Insurance Presentation

| Introduction to Insurance | ||

|---|---|---|

| Insurance is a risk management tool that provides financial protection against potential losses. It is a contract between the insured and the insurer, where the insured pays a premium in exchange for coverage. Insurance helps individuals and businesses mitigate the financial impact of unexpected events. | ||

| 1 | ||

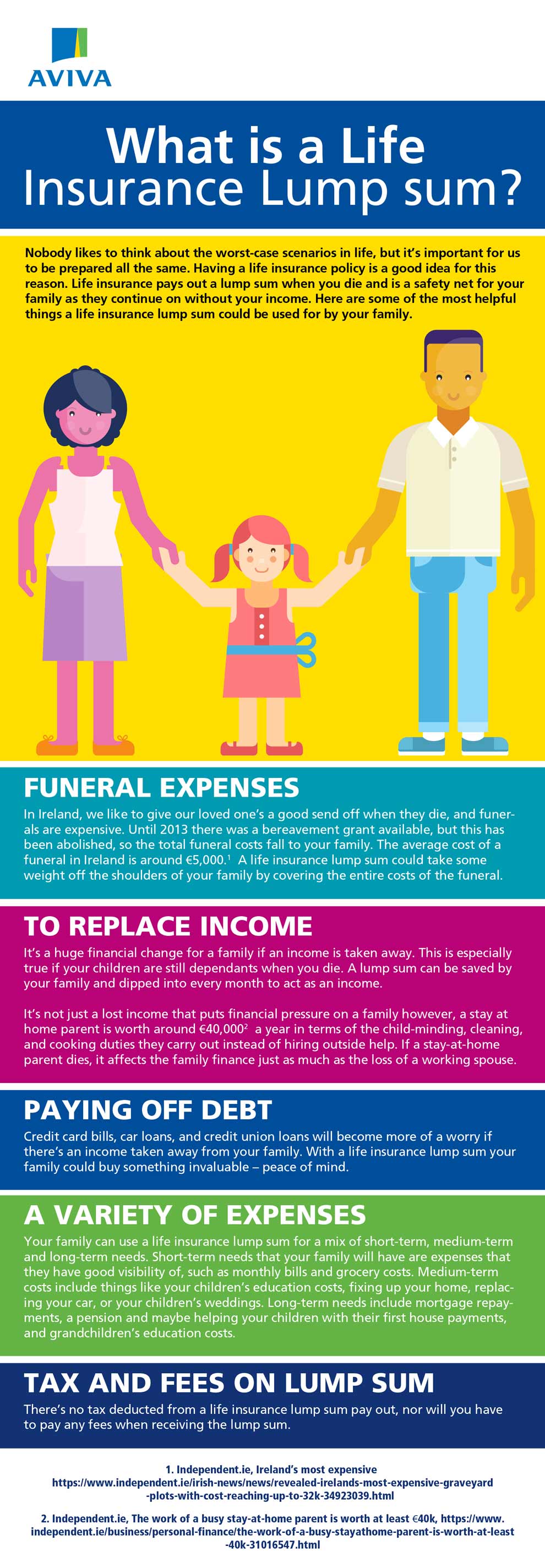

| Types of Insurance | ||

|---|---|---|

| Life Insurance: Provides a lump sum payment to beneficiaries upon the insured's death. Health Insurance: Covers medical expenses and provides access to healthcare services. Auto Insurance: Protects against financial loss in case of accidents or damage to vehicles. | ||

| 2 | ||

| Property Insurance | ||

|---|---|---|

| Homeowners Insurance: Covers damage or loss to a home and its contents. Renters Insurance: Protects renters against theft, liability, and property damage. Commercial Property Insurance: Provides coverage for businesses' buildings, equipment, and inventory. | ||

| 3 | ||

| Liability Insurance | ||

|---|---|---|

| General Liability Insurance: Protects against claims of property damage or bodily injury to others. Professional Liability Insurance: Covers professionals against negligence claims or errors in their work. Product Liability Insurance: Provides protection against claims related to product defects or injuries. | ||

| 4 | ||

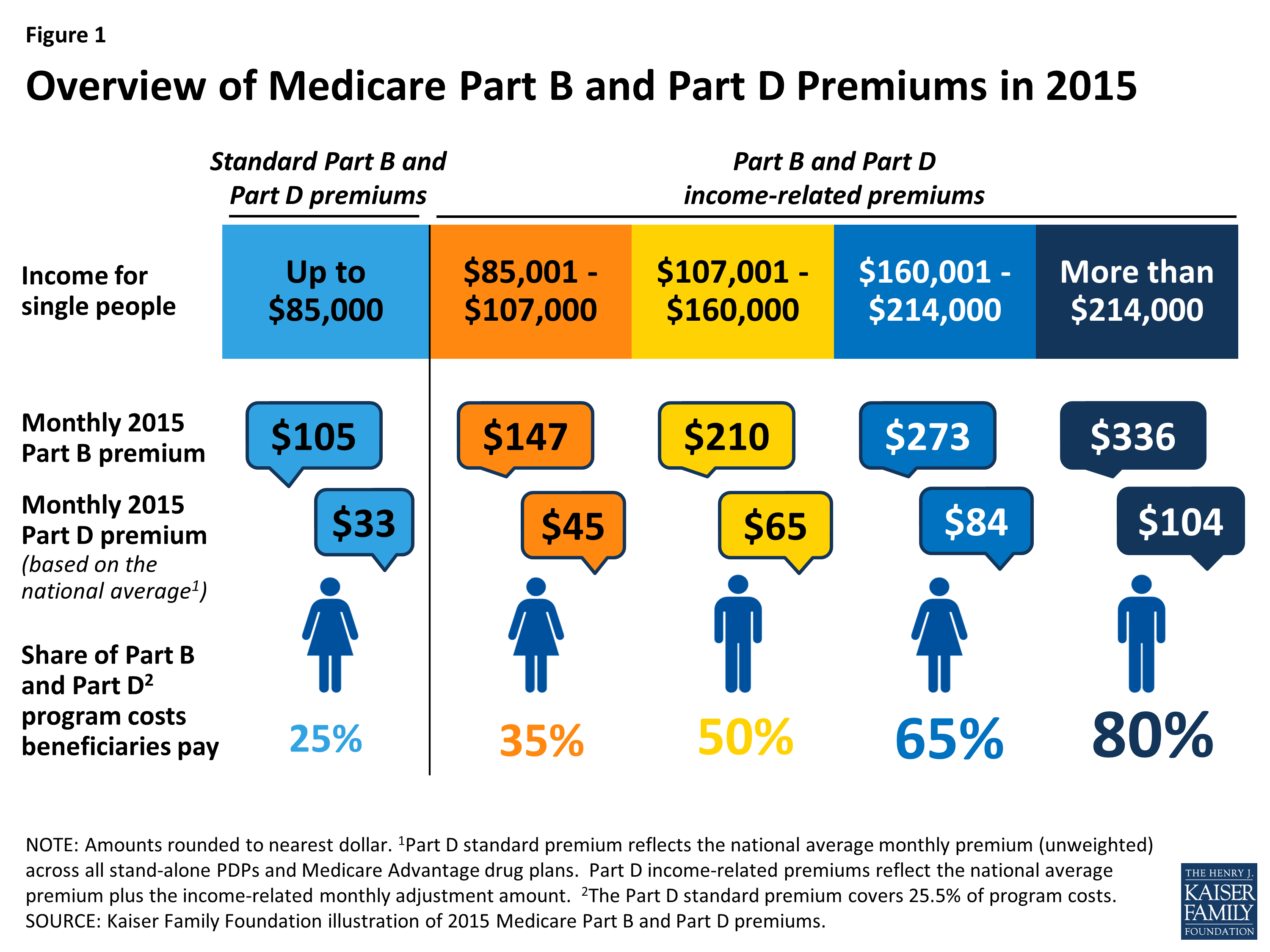

| Insurance Premiums | ||

|---|---|---|

| Premiums are the amount policyholders pay for insurance coverage. Premiums vary based on factors such as age, health, location, and coverage limits. Insurance companies use actuarial data to calculate premiums and assess risks. | ||

| 5 | ||

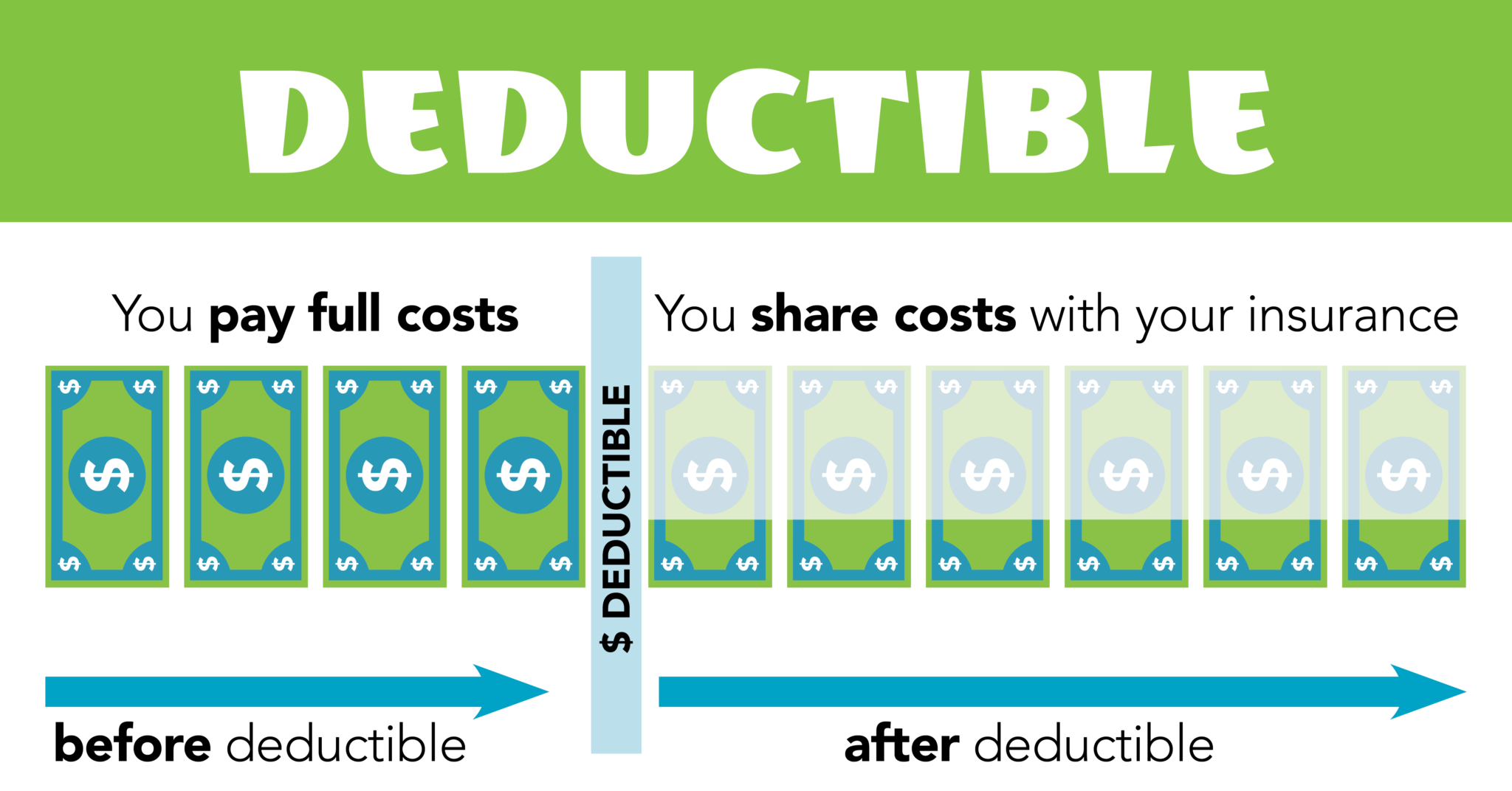

| Deductibles and Coverage Limits | ||

|---|---|---|

| Deductible: The amount policyholders must pay out of pocket before insurance coverage kicks in. Coverage Limits: The maximum amount an insurance policy will pay for a covered loss. Higher deductibles often result in lower premiums, while higher coverage limits offer more financial protection. | ||

| 6 | ||

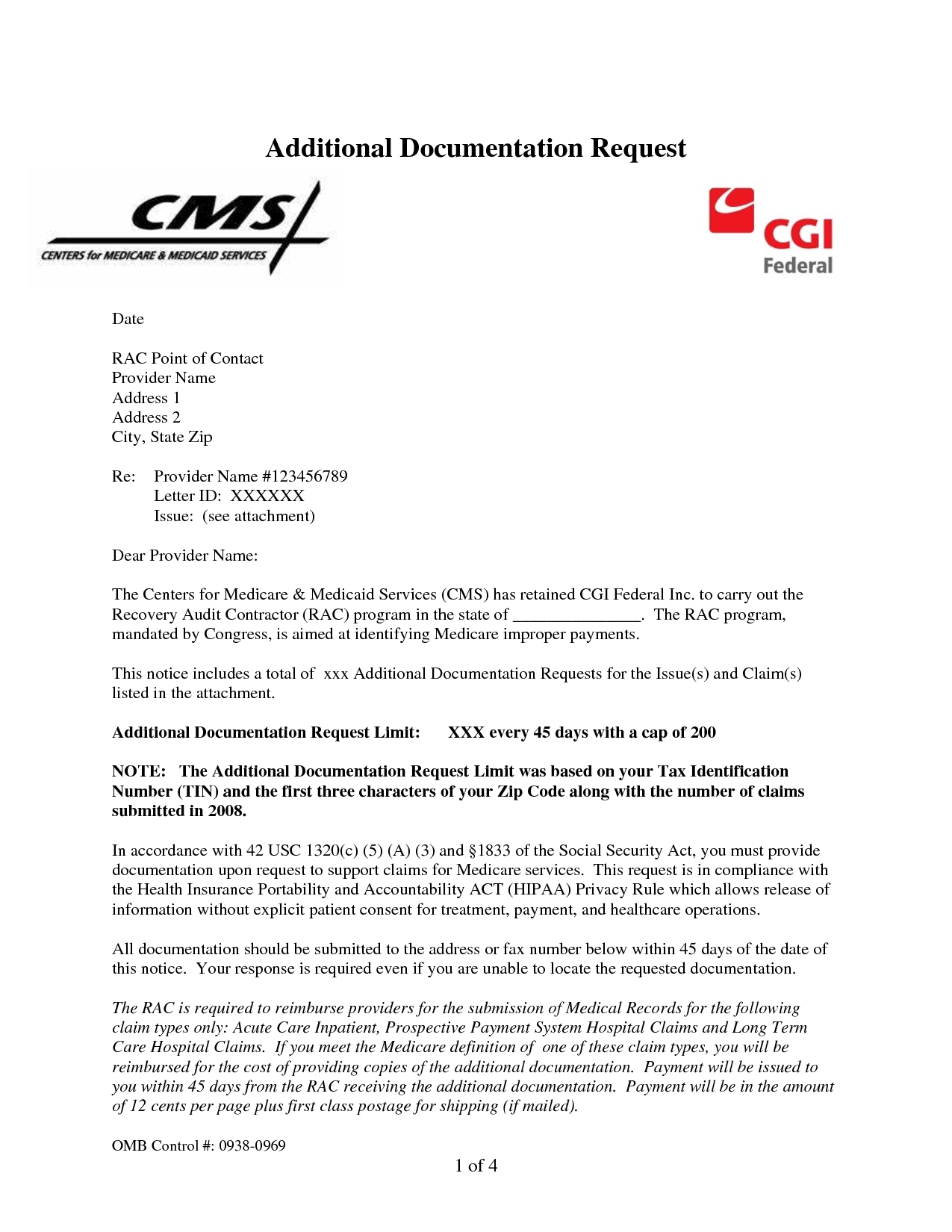

| Insurance Claims | ||

|---|---|---|

| A claim is a request made by the insured to the insurance company for compensation. Insured individuals or businesses must provide evidence of loss or damage to support their claim. Insurance companies investigate claims and determine the appropriate compensation based on the policy terms. | ||

| 7 | ||

| Insurance Regulation | ||

|---|---|---|

| Insurance is regulated by state governments to protect consumers and ensure fair practices. Insurance companies must meet financial solvency requirements to guarantee payment of claims. State insurance departments monitor and enforce insurance laws and regulations. | ||

| 8 | ||

| Benefits of Insurance | ||

|---|---|---|

| Financial Security: Insurance provides peace of mind and safeguards against financial risks. Business Continuity: Insurance helps businesses recover from unexpected events and minimize disruptions. Community Resilience: Insurance plays a crucial role in rebuilding communities after natural disasters. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Insurance is a vital tool for managing risks and protecting against financial losses. Understanding different types of insurance and their benefits is essential for individuals and businesses. By choosing appropriate coverage and working with reputable insurance companies, individuals and businesses can better prepare for the unexpected. | ||

| 10 | ||

| References (download PPTX file for details) | ||

|---|---|---|

| Insurance Information Institute. (n.d.). What... Your second bullet... Your third bullet... |  | |

| 11 | ||