Micro Finance In Agriculture Assessing It's Role In Empowering Small Scale Farmers Presentation

| Introduction | ||

|---|---|---|

| Micro finance in agriculture refers to the provision of financial services, such as loans and savings accounts, to small scale farmers. Access to micro finance can play a significant role in empowering small scale farmers. By providing financial resources, micro finance enables farmers to invest in improved farming practices and increase their productivity. | ||

| 1 | ||

| Increased Access to Capital | ||

|---|---|---|

| Micro finance allows small scale farmers to access capital that they may not have been able to obtain through traditional banking channels. Farmers can use this capital to purchase essential inputs such as seeds, fertilizers, and equipment. Access to capital enables farmers to expand their operations, increase their production, and ultimately improve their livelihoods. | ||

| 2 | ||

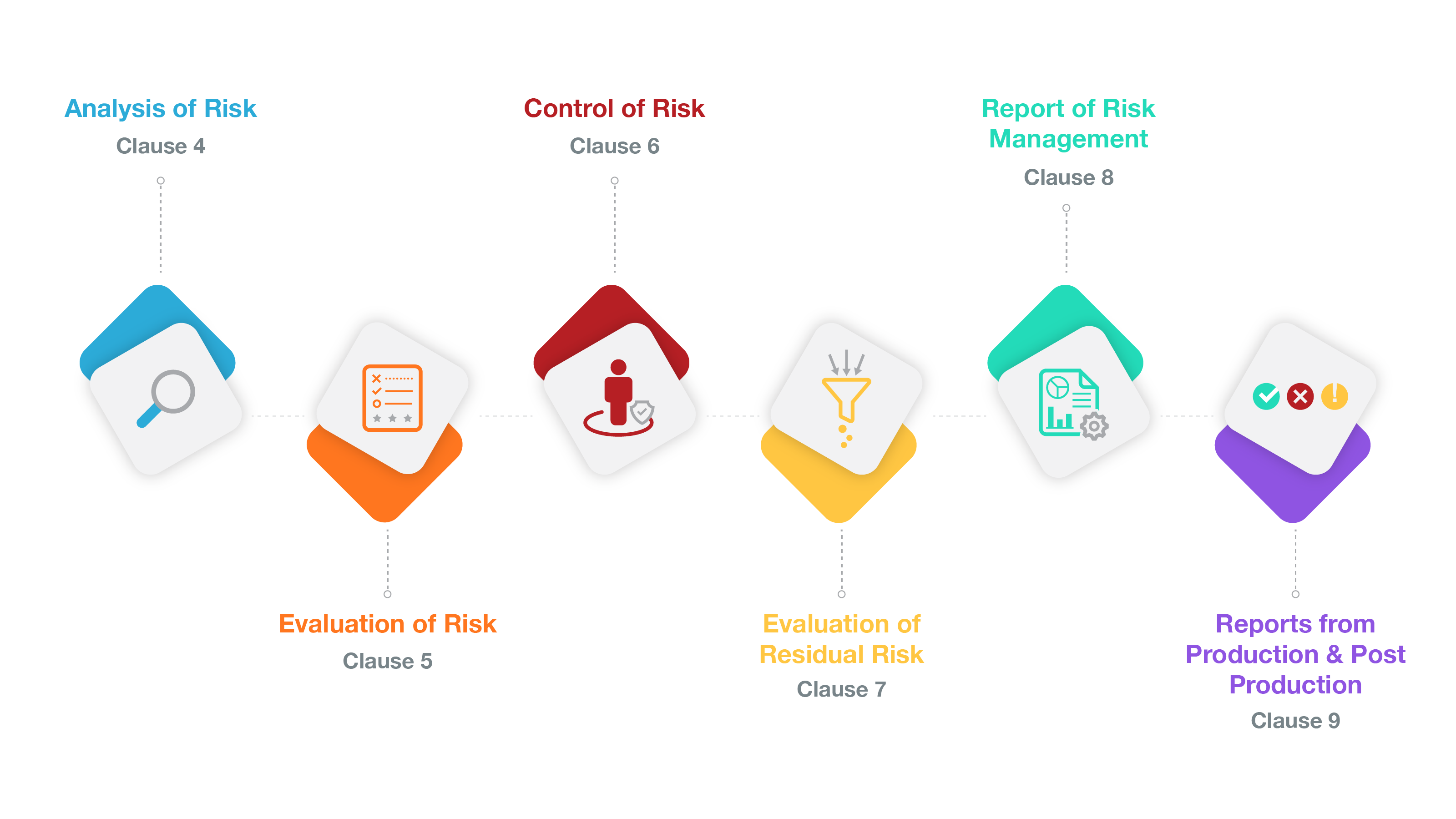

| Risk Management | ||

|---|---|---|

| Micro finance in agriculture also helps small scale farmers manage risks associated with farming activities. Farmers can use micro loans to purchase insurance or invest in irrigation systems to mitigate the impact of climate variability. By managing risks, farmers are better equipped to withstand unexpected events and safeguard their farming businesses. | ||

| 3 | ||

| Improved Farming Practices | ||

|---|---|---|

| Micro finance can be used to promote the adoption of sustainable and innovative farming practices. Farmers can invest in training, education, and technology to enhance their knowledge and skills. This enables farmers to implement more efficient and environmentally-friendly farming techniques, leading to increased productivity and profitability. | ||

| 4 | ||

| Market Access | ||

|---|---|---|

| Micro finance institutions can support small scale farmers by providing market linkages and access to value chains. Farmers can use micro loans to invest in storage facilities, transportation, or processing equipment, enabling them to reach larger markets. Access to markets creates opportunities for small scale farmers to sell their produce at better prices, increasing their income and economic empowerment. | ||

| 5 | ||

| Women Empowerment | ||

|---|---|---|

| Micro finance in agriculture has a significant impact on empowering women in rural areas. Women often face barriers in accessing financial services, but micro finance institutions can provide them with the necessary capital. By having access to finance, women farmers can improve their agricultural practices, generate income, and have greater control over their economic and social decision-making. | ||

| 6 | ||

| Increased Food Security | ||

|---|---|---|

| Micro finance in agriculture contributes to food security by supporting small scale farmers to increase their productivity and income. With improved access to capital, farmers can invest in better farming practices, technologies, and inputs, resulting in higher crop yields. Increased food production by empowered small scale farmers helps to meet the growing demand for food and reduce global hunger. | ||

| 7 | ||

| Environmental Sustainability | ||

|---|---|---|

| Micro finance in agriculture can promote environmentally sustainable farming practices. Farmers can use micro loans to invest in organic farming methods, agroforestry, or renewable energy sources. By adopting sustainable practices, small scale farmers contribute to the conservation of natural resources and reduce the negative impact of agriculture on the environment. | ||

| 8 | ||

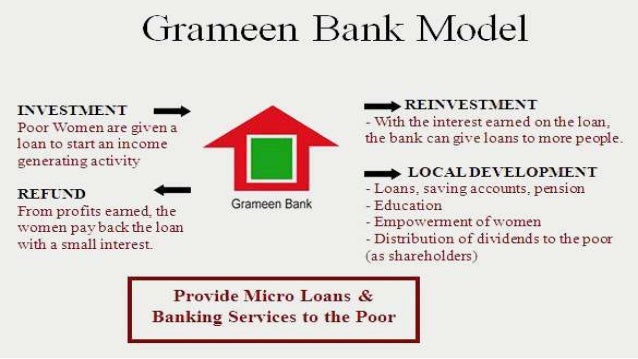

| Case Study: Grameen Bank | ||

|---|---|---|

| Grameen Bank, founded by Muhammad Yunus, is a notable example of micro finance in agriculture. It has successfully empowered small scale farmers in Bangladesh by providing them with access to finance and training. Grameen Bank's model has improved the livelihoods of millions of farmers, reducing poverty and promoting sustainable farming practices. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Micro finance in agriculture plays a crucial role in empowering small scale farmers. It provides them with increased access to capital, risk management tools, and opportunities for market access. By supporting sustainable farming practices and promoting gender equality, micro finance contributes to poverty reduction and food security. | ||

| 10 | ||

| References (download PPTX file for details) | ||

|---|---|---|

| Grameen Bank. (2021). Retrieved from https://... Your second bullet... Your third bullet... |  | |

| 11 | ||