Capital Budgeting Presentation

| Introduction to Capital Budgeting | ||

|---|---|---|

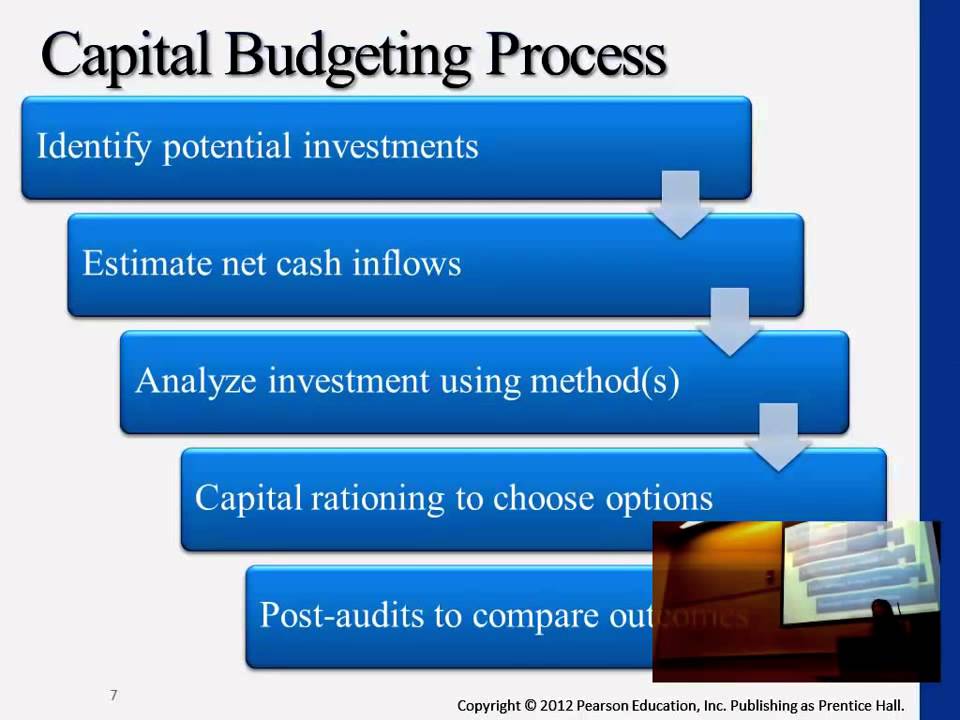

| Capital budgeting is the process of evaluating and selecting long-term investment projects. It involves analyzing the cash flows and profitability of potential investments. The goal is to maximize the value of the firm by investing in projects with positive net present value (NPV). | ||

| 1 | ||

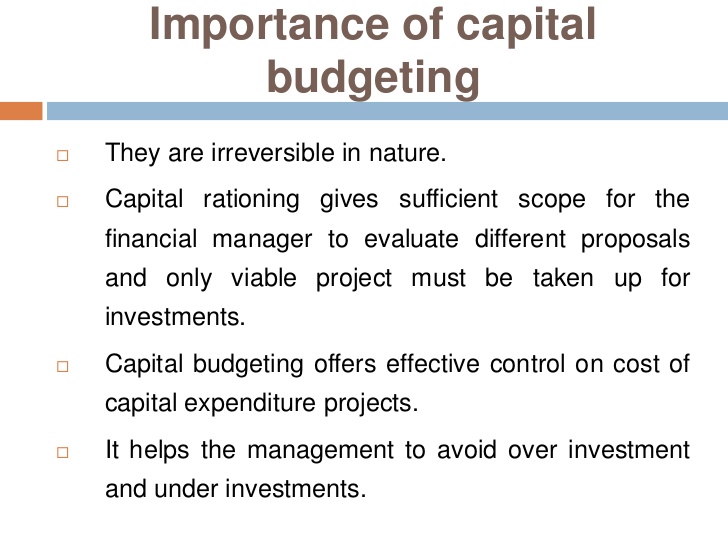

| Importance of Capital Budgeting | ||

|---|---|---|

| Capital budgeting helps in making informed investment decisions. It ensures optimal allocation of resources by prioritizing projects. It helps in achieving long-term sustainability and growth for the company. | ||

| 2 | ||

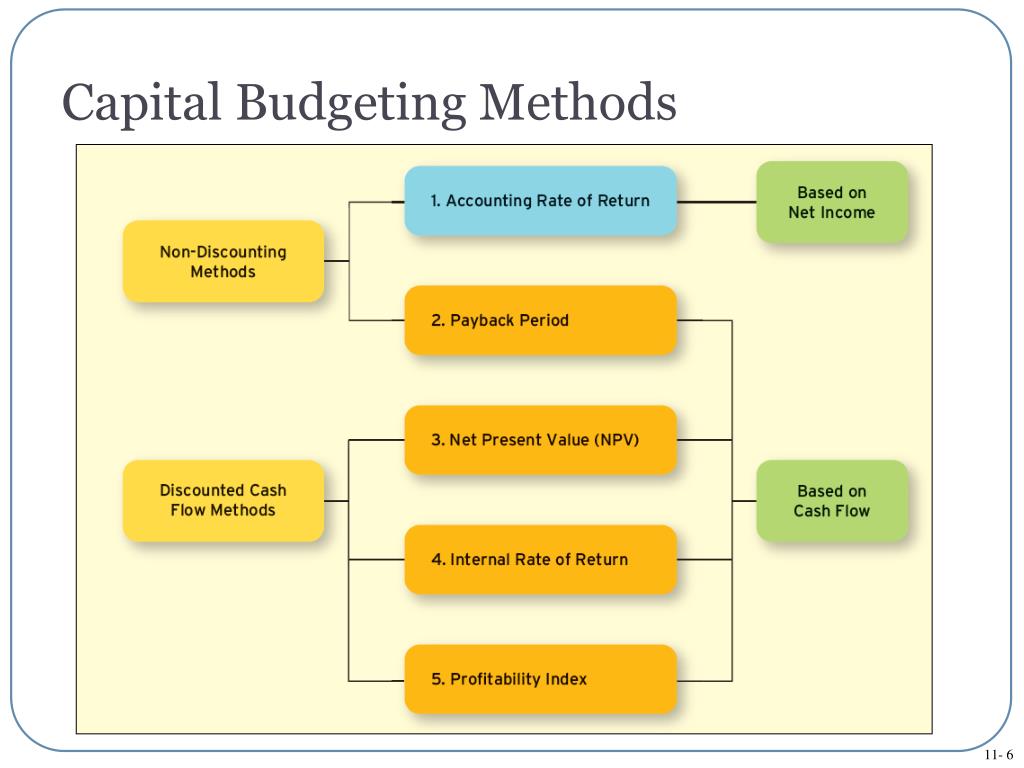

| Methods of Capital Budgeting | ||

|---|---|---|

| Payback period: It measures the time required to recover the initial investment. Net Present Value (NPV): It calculates the present value of cash inflows and outflows. Internal Rate of Return (IRR): It is the discount rate at which NPV becomes zero. | ||

| 3 | ||

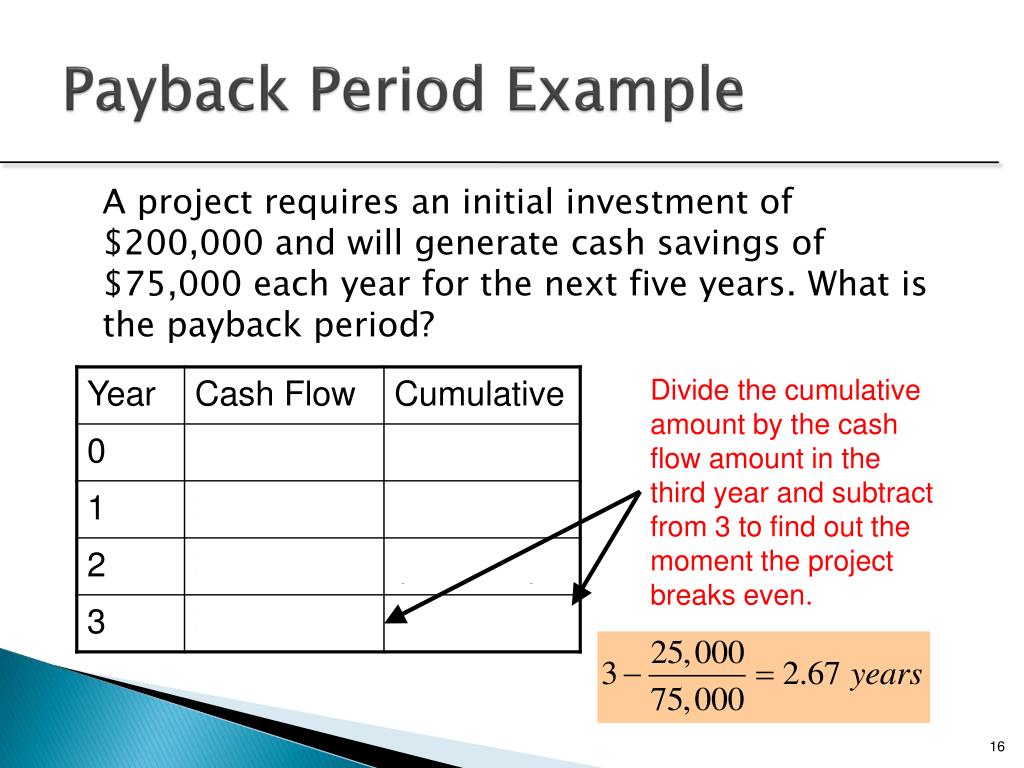

| Payback Period | ||

|---|---|---|

| Payback period is simple and easy to understand. It focuses on the recovery of initial investment. However, it ignores cash flows beyond the payback period and does not consider the time value of money. | ||

| 4 | ||

| Net Present Value (NPV) | ||

|---|---|---|

| NPV takes into account the time value of money. It considers all cash flows over the project's life. Positive NPV indicates profitability and value creation. | ||

| 5 | ||

| Internal Rate of Return (IRR) | ||

|---|---|---|

| IRR calculates the discount rate at which NPV equals zero. It represents the project's profitability. Projects with higher IRR are preferred as they generate higher returns. | ||

| 6 | ||

| Capital Budgeting Techniques Comparison | ||

|---|---|---|

| Payback period is quick but does not consider the time value of money. NPV considers the time value of money and all cash flows. IRR is useful for comparing projects but may have multiple solutions. | ||

| 7 | ||

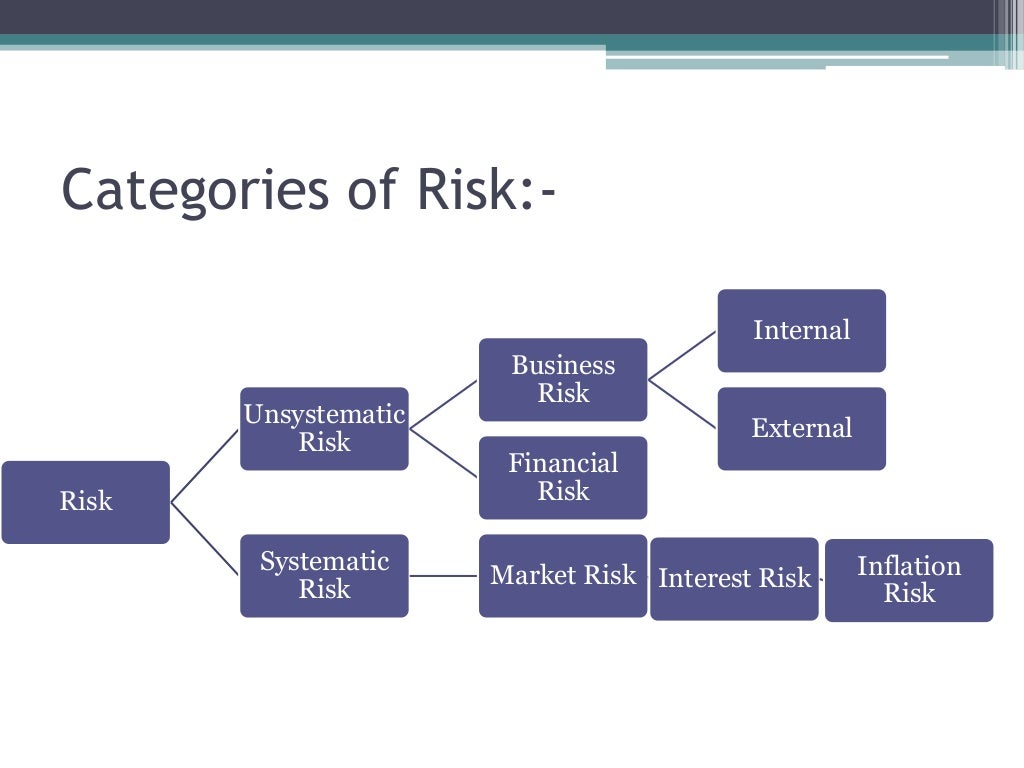

| Risk Analysis in Capital Budgeting | ||

|---|---|---|

| Capital budgeting involves assessing project risks. Sensitivity analysis evaluates the impact of changes in key variables. Scenario analysis considers different scenarios and their potential outcomes. | ||

| 8 | ||

| Capital Rationing | ||

|---|---|---|

| Capital rationing occurs when a company has limited funds for investment. It requires prioritizing projects based on their profitability and strategic importance. The goal is to select projects that maximize the firm's value within the budget constraints. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Capital budgeting is a crucial process for making long-term investment decisions. It helps in allocating resources wisely and maximizing the value of the firm. By considering various methods and risk analysis, companies can make informed decisions for sustainable growth. | ||

| 10 | ||