GSTR 9 Presentation

| Introduction to GSTR 9 | ||

|---|---|---|

| GSTR 9 is an annual return form under the Goods and Services Tax (GST) system in India. It is applicable to regular taxpayers, including businesses, who are registered under GST. The return is a consolidation of all the monthly/ quarterly returns filed during the financial year. | ||

| 1 | ||

| Objective of GSTR 9 | ||

|---|---|---|

| The main objective of GSTR 9 is to provide a summarized view of the taxpayer's activities for the financial year. It ensures that the taxpayer's records are in sync with the GST returns filed throughout the year. GSTR 9 helps in reconciling and rectifying any discrepancies in the reported turnover, input tax credit, and tax liability. | ||

| 2 | ||

| Types of GSTR 9 | ||

|---|---|---|

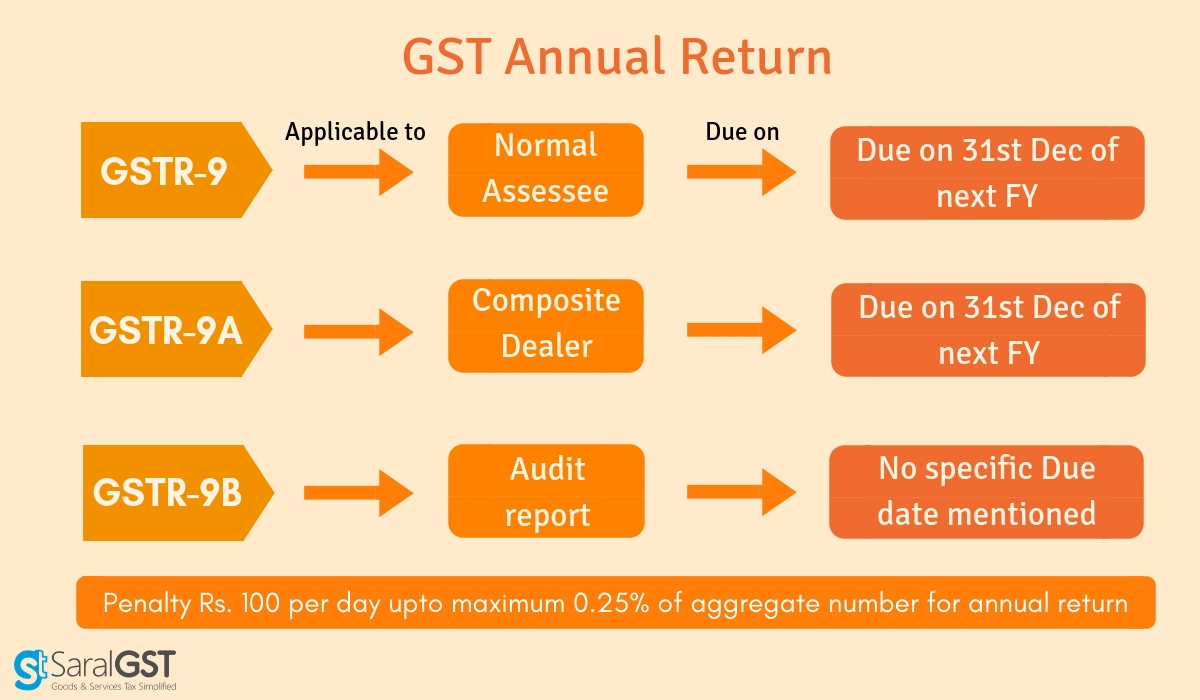

| GSTR 9: This is the regular GSTR 9 form applicable to most taxpayers. GSTR 9A: This is for composition scheme taxpayers. GSTR 9C: This is a reconciliation statement and certification for taxpayers above a certain turnover threshold. | ||

| 3 | ||

| Filing Due Date and Penalty | ||

|---|---|---|

| The due date for filing GSTR 9 is usually 31st December of the subsequent financial year. Late filing of GSTR 9 may attract a penalty of Rs. 100 per day of delay, subject to a maximum limit. Non-filing or incorrect filing of GSTR 9 can lead to compliance issues and scrutiny by the tax authorities. | ||

| 4 | ||

| Components of GSTR 9 | ||

|---|---|---|

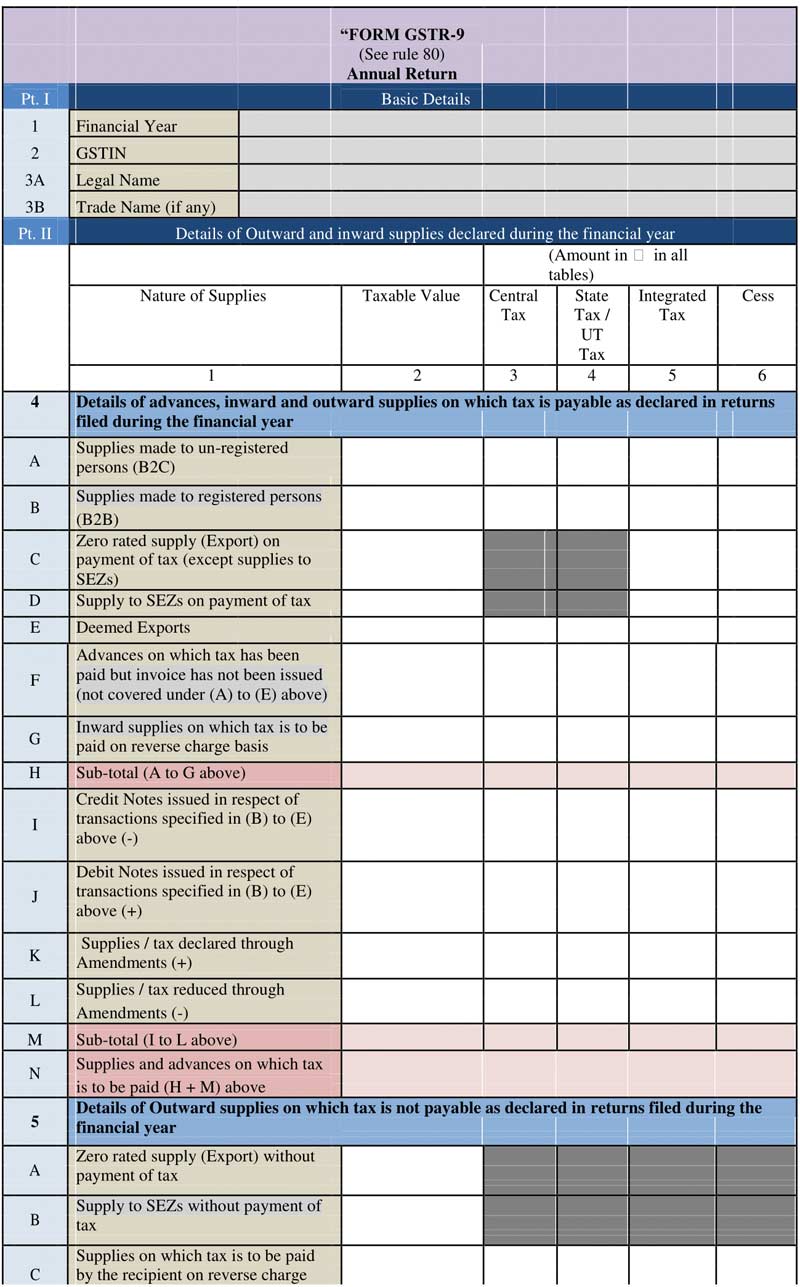

| Part I: Basic details of the taxpayer, financial year, and turnover details. Part II: Consolidated information of outward and inward supplies, including amendments. Part III: Details of input tax credit availed, reversed, and ineligible credits. | ||

| 5 | ||

| Important Points to Note | ||

|---|---|---|

| GSTR 9 is an annual return and needs to be filed even if there are no transactions during the financial year. It is essential to reconcile the figures in GSTR 9 with the monthly/ quarterly returns filed. Any discrepancies found should be rectified in subsequent returns or through GSTR 9C, if applicable. | ||

| 6 | ||

| Benefits of Filing GSTR 9 | ||

|---|---|---|

| GSTR 9 helps in identifying any missed out or incorrect reporting of transactions. It ensures compliance with GST laws and regulations, reducing the risk of penalties or scrutiny. Filing GSTR 9 provides a clear and transparent view of the taxpayer's financial activities to the tax authorities. | ||

| 7 | ||

| Common Challenges in Filing GSTR 9 | ||

|---|---|---|

| Gathering and reconciling data from various sources can be time-consuming and complex. Understanding the different components and ensuring accurate reporting can be challenging for taxpayers. Identifying and rectifying discrepancies in input tax credit and turnover figures may require additional effort. | ||

| 8 | ||

| Tips for Smooth GSTR 9 Filing | ||

|---|---|---|

| Maintain proper books of accounts and records throughout the financial year for easy reconciliation. Regularly reconcile GST returns with books of accounts to ensure accuracy. Seek professional assistance, if required, to understand and comply with the requirements of GSTR 9. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| GSTR 9 is a crucial component of GST compliance for regular taxpayers in India. Filing GSTR 9 accurately and on time helps in maintaining transparency and avoiding penalties. It is essential to understand the various components and reconcile data to ensure smooth filing of GSTR 9. | ||

| 10 | ||