GST Council Presentation

| Introduction to GST Council | ||

|---|---|---|

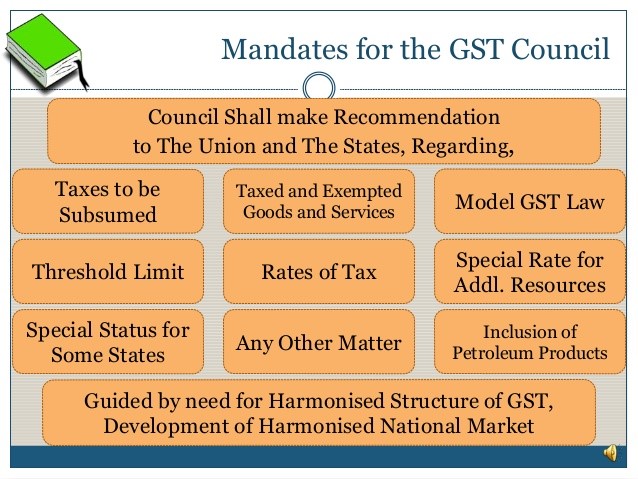

| The GST Council is a constitutional body comprised of the Union Finance Minister and Finance Ministers of all the states. It was formed to make decisions regarding Goods and Services Tax (GST) in India. The council meets periodically to discuss and make recommendations on important GST-related issues. | ||

| 1 | ||

| Composition of GST Council | ||

|---|---|---|

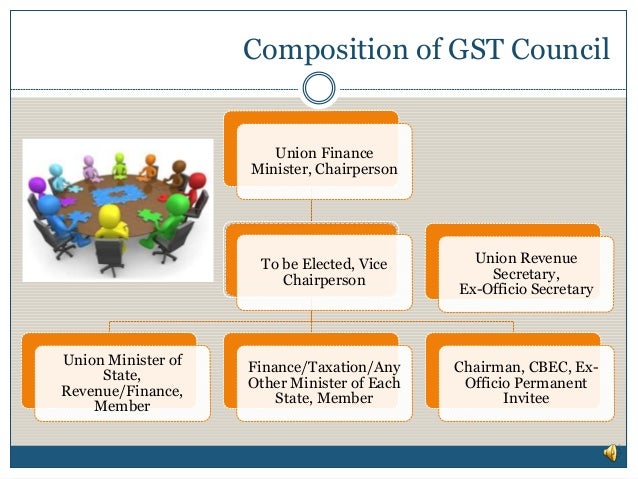

| The council is chaired by the Union Finance Minister. The Union Minister of State for Finance and State Finance Ministers are members of the council. The council also includes representatives from Union Territories with legislatures. | ||

| 2 | ||

| Functions of GST Council | ||

|---|---|---|

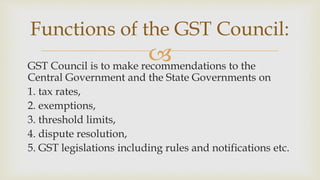

| The primary function of the council is to recommend tax rates, exemptions, and thresholds. It decides on the division of tax revenue between the central and state governments. The council also resolves any disputes that may arise between the center and the states regarding GST implementation. | ||

| 3 | ||

| Decision-Making Process | ||

|---|---|---|

| The council takes decisions on GST matters through a voting process. Each member has one vote, and decisions require a three-fourth majority to be approved. The Union Government and State Governments together have a weighted vote share of 75% while Union Territories have a vote share of 25%. |  | |

| 4 | ||

| GST Council Meetings | ||

|---|---|---|

| The council meets at least once every quarter. Extraordinary meetings can be called if there is a need. The meetings are chaired by the Union Finance Minister, and all decisions are recorded in the minutes of the meeting. | ||

| 5 | ||

| Role in GST Rate Changes | ||

|---|---|---|

| The council plays a crucial role in deciding changes to the GST rates. It analyzes the revenue trends, tax collections, and economic factors before recommending any rate adjustments. The council aims to strike a balance between revenue generation and consumer affordability. | ||

| 6 | ||

| Recent Achievements | ||

|---|---|---|

| The GST Council has successfully introduced several reforms to simplify the GST process. It has reduced tax rates on various goods and services to promote consumption and economic growth. The council has implemented measures to improve compliance and reduce tax evasion. | ||

| 7 | ||

| Conclusion | ||

|---|---|---|

| The GST Council is a vital institution in the implementation and management of GST in India. It ensures a cooperative federalism approach by involving both the central and state governments in decision-making. The council's efforts have led to a more streamlined and efficient indirect tax system in the country. | ||

| 8 | ||