Cost Of Dept Presentation

| Introduction to Cost of Debt | ||

|---|---|---|

| The cost of debt refers to the interest expense incurred by a company when it borrows funds. It is an important metric used by investors and analysts to assess a company's financial health. The cost of debt is influenced by factors such as interest rates, credit rating, and market conditions. | ||

| 1 | ||

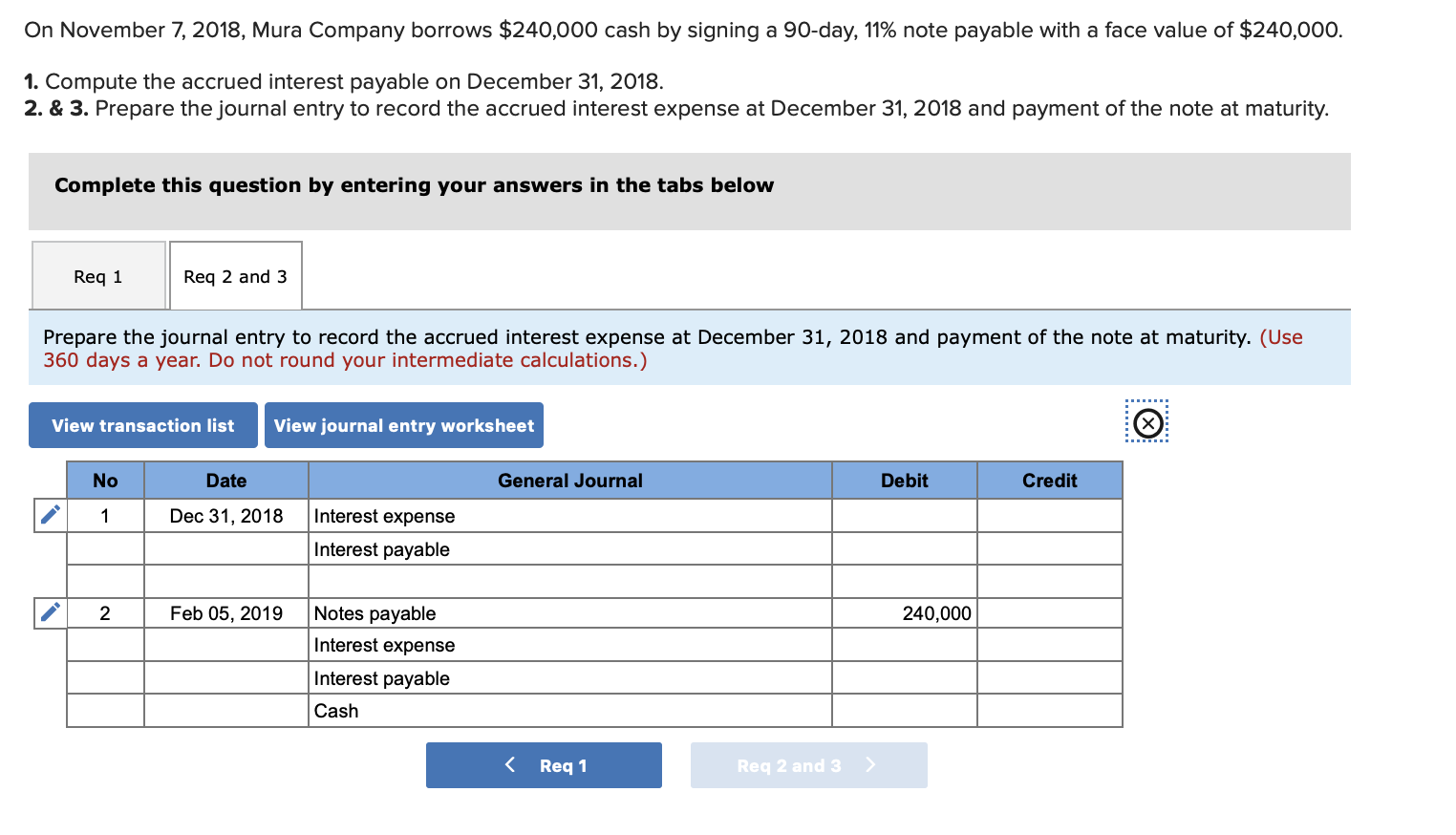

| Calculation of Cost of Debt | ||

|---|---|---|

| The cost of debt can be calculated by dividing the interest expense by the average debt outstanding. Alternatively, it can be estimated by comparing the yield on a company's existing debt to similar risk investments. The cost of debt is typically expressed as a percentage or an interest rate. | ||

| 2 | ||

| Importance of Cost of Debt | ||

|---|---|---|

| The cost of debt provides insight into a company's ability to manage its debt obligations. It helps investors assess the risk associated with a company's debt and determine its creditworthiness. The cost of debt also impacts a company's weighted average cost of capital (WACC) and overall valuation. | ||

| 3 | ||

| Factors Influencing Cost of Debt | ||

|---|---|---|

| Interest rates: Higher interest rates increase the cost of debt, while lower rates reduce it. Credit rating: A higher credit rating allows a company to borrow at lower interest rates, lowering its cost of debt. Market conditions: Market demand for debt securities and overall economic conditions can impact the cost of debt. | ||

| 4 | ||

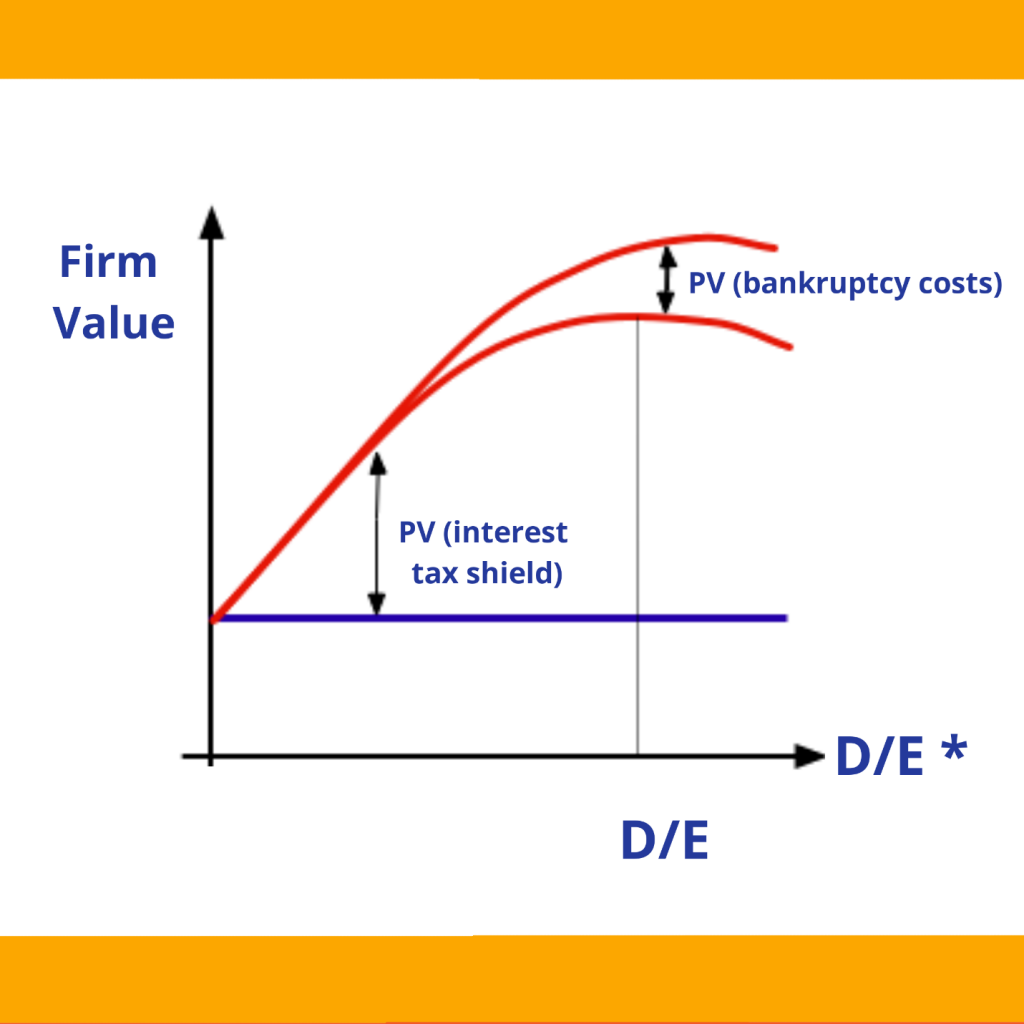

| Comparison with Cost of Equity | ||

|---|---|---|

| The cost of debt is typically lower than the cost of equity, as debt is considered less risky for investors. Unlike equity, debt holders have a fixed claim on a company's assets and cash flows, reducing their risk. Companies often strive for an optimal mix of debt and equity to minimize their overall cost of capital. | ||

| 5 | ||

| Impact of Cost of Debt on Financial Performance | ||

|---|---|---|

| Higher cost of debt increases interest expenses, potentially reducing a company's profitability. It can limit a company's ability to invest in growth opportunities or pay dividends to shareholders. A lower cost of debt allows a company to save on interest expenses, improving its financial performance. | ||

| 6 | ||

| Managing the Cost of Debt | ||

|---|---|---|

| Companies can manage their cost of debt by improving their credit rating through sound financial management and timely debt repayments. Negotiating lower interest rates with lenders or refinancing existing debt at more favorable terms can also reduce the cost of debt. Maintaining a healthy debt-to-equity ratio and managing overall debt levels can help optimize the cost of debt. | ||

| 7 | ||

| Conclusion | ||

|---|---|---|

| The cost of debt is a critical financial metric that impacts a company's profitability, creditworthiness, and overall financial performance. Understanding and managing the cost of debt is essential for companies to maintain a healthy financial position and attract investors. Continuously monitoring and optimizing the cost of debt can help companies reduce interest expenses and improve their bottom line. | ||

| 8 | ||