Rbi Presentation

| Introduction to RBI | ||

|---|---|---|

| RBI stands for Reserve Bank of India. It is the central banking institution of India, responsible for controlling the monetary policy in the country. Established on April 1, 1935, under the Reserve Bank of India Act, 1934. | ||

| 1 | ||

| Functions of RBI | ||

|---|---|---|

| Formulating and implementing monetary policy to maintain price stability and ensure economic growth. Regulating and supervising the banking system to ensure stability and protect depositors' interests. Issue and manage the currency and credit system of the country. | ||

| 2 | ||

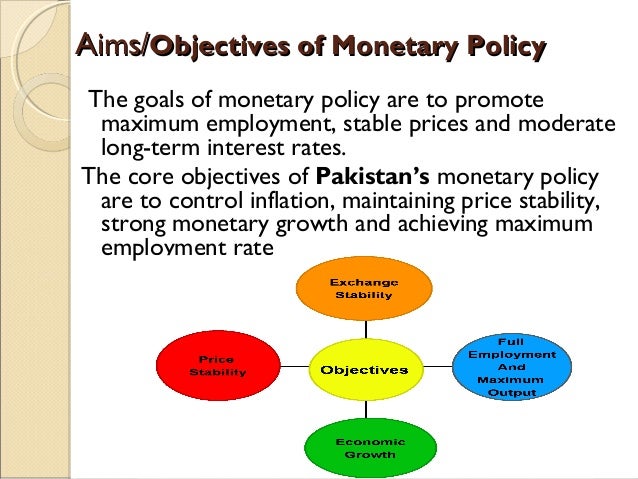

| Monetary Policy Objectives | ||

|---|---|---|

| Maintaining price stability to control inflation and promote sustainable economic growth. Ensuring adequate liquidity in the banking system to support economic activities. Promoting financial stability by regulating interest rates, exchange rates, and managing foreign exchange reserves. | ||

| 3 | ||

| Banking Regulation and Supervision | ||

|---|---|---|

| Licensing and regulation of banks to ensure their soundness and stability. Regular inspections and audits to assess banks' financial health and compliance with regulations. Imposing penalties and taking corrective measures to address any irregularities or misconduct in the banking sector. | ||

| 4 | ||

| Currency Management | ||

|---|---|---|

| Issue and circulation of currency notes and coins in the country. Managing and maintaining the integrity of the currency system, including counterfeit detection and withdrawal of unfit notes. Facilitating efficient payment and settlement systems to ensure smooth financial transactions. | ||

| 5 | ||

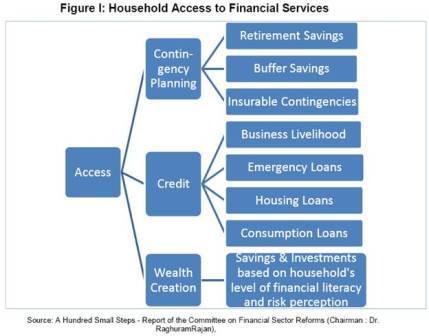

| Developmental Role | ||

|---|---|---|

| Promoting financial inclusion and access to banking services for all sections of society. Supporting and regulating the development of financial markets, including money, bond, and forex markets. Initiating policies and programs to enhance financial literacy and consumer protection. | ||

| 6 | ||

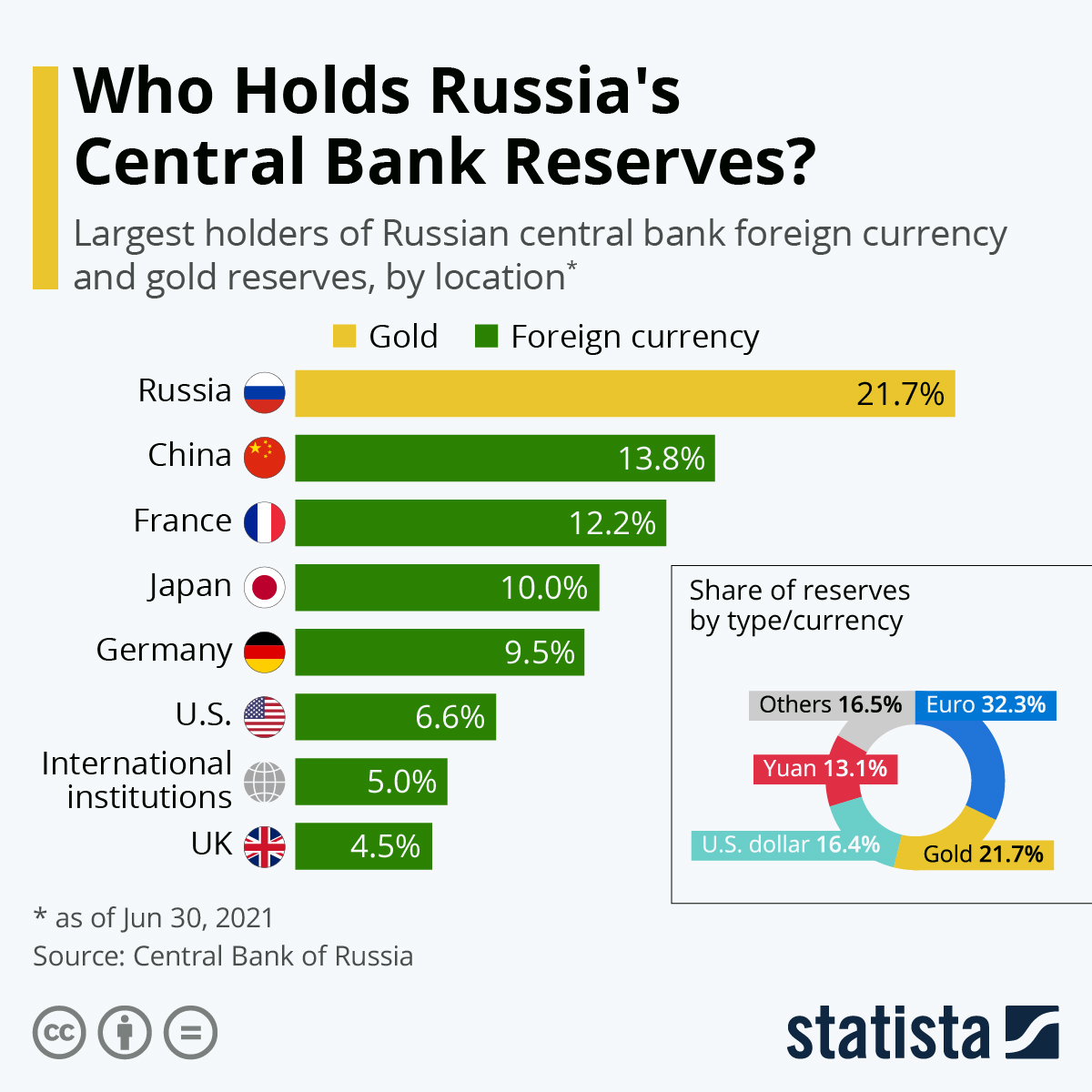

| Foreign Exchange Management | ||

|---|---|---|

| Managing the foreign exchange reserves of the country to ensure stability and meet external payment obligations. Regulating and supervising foreign exchange transactions, including cross-border trade and investment. Facilitating a conducive environment for the growth of international trade and capital flows. | ||

| 7 | ||

| RBI's Autonomy | ||

|---|---|---|

| RBI operates with a significant degree of autonomy to make decisions on monetary policy and regulatory matters. The Governor of RBI is appointed by the central government, but the institution functions independently. Collaboration with the central government on key economic and financial matters while maintaining its autonomous status. | ||

| 8 | ||

| Challenges and Criticisms | ||

|---|---|---|

| Balancing inflation control with economic growth objectives. Ensuring the stability of the banking system in the face of emerging risks and vulnerabilities. Adapting to the changing dynamics of the global economy and technological advancements. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| RBI plays a crucial role in maintaining financial stability and promoting economic growth in India. Its functions encompass monetary policy, banking regulation, currency management, and developmental initiatives. Continual efforts are required to address challenges and enhance the effectiveness of RBI's policies and operations. | ||

| 10 | ||