Pawn Brokers Presentation

| Introduction to Pawn Brokers | ||

|---|---|---|

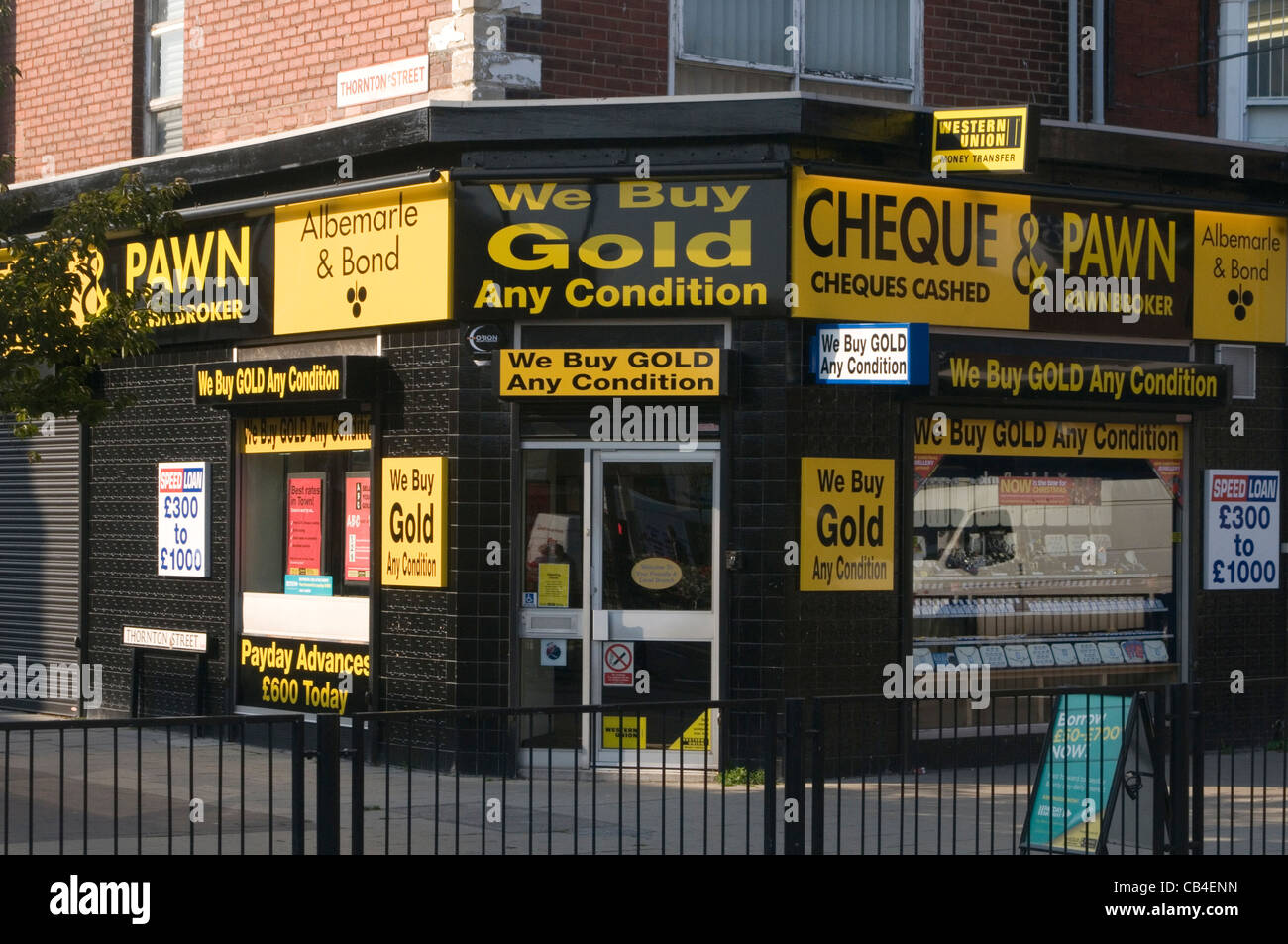

| Pawn brokers are financial institutions that provide loans to individuals in exchange for collateral. They have been around for centuries, providing a valuable service to people in need of quick cash. Pawn brokers operate under strict regulations to protect both the borrower and the lender. | ||

| 1 | ||

| How Pawn Brokers Work | ||

|---|---|---|

| When a borrower brings in an item of value, the pawn broker assesses its worth and offers a loan based on a percentage of that value. The borrower receives the cash, and the item is held as collateral by the pawn broker. The borrower has a set period, typically 30 to 90 days, to repay the loan plus interest. If they fail to do so, the pawn broker can sell the item to recoup their money. | ||

| 2 | ||

| Benefits of Pawn Brokers | ||

|---|---|---|

| Pawn brokers offer quick and easily accessible loans without requiring a credit check or income verification. They provide a solution for individuals who may not qualify for traditional bank loans or need immediate cash. Pawn brokers also offer the option of buying back the pawned item if the borrower’s financial situation improves. | ||

| 3 | ||

| Types of Items Accepted | ||

|---|---|---|

| Pawn brokers accept a wide range of items as collateral, including jewelry, electronics, musical instruments, firearms, and more. The value of the item is assessed based on factors such as condition, brand, and market demand. Some pawn brokers specialize in certain types of items, such as luxury watches or fine art. | ||

| 4 | ||

| Interest Rates and Fees | ||

|---|---|---|

| Pawn brokers charge interest rates that vary depending on local regulations and the value of the loan. Fees such as storage fees or insurance may also be applied. It's important for borrowers to fully understand the interest rates and fees associated with the loan before entering into an agreement with a pawn broker. | ||

| 5 | ||

| Regulations and Consumer Protection | ||

|---|---|---|

| Pawn brokers are subject to state and federal regulations to ensure fair practices and protect consumers. These regulations govern interest rates, fees, loan terms, and the proper handling of pawned items. Borrowers should choose licensed pawn brokers who adhere to these regulations to ensure their rights are protected. | ||

| 6 | ||

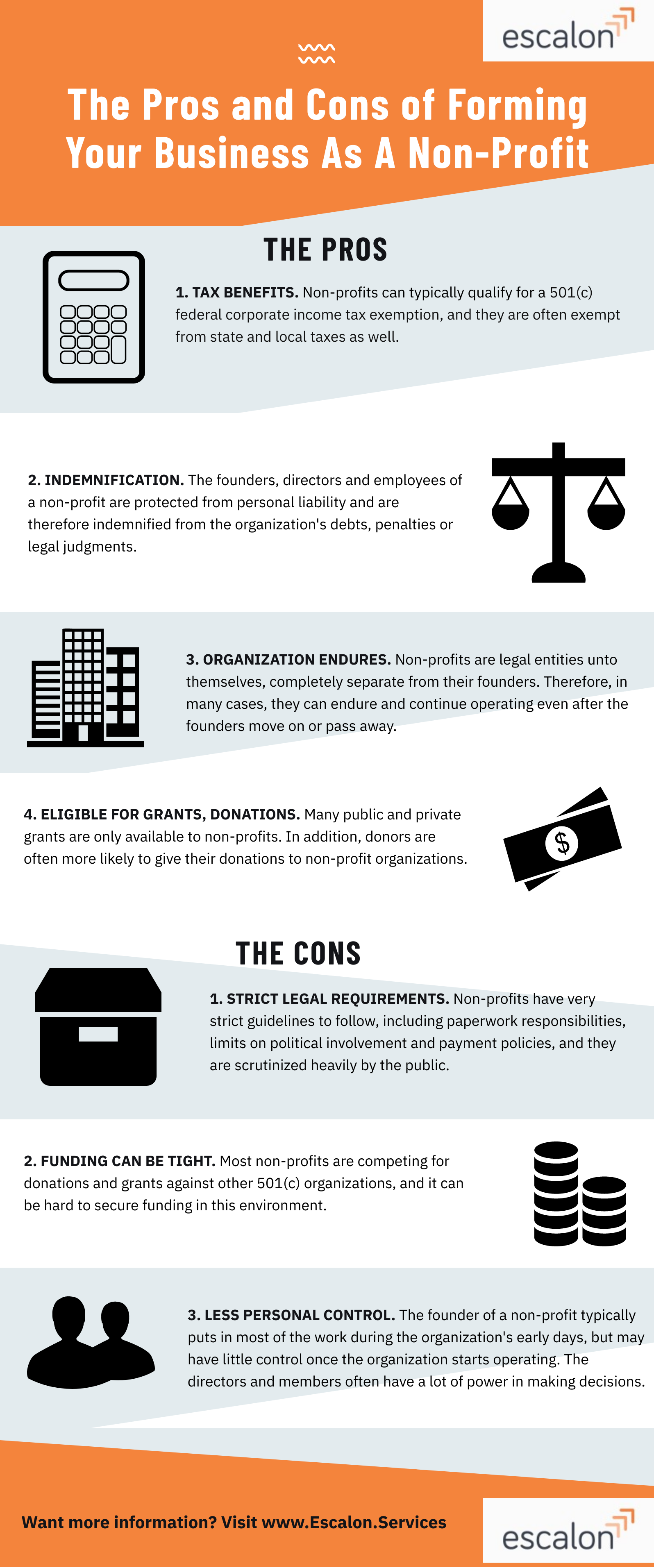

| Pros and Cons for Borrowers | ||

|---|---|---|

| Pros: Quick access to cash, no credit check, ability to reclaim the pawned item, flexibility in loan terms. Cons: Higher interest rates compared to traditional loans, potential loss of the pawned item if unable to repay, limited loan amounts based on item value. Your third bullet | ||

| 7 | ||

| Pros and Cons for Pawn Brokers | ||

|---|---|---|

| Pros: Profit from interest rates and fees, minimal risk due to collateral, potential to sell pawned items for profit. Cons: Risk of borrowers defaulting on loans, need for proper storage and security of pawned items, potential fluctuations in item value affecting profitability. Your third bullet | ||

| 8 | ||

| How to Choose a Pawn Broker | ||

|---|---|---|

| Research local pawn brokers and read customer reviews to ensure a reputable establishment. Inquire about interest rates, fees, and loan terms to compare options. Choose a pawn broker that specializes in the type of item you plan to pawn for accurate assessments and fair loan offers. | ||

| 9 | ||

| Conclusion and Final Thoughts | ||

|---|---|---|

| Pawn brokers provide a valuable service for individuals in need of quick cash. They offer flexible loan terms and accept a wide range of collateral items. By understanding the regulations, fees, and risks associated with pawn brokers, borrowers can make informed decisions and protect their interests. | ||

| 10 | ||