ATM Security Using Eye And Facial Recognition System Presentation

| Introduction to ATM Security Using Eye and Facial Recognition System | ||

|---|---|---|

| Eye and facial recognition technology is revolutionizing ATM security. This advanced system enhances the security of ATM transactions. It provides a more secure and convenient experience for ATM users. | ||

| 1 | ||

| How Eye and Facial Recognition Works | ||

|---|---|---|

| Eye and facial recognition technology captures and analyzes unique biometric features. The system compares these features with the stored data of authorized users. It uses algorithms to map and verify the identity of the person using the ATM. | ||

| 2 | ||

| Benefits of Eye and Facial Recognition in ATM Security | ||

|---|---|---|

| Enhanced security: Eye and facial recognition add an additional layer of security to ATM transactions. Eliminates the need for PINs and cards: Users can access their accounts using only their biometric information. Prevents identity theft: The unique biometric data cannot be easily forged or duplicated. | ||

| 3 | ||

| Improved Convenience for ATM Users | ||

|---|---|---|

| Faster transactions: Users can complete transactions without the need to remember PINs or carry cards. No more forgotten PINs: With eye and facial recognition, there is no risk of forgetting PINs or resetting them. Accessibility for visually impaired: The technology can be designed to accommodate visually impaired users. | ||

| 4 | ||

| Enhanced Security Measures | ||

|---|---|---|

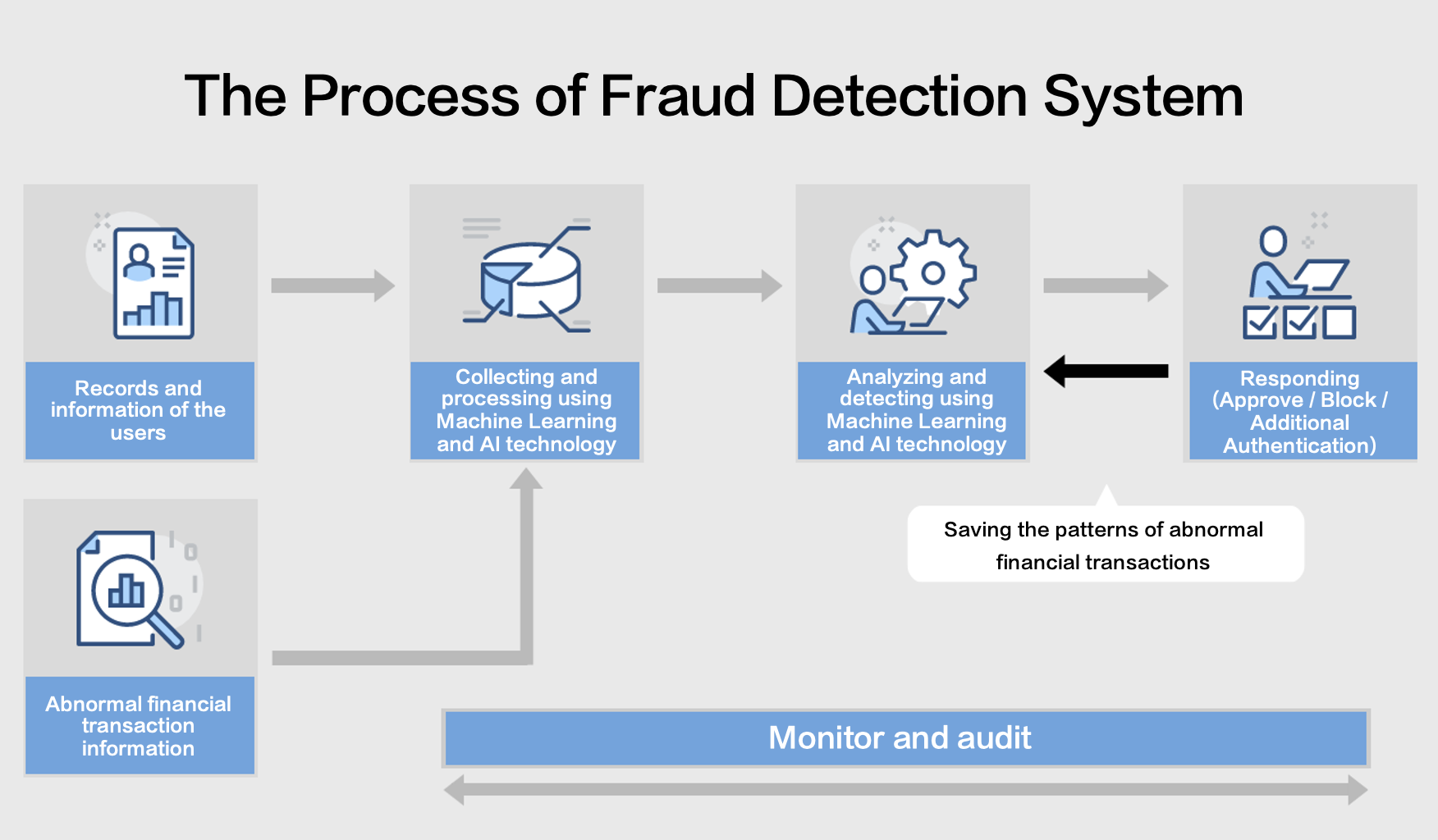

| Fraud detection: The system can detect suspicious patterns or behaviors, triggering additional security measures. Multi-factor authentication: Eye and facial recognition can be combined with other security measures for stronger authentication. Real-time monitoring: The technology allows for real-time monitoring of ATM transactions, enabling immediate response to suspicious activities. | ||

| 5 | ||

| Challenges and Concerns | ||

|---|---|---|

| Privacy concerns: Some individuals may have concerns about the collection and storage of biometric data. False positives/ negatives: The system may occasionally fail to recognize authorized users or mistakenly identify unauthorized individuals. Cost and implementation: Implementing eye and facial recognition technology requires significant investment and infrastructure updates. | ||

| 6 | ||

| Successful Implementations | ||

|---|---|---|

| Citibank: Citibank has successfully implemented eye and facial recognition in some of its ATMs for enhanced security. HSBC: HSBC has also adopted eye and facial recognition technology at its ATMs to provide a more secure banking experience. Bank of America: Bank of America has incorporated this technology to prevent card skimming and identity theft. | ||

| 7 | ||

| Future Developments | ||

|---|---|---|

| Continuous advancements: Eye and facial recognition technology will continue to evolve with new features and improved accuracy. Integration with mobile devices: Eye and facial recognition may be integrated with mobile banking apps for seamless authentication. Expansion to other industries: The technology may find applications in other industries beyond banking, such as retail and healthcare. | ||

| 8 | ||

| Conclusion | ||

|---|---|---|

| ATM security is being significantly enhanced with the introduction of eye and facial recognition technology. This advanced system offers improved security, convenience, and fraud detection capabilities. As technology continues to advance, eye and facial recognition will play an increasingly vital role in securing ATM transactions. | ||

| 9 | ||

| References (download PPTX file for details) | ||

|---|---|---|

| Citibank. (n.d.). ATM and Branch Locator. Ret... HSBC. (n.d.). ATM Locations. Retrieved from h... Bank of America. (n.d.). ATM and Branch Locat... |  | |

| 10 | ||