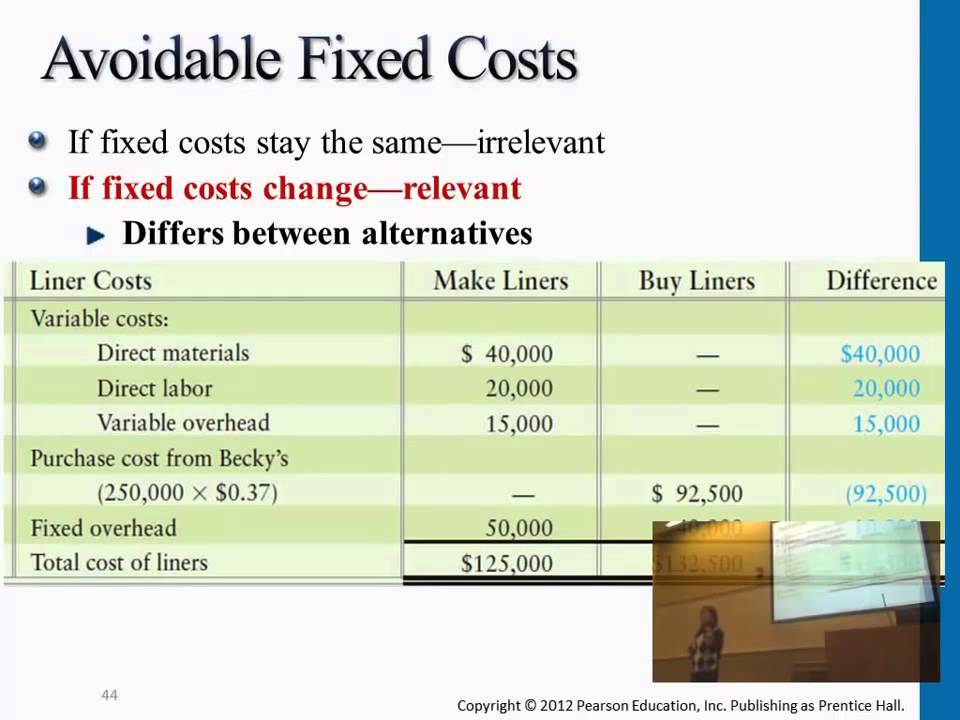

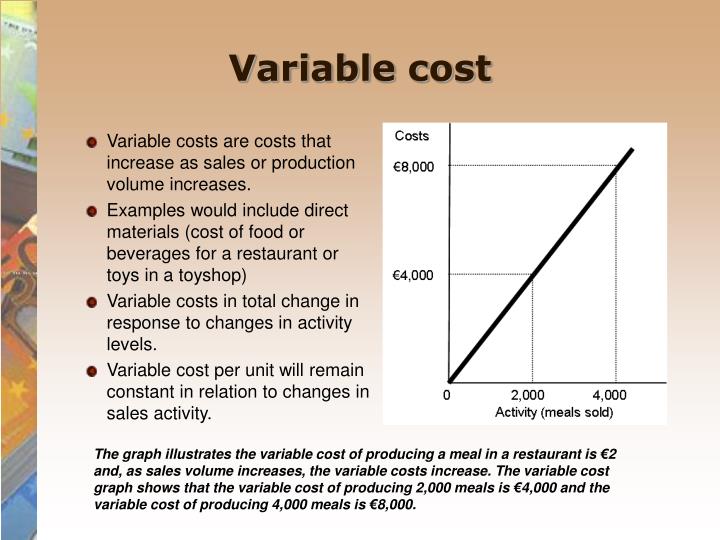

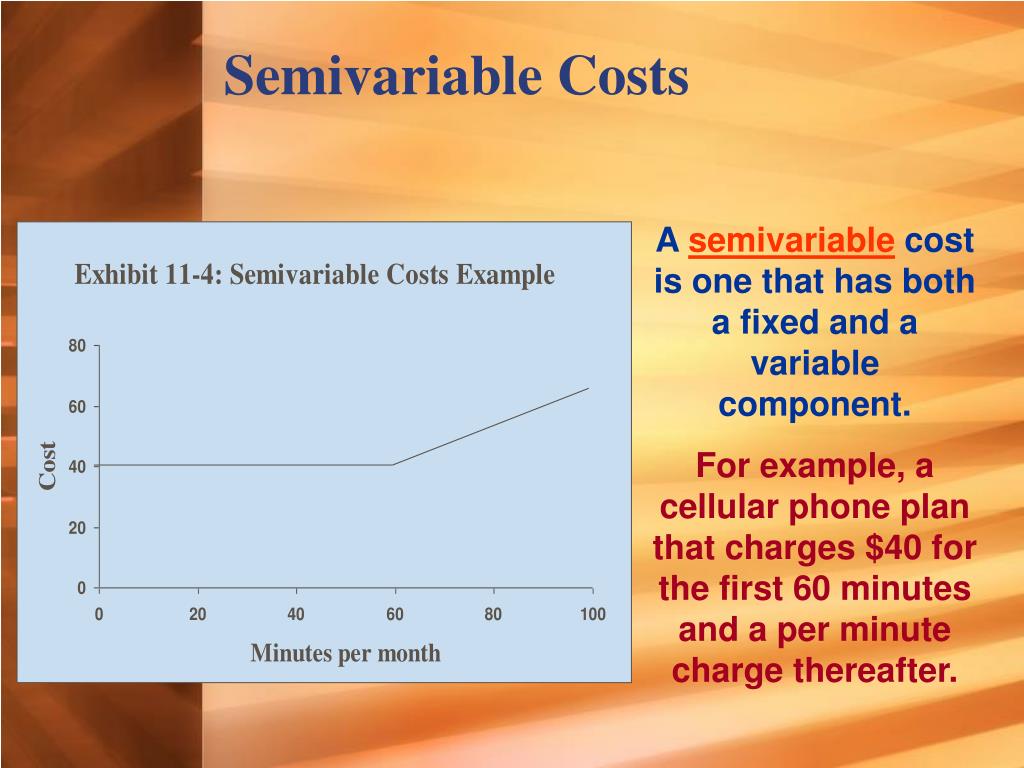

| Fixed Cost: Costs that do not change with the level of production or sales, such as rent, insurance, or salaries. Variable Cost: Costs that change in direct proportion to the level of production or sales, such as raw materials or direct labor. Semi-variable Cost: Costs that have both fixed and variable components, such as utility bills or maintenance costs. | ||

| 1 | ||

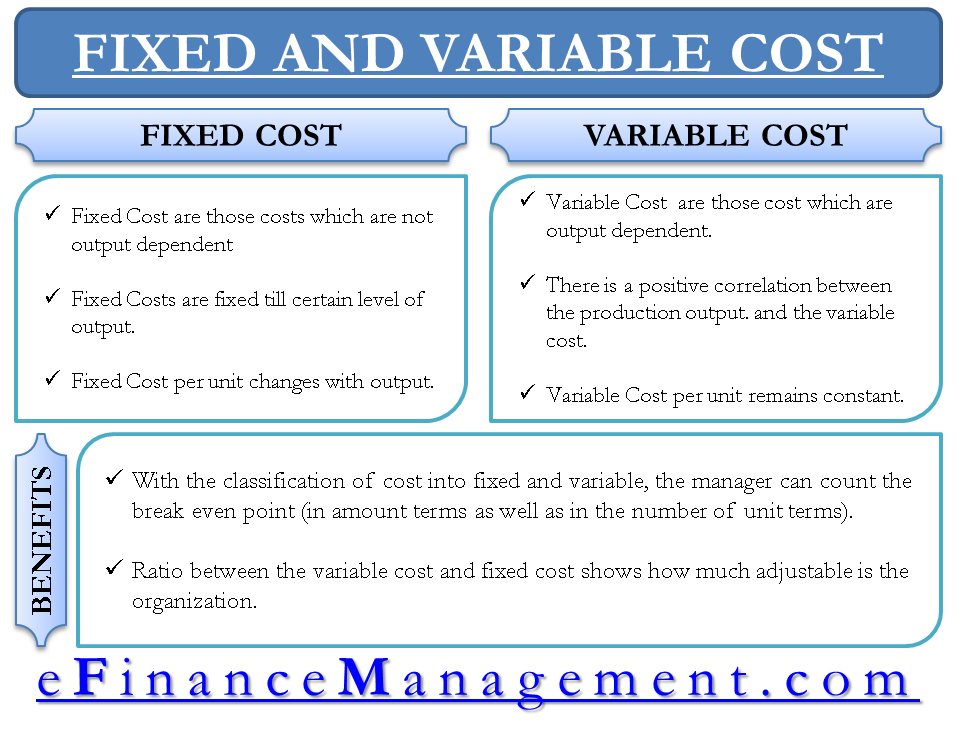

| Fixed Cost | ||

|---|---|---|

| Fixed costs are not affected by changes in production or sales volume. These costs remain constant over a specific period, regardless of output. Examples of fixed costs include rent, property taxes, and depreciation. | ||

| 2 | ||

| Variable Cost | ||

|---|---|---|

| Variable costs change with the level of production or sales. These costs increase or decrease in direct proportion to the volume of output. Examples of variable costs include raw materials, direct labor, and sales commissions. | ||

| 3 | ||

| Semi-variable Cost | ||

|---|---|---|

| Semi-variable costs have both fixed and variable components. They have a fixed portion that remains constant and a variable portion that changes with production or sales volume. Examples of semi-variable costs include utility bills, maintenance costs, and telephone bills. | ||

| 4 | ||

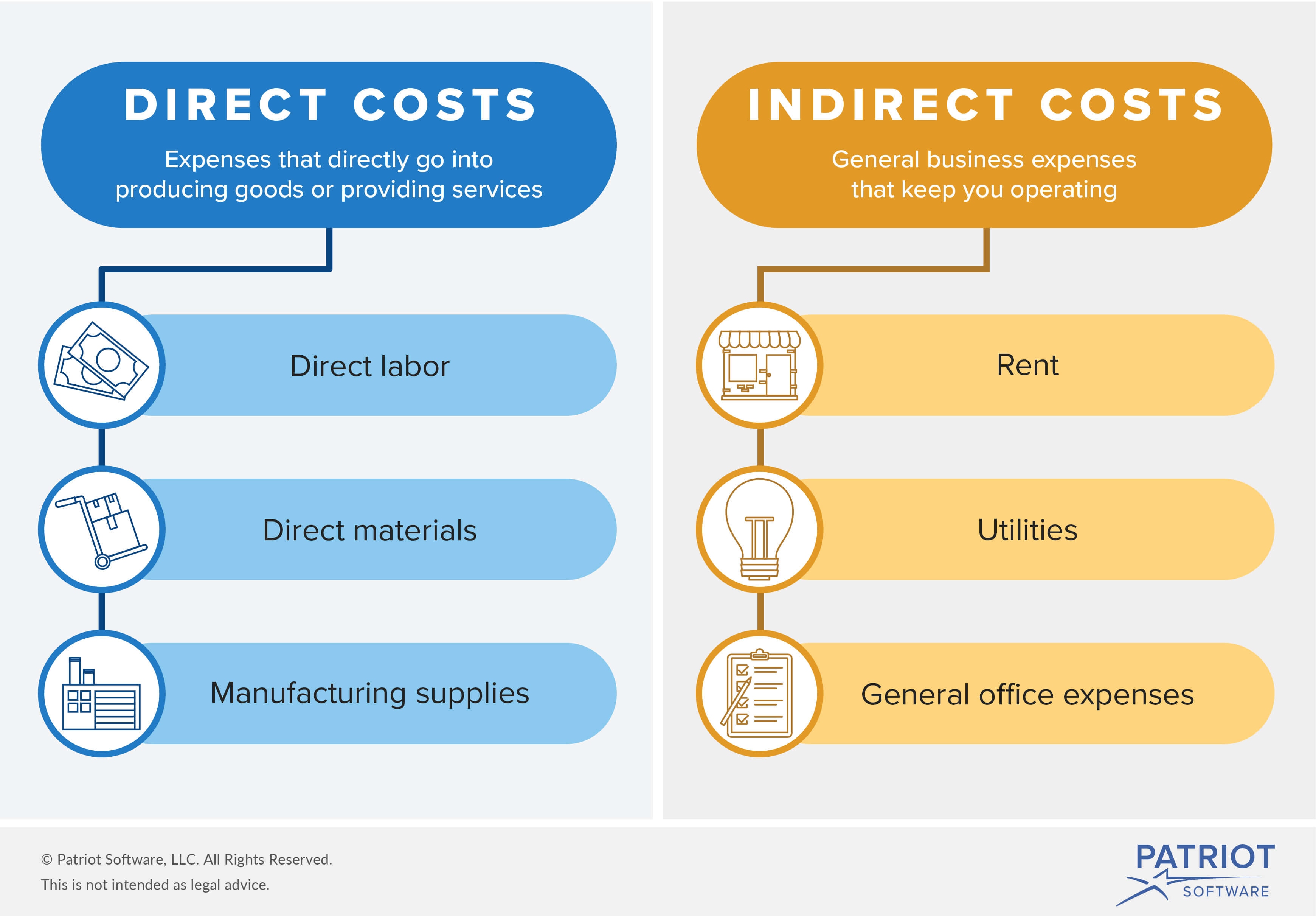

| Direct Cost | ||

|---|---|---|

| Direct costs are expenses that can be specifically attributed to a particular product or service. These costs are directly related to the production or delivery of a specific item or service. Examples of direct costs include direct materials and direct labor. | ||

| 5 | ||

| Indirect Cost | ||

|---|---|---|

| Indirect costs are expenses that cannot be directly attributed to a specific product or service. These costs are incurred for the overall operation of a business and are allocated to various products or services. Examples of indirect costs include rent, utilities, and administrative salaries. | ||

| 6 | ||

| Opportunity Cost | ||

|---|---|---|

| Opportunity cost is the value of the next best alternative that is forgone when a decision is made. It represents the potential benefits or profits that could have been obtained from an alternative course of action. Examples of opportunity costs include the potential revenue from choosing a different product line or investment opportunity. | ||

| 7 | ||

| Sunk Cost | ||

|---|---|---|

| Sunk costs are expenses that have already been incurred and cannot be recovered. These costs should not be considered in decision-making as they are irrelevant to future actions. Examples of sunk costs include research and development costs for a failed project or non-refundable deposits. | ||

| 8 | ||

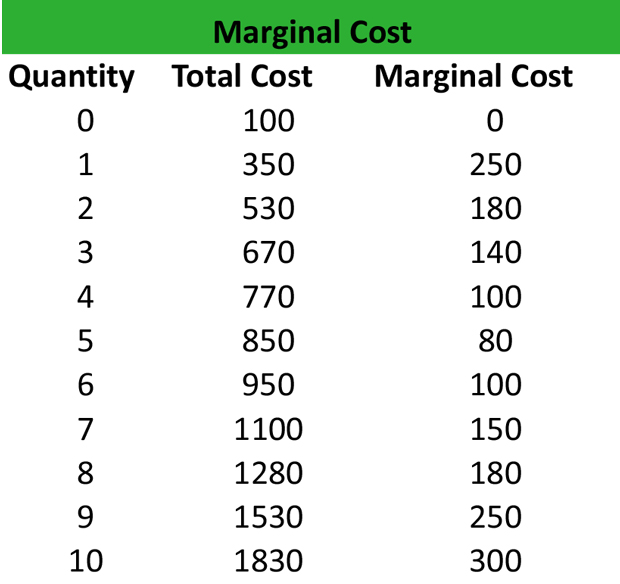

| Marginal Cost | ||

|---|---|---|

| Marginal cost is the change in total cost resulting from producing one additional unit of output. It helps in determining the optimal level of production by comparing the additional cost to the additional revenue generated. Marginal costs include the cost of additional raw materials, labor, or energy required for one extra unit of production. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Understanding the different types of cost is crucial for effective financial management. Fixed costs, variable costs, and semi-variable costs play a significant role in determining a company's profitability. By analyzing costs accurately, businesses can make informed decisions and optimize their operations. | ||

| 10 | ||