Approaches To Corporate Valuation Presentation

| Introduction to Approaches to Corporate Valuation | ||

|---|---|---|

| Corporate valuation is the process of determining the worth of a company. Various approaches can be used to determine the value of a company. The choice of approach depends on the purpose of valuation and the availability of information. | ||

| 1 | ||

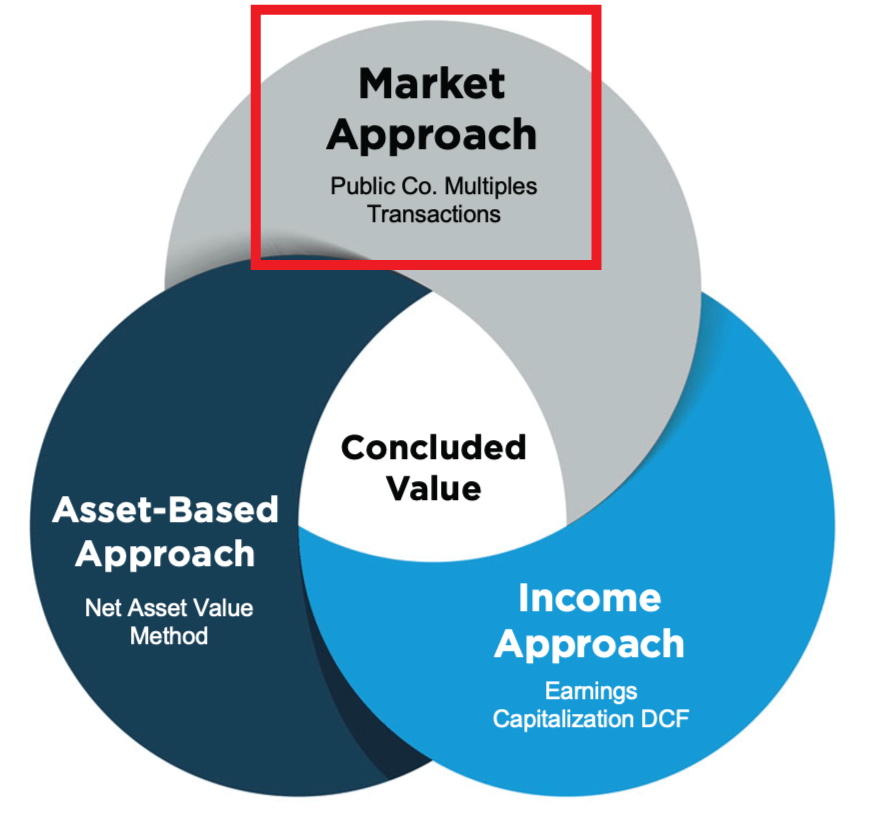

| Market-Based Approaches | ||

|---|---|---|

| Market-based approaches rely on market prices and information. Comparable company analysis compares the target company with similar publicly traded companies. Precedent transaction analysis examines the value of similar companies in recent acquisition deals. | ||

| 2 | ||

| Income-Based Approaches | ||

|---|---|---|

| Income-based approaches focus on the company's ability to generate future cash flows. Discounted Cash Flow (DCF) analysis estimates the present value of future cash flows. Earnings Multiples approach uses a multiple of earnings to determine the company's value. | ||

| 3 | ||

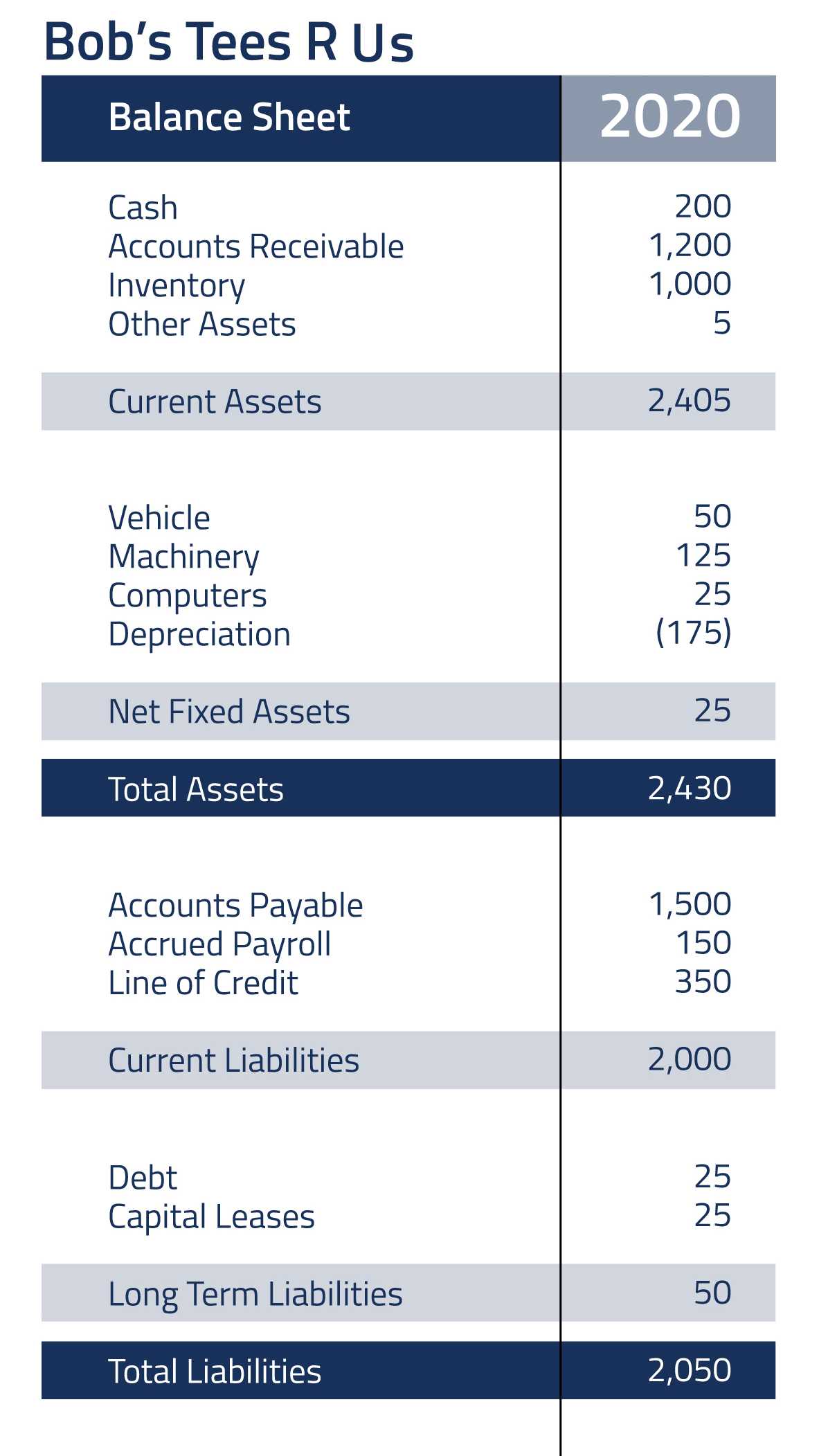

| Asset-Based Approaches | ||

|---|---|---|

| Asset-based approaches focus on the company's tangible and intangible assets. Book Value method calculates the value based on the company's net assets. Replacement Cost method estimates the cost to replace the company's assets. | ||

| 4 | ||

| Weighted Average Cost of Capital (WACC) | ||

|---|---|---|

| WACC is a commonly used method in corporate valuation. It considers the cost of debt and equity to determine the company's overall cost of capital. WACC is used in DCF analysis to discount future cash flows. | ||

| 5 | ||

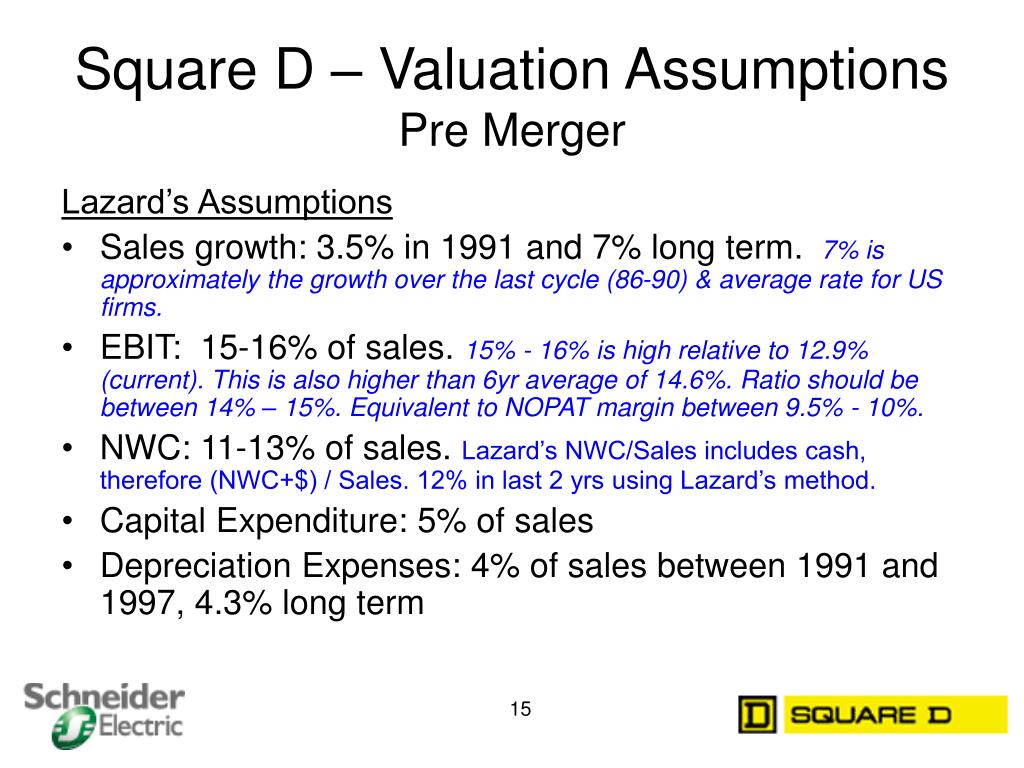

| Adjustments and Assumptions | ||

|---|---|---|

| Valuation approaches require adjustments and assumptions. Adjustments are made to account for differences between the target company and comparable companies. Assumptions are necessary to forecast future cash flows and estimate growth rates. | ||

| 6 | ||

| Combination of Approaches | ||

|---|---|---|

| Valuation often involves using a combination of approaches. Different approaches can provide a more comprehensive view of the company's value. The combination of approaches can help validate the valuation results. | ||

| 7 | ||

| Limitations and Challenges | ||

|---|---|---|

| Valuation is subject to limitations and challenges. It relies on assumptions and forecasts which may not be accurate. Market conditions and economic factors can also impact the valuation results. | ||

| 8 | ||

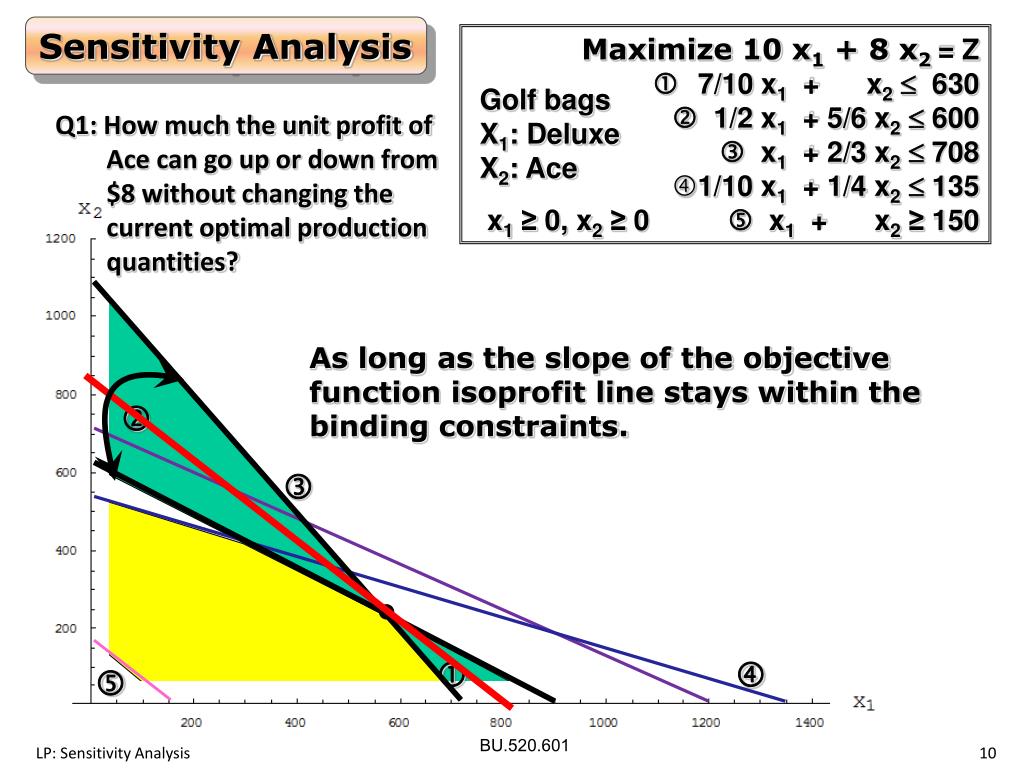

| Sensitivity Analysis | ||

|---|---|---|

| Sensitivity analysis helps assess the impact of changes in key variables on the valuation. It provides a range of possible values based on different scenarios. Sensitivity analysis enhances the understanding of the valuation's sensitivity to various inputs. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Corporate valuation is a complex process with various approaches available. The choice of approach depends on the purpose of valuation and the available data. A combination of approaches and sensitivity analysis can provide a more robust valuation. | ||

| 10 | ||

| References (download PPTX file for details) | ||

|---|---|---|

| Damodaran, A. (2012). Investment valuation: T... Pratt, S. P., Reilly, R. F., & Schweihs, R. P... McKinsey & Company. (2020). Corporate Valuati... |  | |

| 11 | ||