Investment Awareness And Preference Of Investment With Respect To Different Age Groups. Presentation

| Introduction | ||

|---|---|---|

| Investment Awareness and Preference across Different Age Groups Understanding how age influences investment decisions Importance of tailoring investment strategies based on age | ||

| 1 | ||

| Millennials (Age 25-40) | ||

|---|---|---|

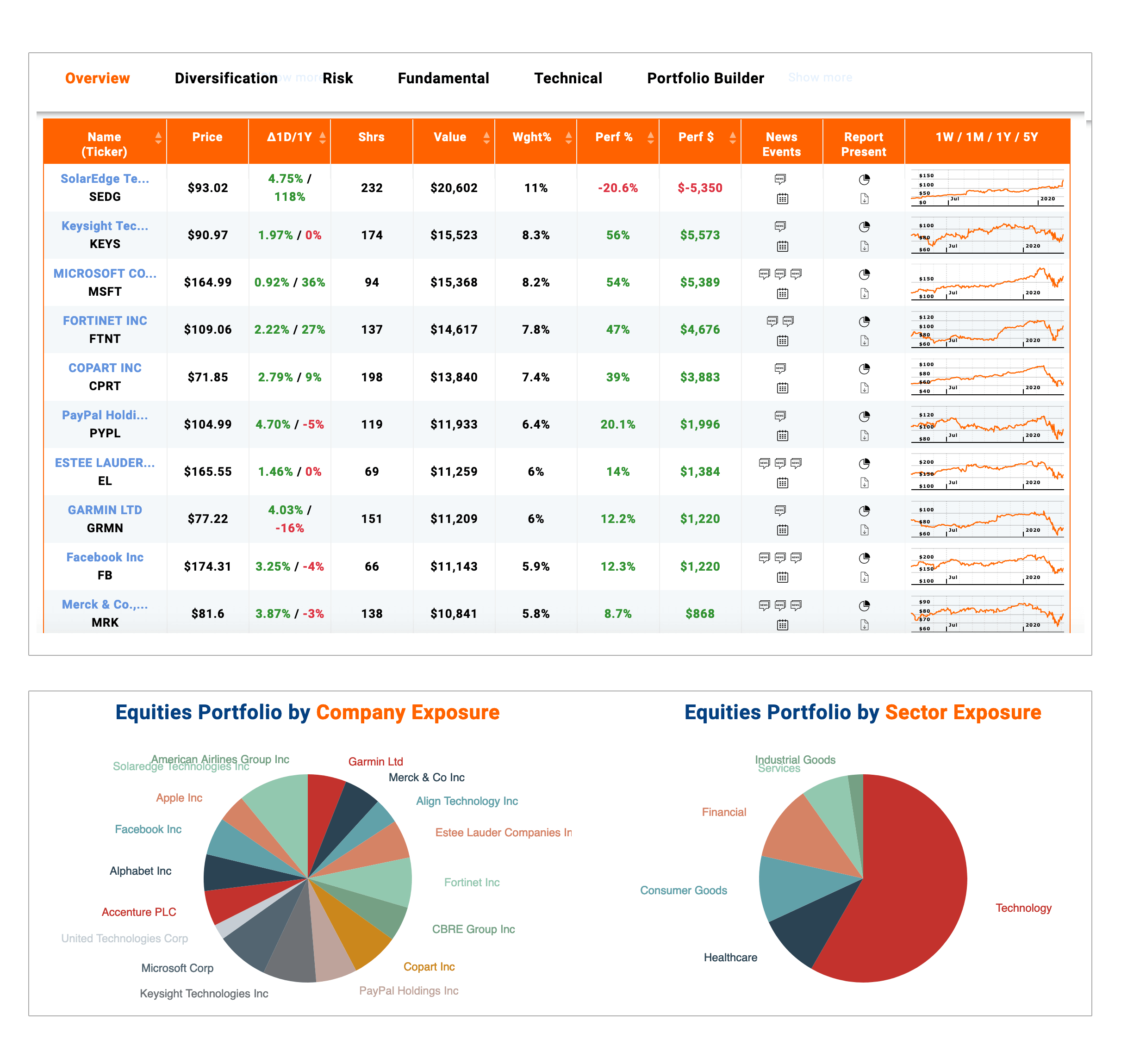

| Focus on long-term goals, such as retirement planning Prefer technology-driven investment platforms High preference for socially responsible investments | ||

| 2 | ||

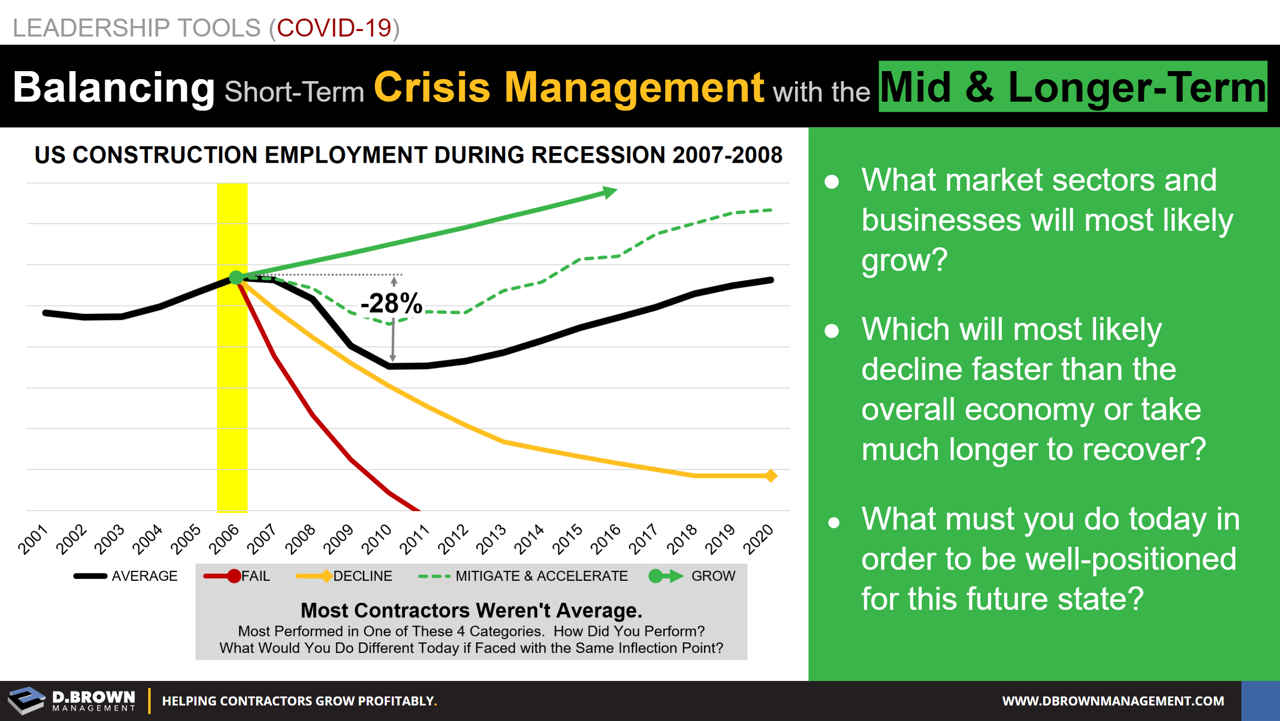

| Generation X (Age 41-55) | ||

|---|---|---|

| Balancing short-term financial needs with long-term goals Diversification of investment portfolio Interest in real estate investments for stability and growth | ||

| 3 | ||

| Baby Boomers (Age 56-75) | ||

|---|---|---|

| Focus on capital preservation and generating income Preference for low-risk investments, such as bonds and dividend stocks Consideration of annuities for guaranteed income stream | ||

| 4 | ||

| Silent Generation (Age 76 and above) | ||

|---|---|---|

| Capital preservation and income generation are top priorities Preference for low-risk investments, such as fixed deposits and treasury bonds Healthcare and long-term care investments become more significant | ||

| 5 | ||

| Factors Influencing Investment Decisions | ||

|---|---|---|

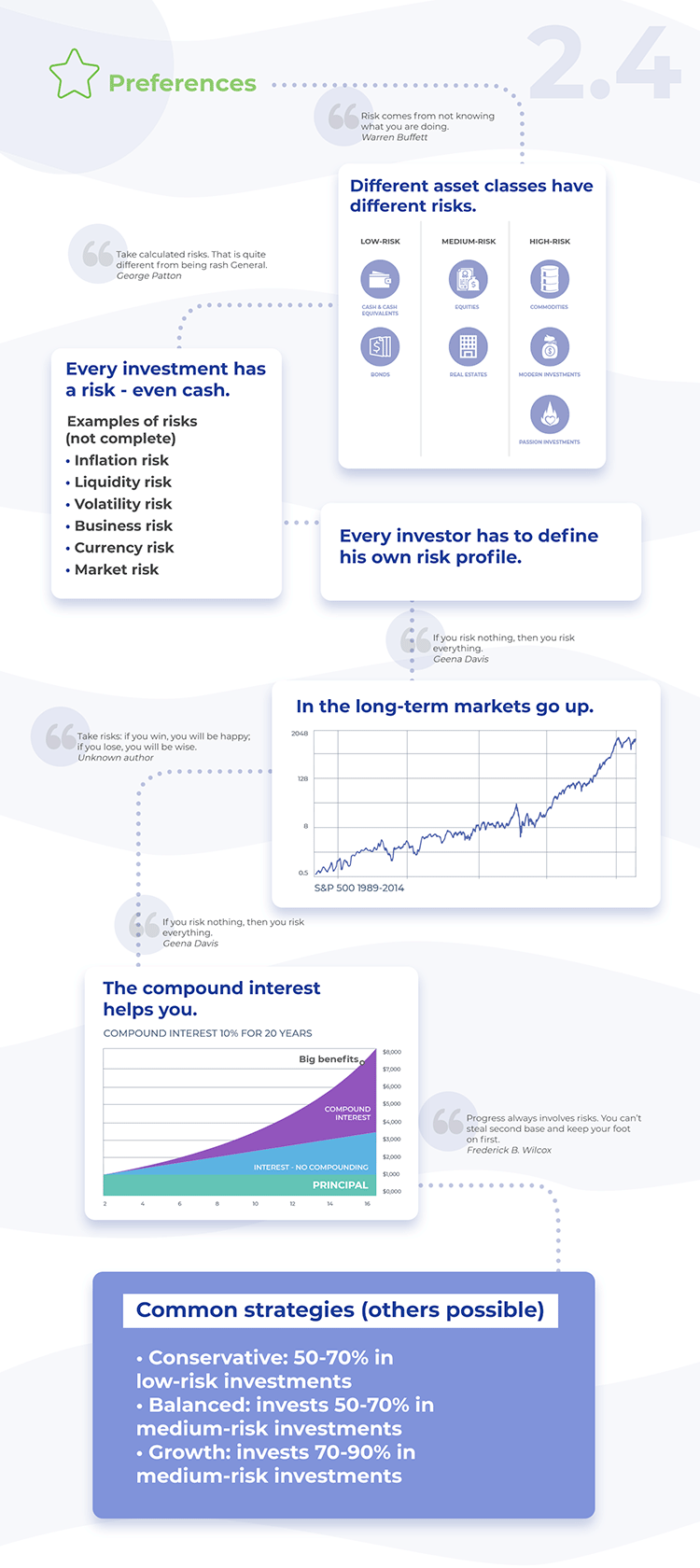

| Risk tolerance and time horizon Financial literacy and investment knowledge Economic conditions and market trends | ||

| 6 | ||

| Investment Awareness Initiatives | ||

|---|---|---|

| Financial education programs for different age groups Online resources and investment guides Collaboration between financial institutions and educational institutions | ||

| 7 | ||

| Tailoring Investment Strategies | ||

|---|---|---|

| Customized investment plans based on age and risk tolerance Regular portfolio rebalancing to suit changing needs Incorporating tax-efficient investment strategies | ||

| 8 | ||

| Common Investment Mistakes by Age Group | ||

|---|---|---|

| Millennials: Overemphasis on short-term gains and lack of diversification Generation X: Neglecting retirement savings and overreliance on employer pensions Baby Boomers: Failure to adapt investment strategy for post-retirement income needs | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Investment awareness and preferences vary significantly across different age groups Tailoring investment strategies based on age and risk tolerance is crucial Continuous education and awareness initiatives can improve investment decision-making | ||

| 10 | ||

| References (download PPTX file for details) | ||

|---|---|---|

| Doe, J. (2020). Understanding Investment Pref... Smith, A. (2019). Investment Awareness and Be... Johnson, M. (2018). Investment Strategies for... |  | |

| 11 | ||