E Banking Presentation

| Introduction to E banking | ||

|---|---|---|

| E banking refers to the electronic delivery of banking services through digital platforms. It allows customers to perform various banking activities conveniently and securely from their electronic devices. E banking has gained popularity due to its convenience, accessibility, and time-saving features. | ||

| 1 | ||

| Benefits of E banking | ||

|---|---|---|

| E banking provides 24/ 7 access to banking services, allowing customers to manage their finances anytime and anywhere. It offers convenience by eliminating the need to visit physical bank branches for routine transactions such as account balance inquiries or fund transfers. E banking enhances security through features like two-factor authentication, encryption, and monitoring systems, ensuring the safety of customer data and transactions. | ||

| 2 | ||

| Types of E banking services | ||

|---|---|---|

| Online banking: Customers can access their accounts, view transactions, pay bills, transfer funds, and apply for loans through a bank's website or mobile app. Mobile banking: Customers can perform banking activities using their smartphones or tablets, including mobile check deposits, person-to-person payments, and account alerts. ATM banking: Automated Teller Machines allow customers to withdraw cash, deposit checks or cash, transfer funds, and check account balances. | ||

| 3 | ||

| E banking features | ||

|---|---|---|

| Account management: Customers can view account balances, transaction histories, and statements online, making it easier to track and manage their finances. Fund transfers: E banking enables customers to transfer funds between their own accounts, to other bank accounts, or to payees using electronic funds transfer methods. Bill payment: Customers can conveniently pay bills online, schedule recurring payments, and receive electronic bill notifications. | ||

| 4 | ||

| E banking security measures | ||

|---|---|---|

| Secure login: E banking platforms require customers to use strong passwords and often implement additional security measures such as multifactor authentication. Encryption: E banking systems encrypt customer data to protect it from unauthorized access or interception during transmission. Fraud monitoring: Banks employ sophisticated monitoring systems to detect and prevent fraudulent activities, providing an additional layer of security for customers. | ||

| 5 | ||

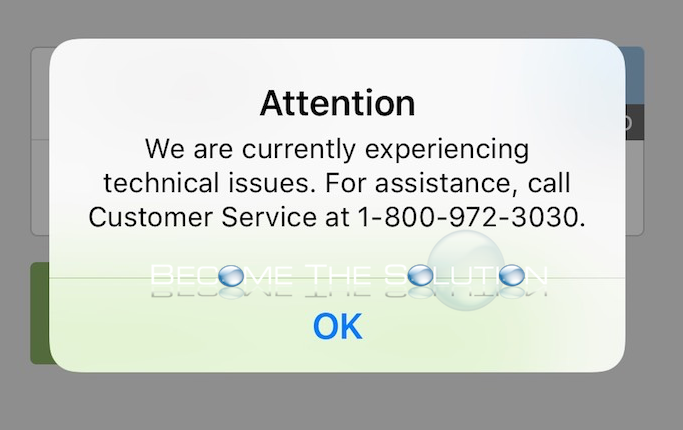

| Challenges of E banking | ||

|---|---|---|

| Technical issues: Customers may encounter technical glitches or system downtime that could affect their ability to access banking services. Security risks: Despite robust security measures, there is always a risk of cyber threats such as phishing, malware, or data breaches. Digital divide: Not all individuals have access to the necessary technology or internet connectivity required for e banking, leading to a digital divide. | ||

| 6 | ||

| Future trends in E banking | ||

|---|---|---|

| Mobile wallet integration: E banking is likely to integrate with mobile wallets, allowing customers to make payments using their smartphones. Artificial intelligence: Banks may leverage AI technology for personalized customer experiences, fraud detection, and virtual assistants. Blockchain technology: E banking could explore the use of blockchain for secure and transparent transactions, reducing the need for intermediaries. | ||

| 7 | ||

| Conclusion | ||

|---|---|---|

| E banking has revolutionized the banking industry, providing customers with convenient access to a wide range of banking services. Despite some challenges, the benefits of e banking, such as 24/ 7 accessibility and enhanced security, make it an increasingly popular choice for customers. As technology continues to advance, the future of e banking holds exciting possibilities for further innovation and improvement. | ||

| 8 | ||

:max_bytes(150000):strip_icc()/iStock-682395884.tashka2000.online.banking-5c6c9639c9e77c00018ccac8.jpg)