Money Recession Presentation

| Introduction to Money Recession | ||

|---|---|---|

| Money recession refers to a period of economic decline characterized by a significant decrease in the overall level of economic activity. It is typically marked by a decline in consumer spending, business investment, and employment rates. Money recession can lead to a decrease in the purchasing power of individuals, businesses, and governments. | ||

| 1 | ||

| Causes of Money Recession | ||

|---|---|---|

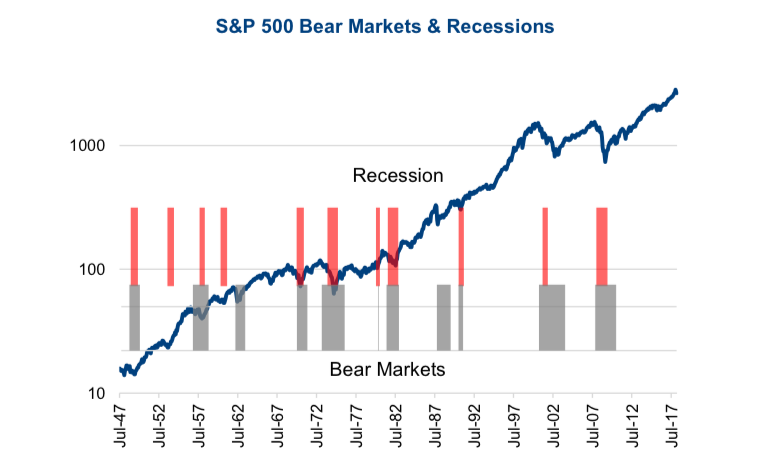

| Financial crises, such as the housing market crash in 2008, can trigger a money recession by creating a domino effect across various sectors of the economy. Decreased consumer confidence and spending can contribute to a decline in economic activity. A decrease in business investment due to uncertainty or lack of available funds can also exacerbate a money recession. | ||

| 2 | ||

| Effects of Money Recession | ||

|---|---|---|

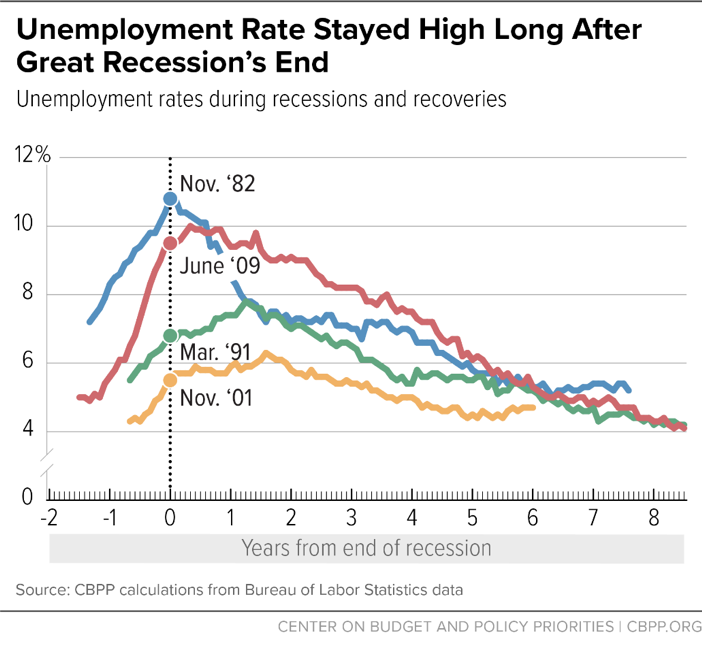

| Unemployment rates tend to rise during a money recession as businesses cut costs and reduce their workforce. Asset prices, such as real estate and stock prices, may decline significantly, leading to wealth erosion for individuals and businesses. Governments may experience a decrease in tax revenues, leading to budget deficits and potential austerity measures. | ||

| 3 | ||

| Measures to Combat Money Recession | ||

|---|---|---|

| Central banks often implement expansionary monetary policies to stimulate economic growth, such as lowering interest rates or increasing the money supply. Governments can introduce fiscal stimulus measures, such as increased public spending or tax cuts, to boost economic activity. International cooperation and coordination among countries can help mitigate the global impact of a money recession. | ||

| 4 | ||

| Potential Risks and Challenges | ||

|---|---|---|

| Excessive reliance on monetary stimulus measures can lead to inflationary pressures in the long run. High levels of public debt resulting from fiscal stimulus measures can pose long-term economic challenges. Global economic interdependence can make it difficult for individual countries to combat money recessions in isolation. | ||

| 5 | ||

| Lessons from Past Money Recessions | ||

|---|---|---|

| Historical data shows that money recessions are part of the economic cycle and often followed by periods of recovery and growth. Effective policy responses, such as coordinated monetary and fiscal measures, can help shorten the duration and severity of a money recession. Learning from past mistakes, such as excessive risk-taking or lax regulation, can help prevent or mitigate future money recessions. | ||

| 6 | ||

| Preparing for a Money Recession | ||

|---|---|---|

| Diversifying investments can help mitigate the impact of a money recession on personal or business finances. Building an emergency fund can provide a financial buffer during times of economic uncertainty. Staying informed about economic indicators and trends can help individuals and businesses make informed decisions during a money recession. | ||

| 7 | ||

| Conclusion | ||

|---|---|---|

| Money recessions are a natural part of the economic cycle, characterized by a decline in economic activity and various negative effects. Effective policy responses, international cooperation, and individual preparedness can help mitigate the impact of a money recession. Understanding the causes, effects, and potential risks of money recessions can enable individuals and businesses to navigate these challenging economic periods. | ||

| 8 | ||

:max_bytes(150000):strip_icc()/what-caused-2008-global-financial-crisis-3306176_FINAL-14548e14071e4bdb90ff985fac727225.jpg)