Sole Proprietorship Presentation

| Introduction to Sole Proprietorship | ||

|---|---|---|

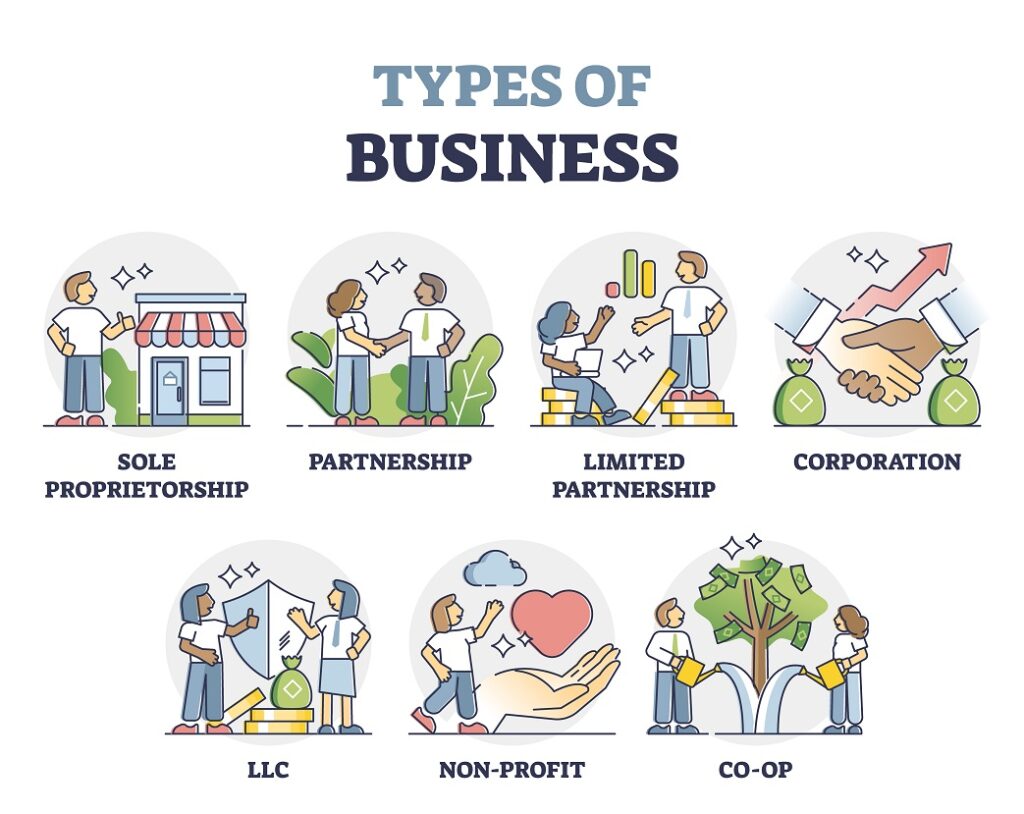

| A sole proprietorship is a type of business structure where an individual owns and operates the business. The owner is personally liable for all debts and obligations of the business. Sole proprietorships are the most common and simplest form of business ownership. | ||

| 1 | ||

| Advantages of Sole Proprietorship | ||

|---|---|---|

| Easy and inexpensive to set up and maintain. Complete control and decision-making power rests with the owner. Simplified tax filing process as the business income is reported on the owner's personal tax return. | ||

| 2 | ||

| Disadvantages of Sole Proprietorship | ||

|---|---|---|

| Unlimited personal liability for all business debts and legal obligations. Limited ability to raise capital compared to other business structures. Lack of continuity as the business is dependent on the owner's involvement. | ||

| 3 | ||

| Liability in Sole Proprietorship | ||

|---|---|---|

| The owner is personally responsible for all business debts and legal actions. Personal assets, such as homes or cars, can be at risk in case of business liabilities. Liability cannot be limited only to the business assets. | ||

| 4 | ||

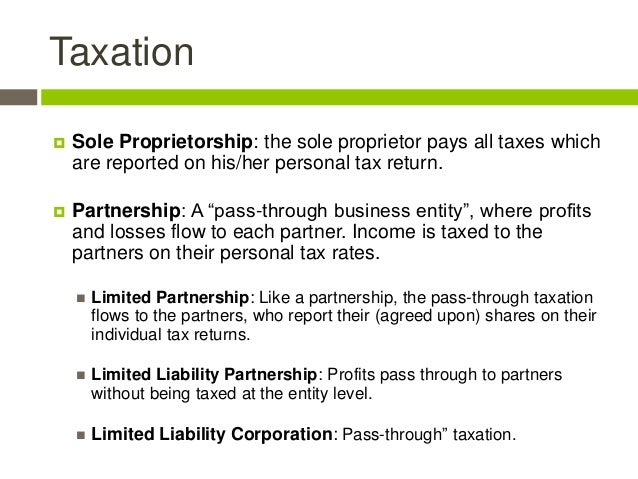

| Taxation in Sole Proprietorship | ||

|---|---|---|

| Business income is reported on the owner's personal tax return. The owner pays self-employment taxes, including Social Security and Medicare taxes. Potential for tax savings as business expenses can be deducted from income. | ||

| 5 | ||

| Flexibility in Sole Proprietorship | ||

|---|---|---|

| The owner has complete control over business decisions and operations. Quick decision-making process allows for flexibility in adapting to market changes. No need for extensive legal formalities or board meetings. | ||

| 6 | ||

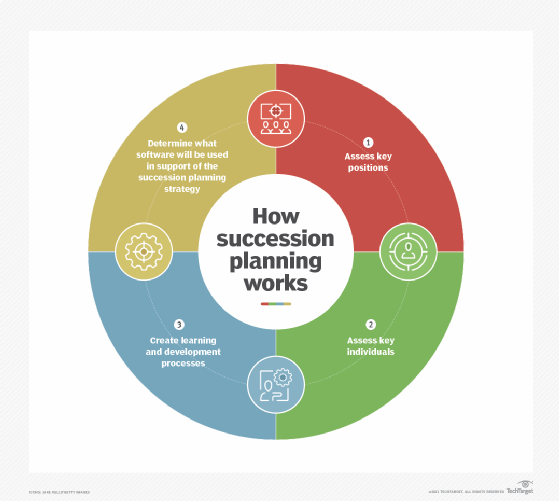

| Sole Proprietorship and Succession Planning | ||

|---|---|---|

| Succession planning can be challenging as the business is closely tied to the owner. Selling the business or transferring ownership requires careful planning. Considerations for the future of the business should be made to ensure its continuity. | ||

| 7 | ||

| Examples of Sole Proprietorship | ||

|---|---|---|

| Freelancers, consultants, and independent contractors often operate as sole proprietors. Small retail stores, local restaurants, and service-based businesses can also be sole proprietorships. Home-based businesses and online businesses are commonly structured as sole proprietorships. | ||

| 8 | ||

| Key Considerations for Sole Proprietorship | ||

|---|---|---|

| Evaluate personal liability risks and consider obtaining appropriate insurance coverage. Understand the tax implications and ensure proper record-keeping for tax purposes. Plan for the future of the business and consider alternative business structures if needed. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Sole proprietorship offers simplicity, control, and flexibility to business owners. However, it also comes with unlimited personal liability and limited ability to raise capital. Careful consideration of the advantages, disadvantages, and key considerations is essential when choosing this business structure. | ||

| 10 | ||