Objectives And Roles Of IASB In International Accounting Presentation

| Introduction to IASB | ||

|---|---|---|

| The International Accounting Standards Board (IASB) is an independent global standard-setting body for accounting practices. It was established in 2001 and is responsible for developing and promoting International Financial Reporting Standards (IFRS). The main objective of IASB is to enhance the comparability, transparency, and quality of financial information globally. | ||

| 1 | ||

| Objective of IASB | ||

|---|---|---|

| The primary objective of IASB is to develop a single set of high-quality, global accounting standards. These standards aim to provide transparent, relevant, and reliable financial information for users of financial statements. IASB's objective is to contribute to the development of a robust and cohesive global financial reporting framework. | ||

| 2 | ||

| Standard-Setting Process | ||

|---|---|---|

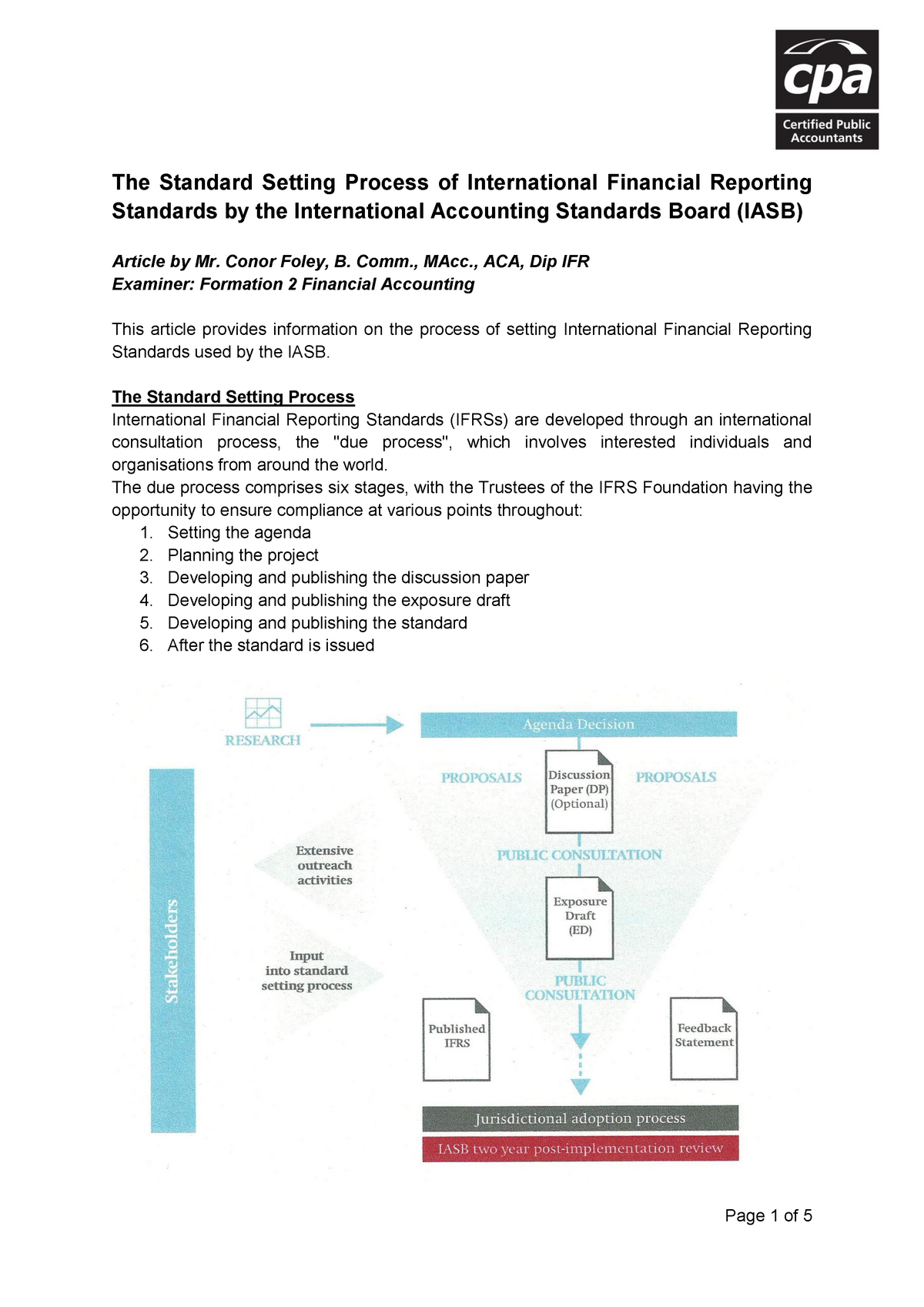

| IASB follows a rigorous due process in developing and issuing accounting standards. The process involves extensive research, public consultation, and deliberations with stakeholders. The objective is to ensure that the standards are based on sound principles and take into account diverse perspectives. | ||

| 3 | ||

| Framework for Financial Reporting | ||

|---|---|---|

| IASB has developed a conceptual framework that provides a foundation for the development of accounting standards. The framework defines the objectives, qualitative characteristics, and elements of financial statements. It guides the preparation and presentation of financial statements to ensure consistency and comparability. | ||

| 4 | ||

| Adoption and Implementation | ||

|---|---|---|

| IASB's standards, known as IFRS, are not mandatory but can be adopted by countries for use in their financial reporting. Many countries have fully or partially adopted IFRS, leading to increased global harmonization of accounting practices. Adoption of IFRS facilitates cross-border comparisons and improves the quality and transparency of financial reporting. | ||

| 5 | ||

| Role in Global Convergence | ||

|---|---|---|

| IASB actively collaborates with other standard-setting bodies, such as the Financial Accounting Standards Board (FASB) in the United States. The objective is to achieve global convergence of accounting standards to reduce differences and enhance consistency. The IASB-FASB convergence project has resulted in the issuance of joint standards on various topics. | ||

| 6 | ||

| Standard Interpretation | ||

|---|---|---|

| IASB works closely with the International Financial Reporting Interpretations Committee (IFRIC) to address implementation issues. IFRIC provides guidance on the application of IFRS and interprets accounting standards in complex situations. The objective is to ensure consistent and appropriate application of standards across different jurisdictions. | ||

| 7 | ||

| Monitoring and Enforcement | ||

|---|---|---|

| IASB does not have direct enforcement authority, but it plays a crucial role in promoting compliance with IFRS. It monitors the adoption and implementation of IFRS by different countries and provides guidance on their application. IASB also cooperates with regulatory bodies to enhance the quality and consistency of financial reporting worldwide. | ||

| 8 | ||

| Investor Protection and Confidence | ||

|---|---|---|

| IASB's objective is to enhance investor protection and confidence by improving the transparency and reliability of financial information. High-quality financial reporting facilitates informed decision-making by investors and stakeholders. IASB's standards aim to provide a level playing field for businesses and promote trust in financial markets. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| The IASB plays a vital role in the development and promotion of international accounting standards. Its objectives include enhancing comparability, transparency, and quality of financial information globally. Through its standard-setting process, adoption and implementation efforts, and collaboration with other bodies, IASB strives for global convergence and improved financial reporting. | ||

| 10 | ||

| References (download PPTX file for details) | ||

|---|---|---|

| International Accounting Standards Board. (20... Deloitte. (n.d.). IFRS in your pocket 202... Retrieved from https:// www2.deloitte.com/ co... |  | |

| 11 | ||