Heads Of Income Presentation

| Introduction to Heads of Income | ||

|---|---|---|

| Heads of income refer to the various categories under which income can be classified for taxation purposes. These categories help in determining the tax liability of individuals or entities. The classification of income into different heads is crucial for accurate reporting and assessment of taxes. | ||

| 1 | ||

| Head of Income - Salary | ||

|---|---|---|

| Salary is one of the most common heads of income for individuals. It includes income received as a salary, wages, commissions, bonuses, and any other monetary compensation for employment. Salary income is taxable under the head "Income from Salary" and is subject to deductions and exemptions as per tax laws. | ||

| 2 | ||

| Head of Income - Business or Profession | ||

|---|---|---|

| Income from a business or profession is another significant head of income. It includes income earned by individuals or entities engaged in a trade, profession, vocation, or any commercial activity. This category covers income from self-employment, partnerships, and proprietorships. | ||

| 3 | ||

| Head of Income - Capital Gains | ||

|---|---|---|

| Capital gains refer to the profits made on the sale of capital assets such as real estate, stocks, bonds, or mutual funds. These gains are categorized as short-term or long-term based on the holding period of the asset. Taxation of capital gains depends on the type and duration of the asset and the applicable tax laws. | ||

| 4 | ||

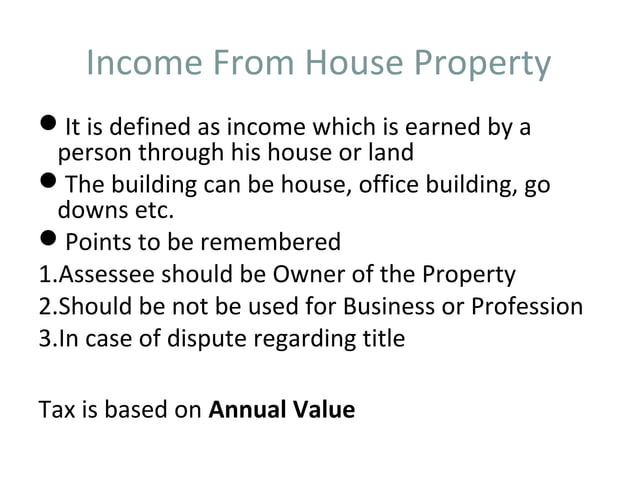

| Head of Income - House Property | ||

|---|---|---|

| Income from house property includes rental income from residential or commercial properties owned by individuals or entities. It also covers deemed rental income from properties that are not rented out but have the potential to generate income. Various deductions and exemptions are available under this head to calculate the taxable income. | ||

| 5 | ||

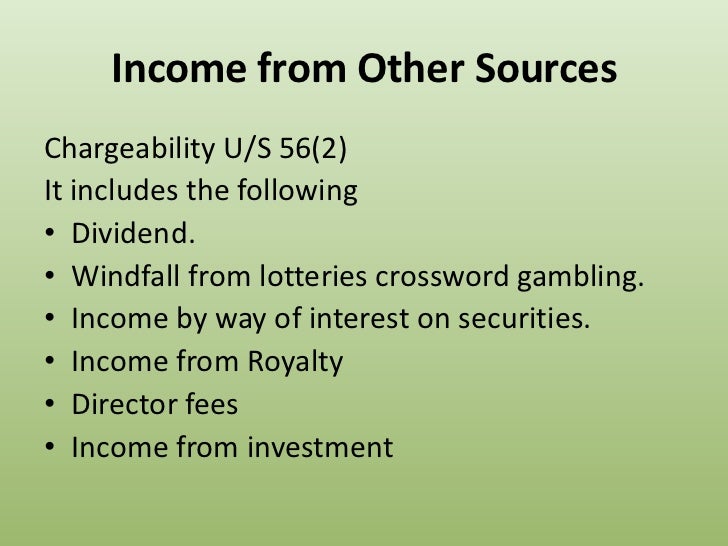

| Head of Income - Other Sources | ||

|---|---|---|

| Income from other sources encompasses all sources of income that do not fall under the previous heads. This includes interest income, dividends, winnings from lotteries or games, royalties, and any other income not specifically categorized elsewhere. Taxability and deductions for income from other sources may vary based on specific regulations. | ||

| 6 | ||

| Importance of Heads of Income | ||

|---|---|---|

| Proper classification of income into different heads is essential for accurate tax assessment. It helps in determining the tax rates, deductions, exemptions, and other provisions applicable to each category. Understanding the heads of income ensures compliance with tax laws and minimizes the risk of penalties or legal issues. | ||

| 7 | ||

| Conclusion | ||

|---|---|---|

| Heads of income play a crucial role in determining the tax liability of individuals and entities. By categorizing income into different heads, accurate reporting and assessment of taxes are achieved. It is essential to understand the specific regulations and provisions applicable to each head of income for proper tax planning and compliance. | ||

| 8 | ||