Indian Financial Structure Presentation

| Introduction to Indian Financial Structure | ||

|---|---|---|

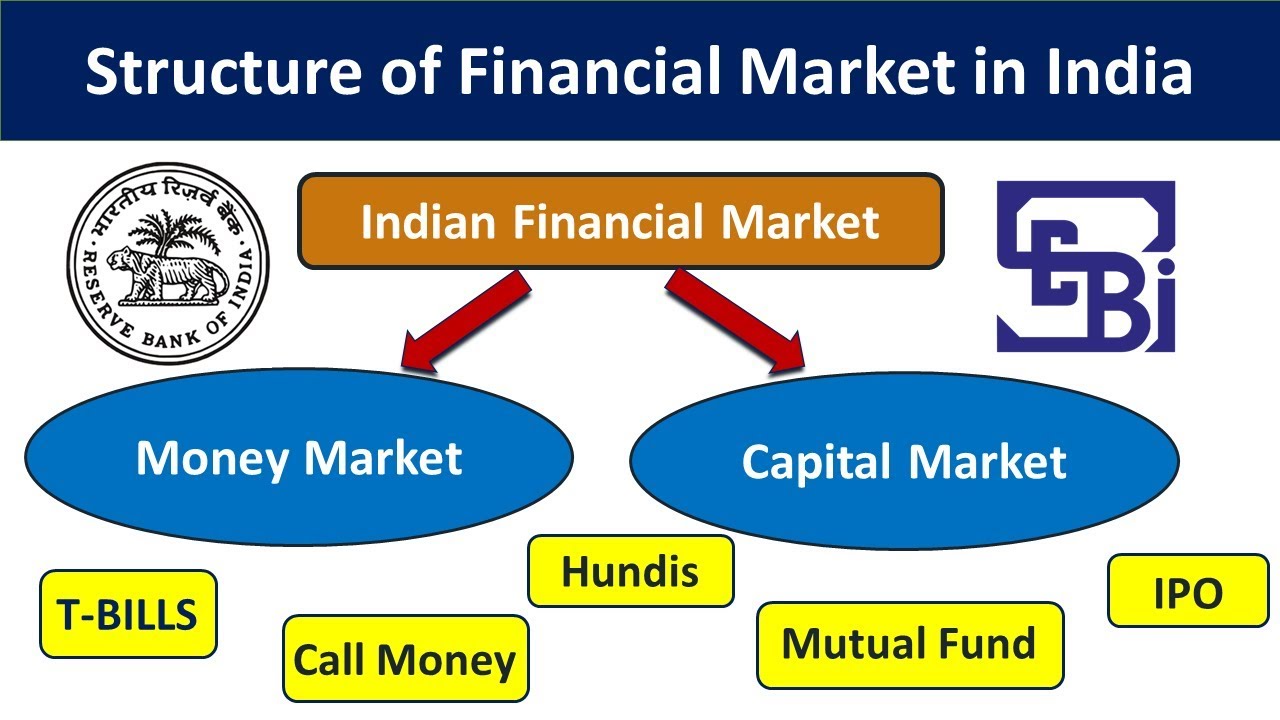

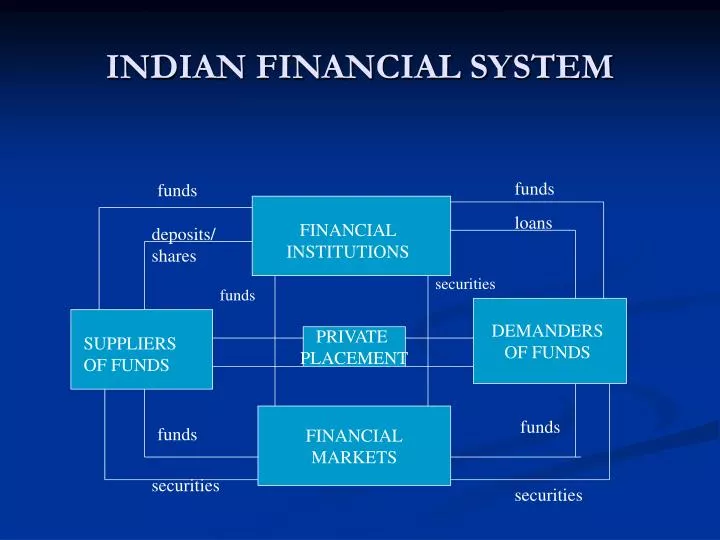

| India has a diverse and complex financial structure that supports its growing economy. The financial sector in India includes banks, non-banking financial companies (NBFCs), stock markets, insurance companies, and more. The Reserve Bank of India (RBI) serves as the central bank and regulates monetary policy in the country. | ||

| 1 | ||

| Indian Banking System | ||

|---|---|---|

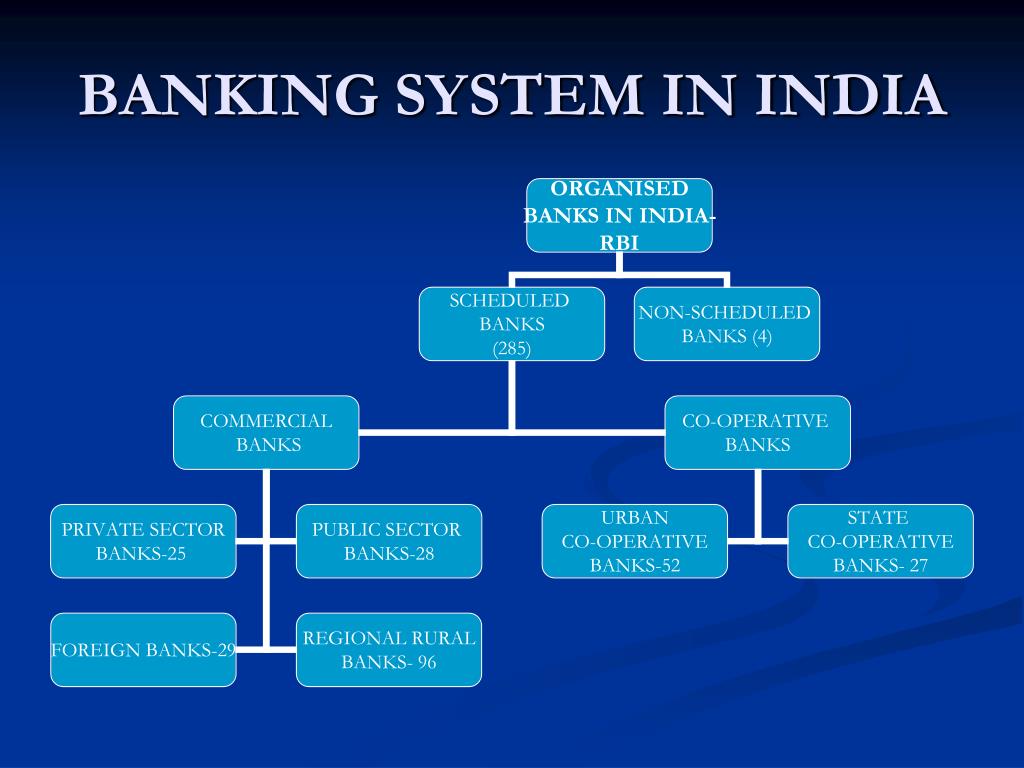

| The Indian banking system consists of commercial banks, cooperative banks, and regional rural banks (RRBs). Public sector banks dominate the sector, followed by private sector banks and foreign banks. The State Bank of India (SBI) is the largest public sector bank and plays a crucial role in the Indian financial system. | ||

| 2 | ||

| Non-Banking Financial Companies (NBFCs) | ||

|---|---|---|

| NBFCs are an important part of the Indian financial structure, providing various financial services. They offer loans, leasing, hire purchase, and other financial products to individuals and businesses. NBFCs complement the banking system by catering to specific needs and extending credit to underserved segments. | ||

| 3 | ||

| Capital Markets in India | ||

|---|---|---|

| Indian capital markets consist of primary and secondary markets. The Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) are the major stock exchanges in India. The Securities and Exchange Board of India (SEBI) regulates and supervises the capital markets. | ||

| 4 | ||

| Insurance Sector in India | ||

|---|---|---|

| The insurance sector in India is growing rapidly, providing various life and non-life insurance products. The Insurance Regulatory and Development Authority of India (IRDAI) oversees the insurance industry. Public sector insurance companies coexist with private insurance companies, offering a wide range of options to consumers. | ||

| 5 | ||

| Microfinance and Financial Inclusion | ||

|---|---|---|

| Microfinance institutions play a crucial role in providing financial services to the unbanked and underserved population. Government initiatives such as Jan Dhan Yojana aim to achieve financial inclusion by promoting access to banking services for all. Financial technology (fintech) companies are also contributing to financial inclusion through innovative digital solutions. | ||

| 6 | ||

| Foreign Direct Investment (FDI) in India | ||

|---|---|---|

| India has witnessed significant inflows of FDI, contributing to the growth of the economy. FDI is allowed in various sectors, subject to certain regulations and guidelines. The government has implemented reforms to attract more FDI and improve the ease of doing business in India. | ||

| 7 | ||

| Government Initiatives for Financial Sector Development | ||

|---|---|---|

| The Indian government has introduced several initiatives to develop the financial sector, such as the Pradhan Mantri Jan-Dhan Yojana (PMJDY) and the Insolvency and Bankruptcy Code (IBC). These initiatives aim to enhance financial inclusion, strengthen the banking system, and promote investor confidence. The government's Digital India campaign is driving the adoption of digital financial services and promoting a cashless economy. | ||

| 8 | ||

| Challenges and Opportunities | ||

|---|---|---|

| The Indian financial structure faces challenges like non-performing assets (NPAs), corporate governance issues, and regulatory complexities. However, there are immense opportunities for growth, especially in areas like digital banking, fintech innovation, and infrastructure financing. The ongoing reforms and policies are expected to address the challenges and unlock the full potential of the Indian financial sector. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| The Indian financial structure is a dynamic and evolving ecosystem, supporting the country's economic growth. The sector encompasses various institutions like banks, NBFCs, capital markets, and insurance companies. With government initiatives and ongoing reforms, the Indian financial structure is poised for further development and expansion. | ||

| 10 | ||

| References (download PPTX file for details) | ||

|---|---|---|

| Reserve Bank of India (RBI) website. [Insert ... Securities and Exchange Board of India (SEBI)... Insurance Regulatory and Development Authorit... |  | |

| 11 | ||