Spot Price Presentation

| Introduction to Spot Price | ||

|---|---|---|

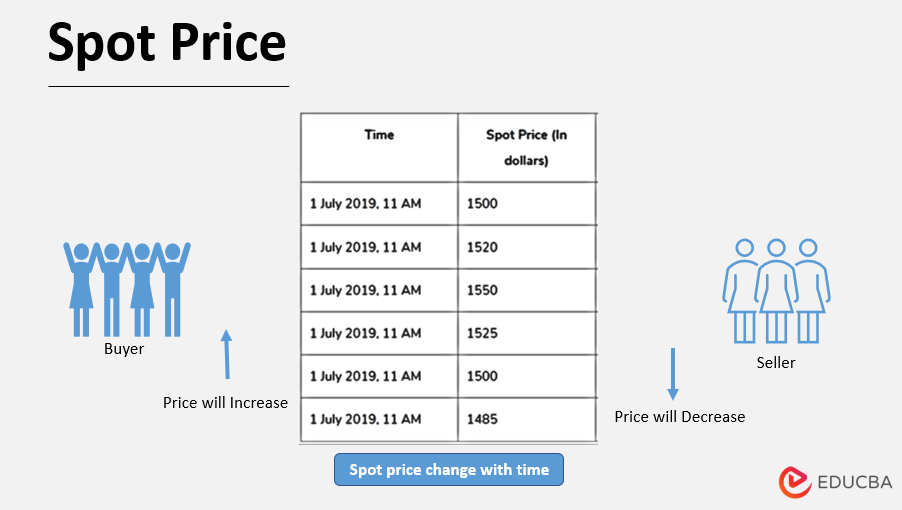

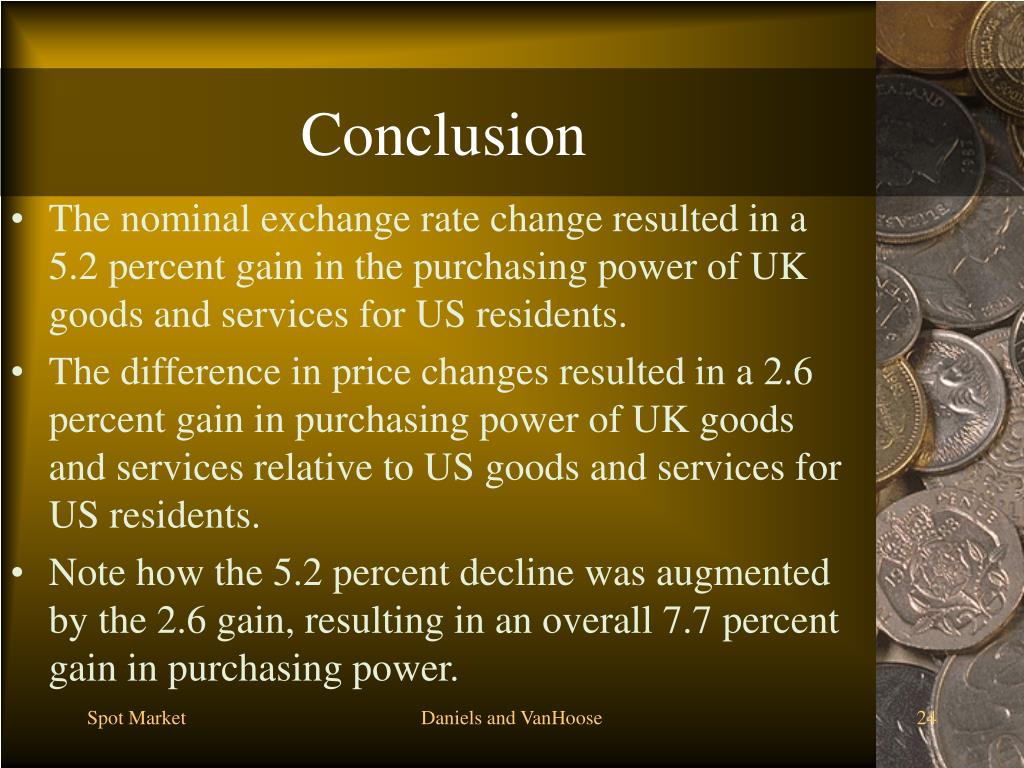

| The spot price is the current market price at which an asset can be bought or sold for immediate delivery. It is determined by supply and demand dynamics in the market. Spot prices are commonly used in commodities, currencies, and financial markets. | ||

| 1 | ||

| Factors Influencing Spot Price | ||

|---|---|---|

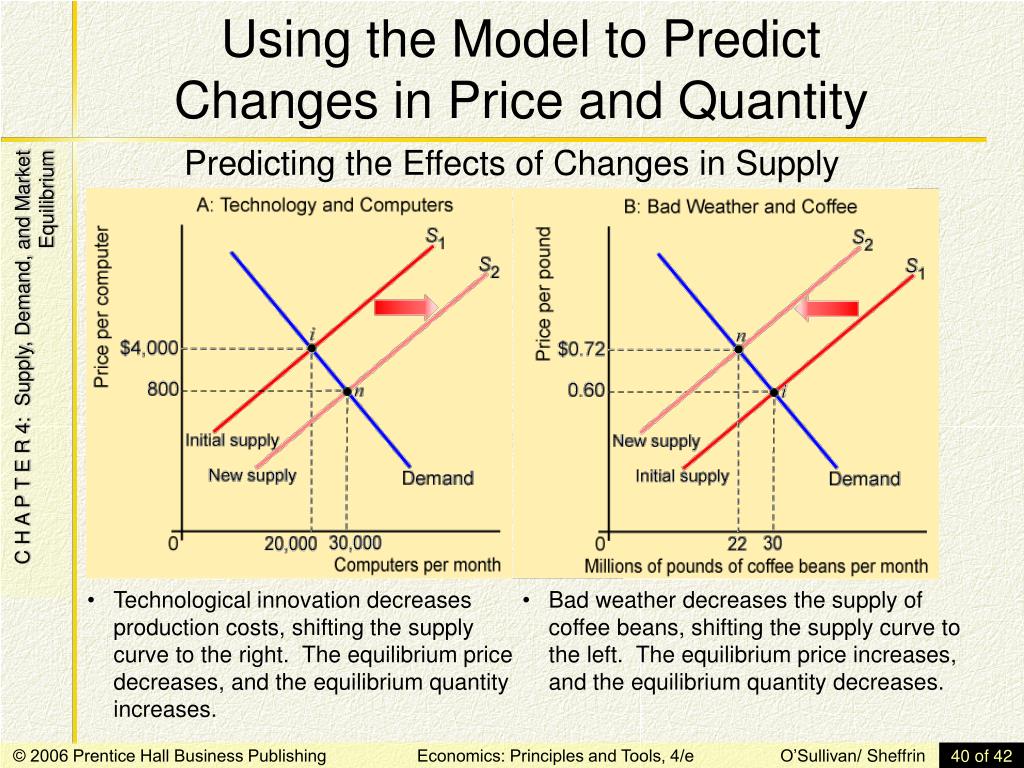

| Supply and demand: Changes in supply or demand can impact spot prices. Market sentiment: Investor perception and expectations can drive spot prices. Economic indicators: Factors like inflation, interest rates, and GDP growth can influence spot prices. | ||

| 2 | ||

| Importance of Spot Price | ||

|---|---|---|

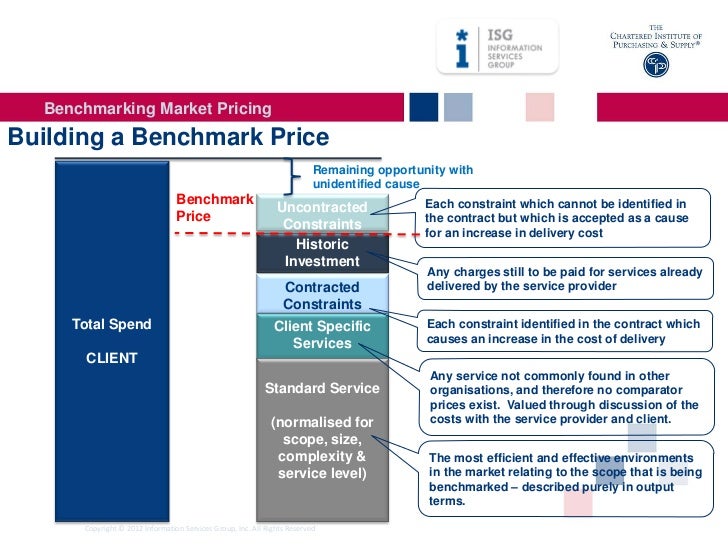

| Pricing benchmark: Spot prices serve as a reference point for pricing contracts and derivatives. Real-time valuation: Spot prices provide up-to-date valuation of assets. Trading opportunities: Spot prices enable traders to take advantage of short-term price fluctuations. | ||

| 3 | ||

| Spot Price vs. Futures Price | ||

|---|---|---|

| Spot price refers to immediate delivery, while futures price refers to a future delivery date. Spot prices are influenced by current market conditions, while futures prices consider future expectations. Spot prices offer more certainty in terms of delivery and price, while futures prices provide hedging opportunities. | ||

| 4 | ||

| Examples of Spot Price | ||

|---|---|---|

| Commodities: Spot prices for gold, oil, and natural gas are widely followed in the commodity markets. Currencies: Spot prices for major currency pairs like EUR/ USD or GBP/ JPY are crucial for forex trading. Financial markets: Spot prices for stocks, bonds, and indices are used for real-time market analysis. | ||

| 5 | ||

| Benefits of Spot Price | ||

|---|---|---|

| Transparent pricing: Spot prices provide transparency and fairness in pricing. Efficient market: Spot prices ensure efficient allocation of resources. Risk management: Spot prices help in assessing and managing market risks. | ||

| 6 | ||

| Spot Price and Investing | ||

|---|---|---|

| Spot prices can guide investment decisions based on current market conditions. Investors can use spot prices to identify undervalued or overvalued assets. Spot prices can indicate market trends and potential opportunities for profit. | ||

| 7 | ||

| Conclusion | ||

|---|---|---|

| Spot prices play a crucial role in various markets, providing real-time valuation and trading opportunities. Understanding spot prices and their drivers is essential for investors and traders. Spot prices serve as a pricing benchmark, facilitate risk management, and enable efficient market operations. | ||

| 8 | ||