Subsidary Books Presentation

| Introduction to Subsidiary Books | ||

|---|---|---|

| Subsidiary books are a type of accounting record used to maintain detailed and organized financial information. They are also known as subsidiary ledgers or special journals. Subsidiary books are used to record specific types of transactions separately, facilitating easy access and analysis. | ||

| 1 | ||

| Types of Subsidiary Books | ||

|---|---|---|

| Cash Book: Used to record all cash transactions, including receipts and payments, in chronological order. Sales Day Book: Records all credit sales made on a daily basis. Purchase Day Book: Records all credit purchases made on a daily basis. | ||

| 2 | ||

| Types of Subsidiary Books (contd.) | ||

|---|---|---|

| Sales Return Book: Records all goods returned by customers. Purchase Return Book: Records all goods returned to suppliers. Bills Receivable Book: Records all bills received from customers. | ||

| 3 | ||

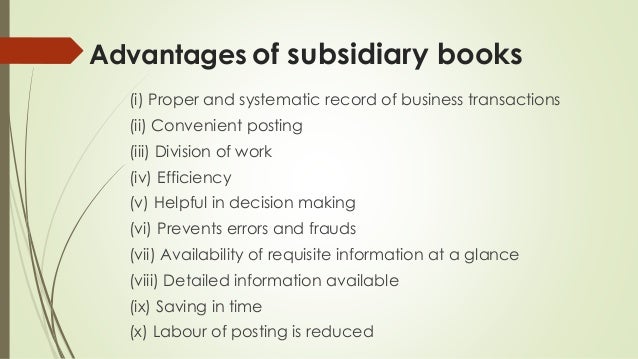

| Advantages of Subsidiary Books | ||

|---|---|---|

| Enhanced efficiency: Subsidiary books help streamline the recording process by categorizing transactions. Increased accuracy: By recording transactions separately, errors can be easily identified and rectified. Easy analysis: Subsidiary books provide a clear overview of specific types of transactions, allowing for better analysis and decision-making. | ||

| 4 | ||

| Cash Book | ||

|---|---|---|

| The cash book is a crucial subsidiary book that records all cash transactions. It includes receipts from customers, payments to suppliers, and other cash-related transactions. It helps in maintaining cash control and preparing bank reconciliation statements. | ||

| 5 | ||

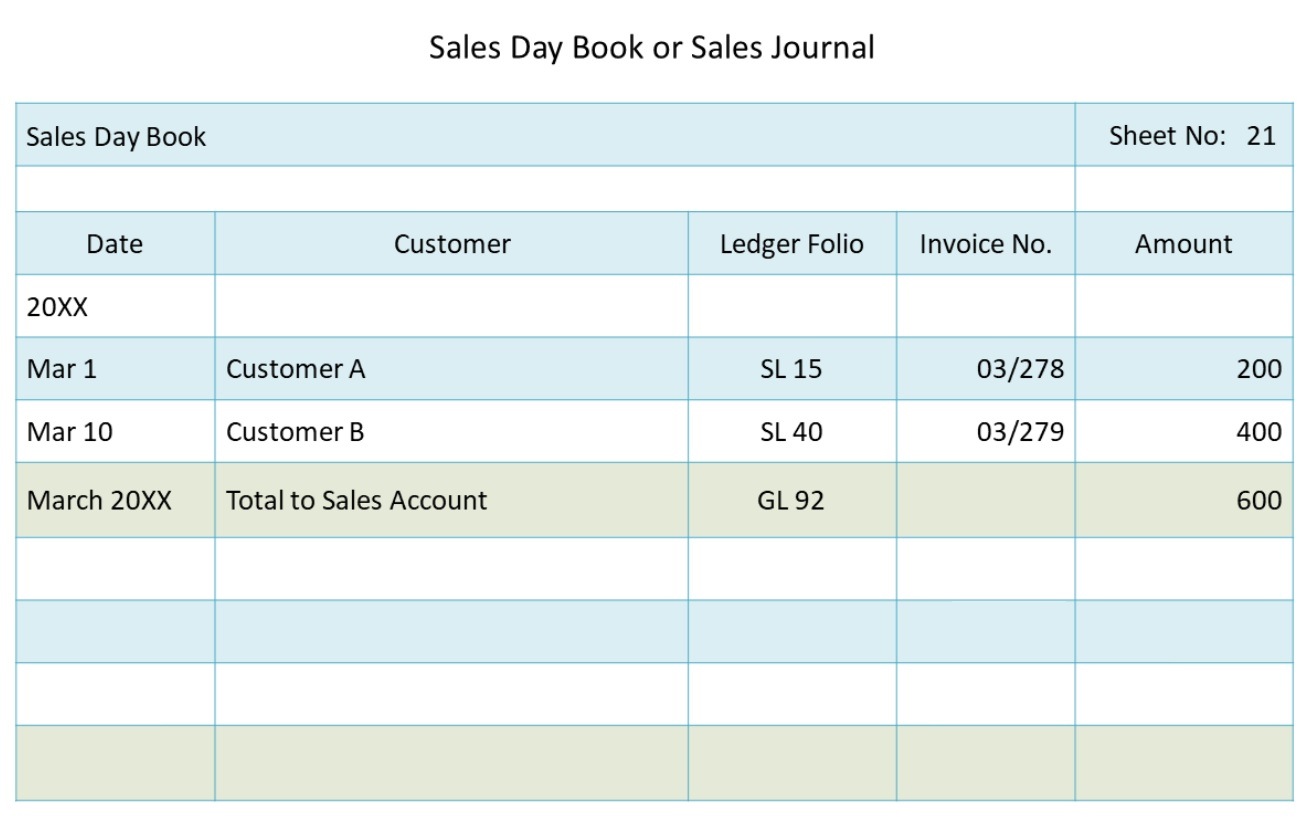

| Sales Day Book | ||

|---|---|---|

| The sales day book records all credit sales made by the business on a daily basis. It includes details such as the date of sale, customer name, invoice number, and amount. It helps in tracking sales, calculating sales commissions, and monitoring customer credit limits. | ||

| 6 | ||

| Purchase Day Book | ||

|---|---|---|

| The purchase day book records all credit purchases made by the business on a daily basis. It includes details such as the date of purchase, supplier name, invoice number, and amount. It helps in tracking purchases, managing supplier accounts, and ensuring timely payment. | ||

| 7 | ||

| Sales Return Book and Purchase Return Book | ||

|---|---|---|

| The sales return book records all goods returned by customers. The purchase return book records all goods returned to suppliers. Both books include details such as the date of return, customer/ supplier name, invoice number, and amount. | ||

| 8 | ||

| Bills Receivable Book and Bills Payable Book | ||

|---|---|---|

| The bills receivable book records all bills received from customers. The bills payable book records all bills payable to suppliers. Both books include details such as the date of the bill, party name, bill number, amount, and due date. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Subsidiary books play a vital role in maintaining accurate and organized financial records. They provide detailed information about specific types of transactions, facilitating efficient analysis and decision-making. By using subsidiary books, businesses can enhance their accounting processes and improve overall financial management. | ||

| 10 | ||