A Study On Internal Audit Procedures Presentation

| Introduction to Internal Audit Procedures | ||

|---|---|---|

| Internal audit procedures are systematic processes designed to assess and evaluate a company's internal controls and operations. These procedures help identify areas of risk and provide recommendations for improvement. The study aims to analyze various internal audit procedures and their effectiveness in enhancing organizational governance. | ||

| 1 | ||

| Importance of Internal Audit Procedures | ||

|---|---|---|

| Internal audit procedures help ensure compliance with laws, regulations, and internal policies. They provide assurance to stakeholders regarding the accuracy and reliability of financial statements. Internal audit procedures also help identify operational inefficiencies and potential areas of fraud or misconduct. | ||

| 2 | ||

| Key Components of Internal Audit Procedures | ||

|---|---|---|

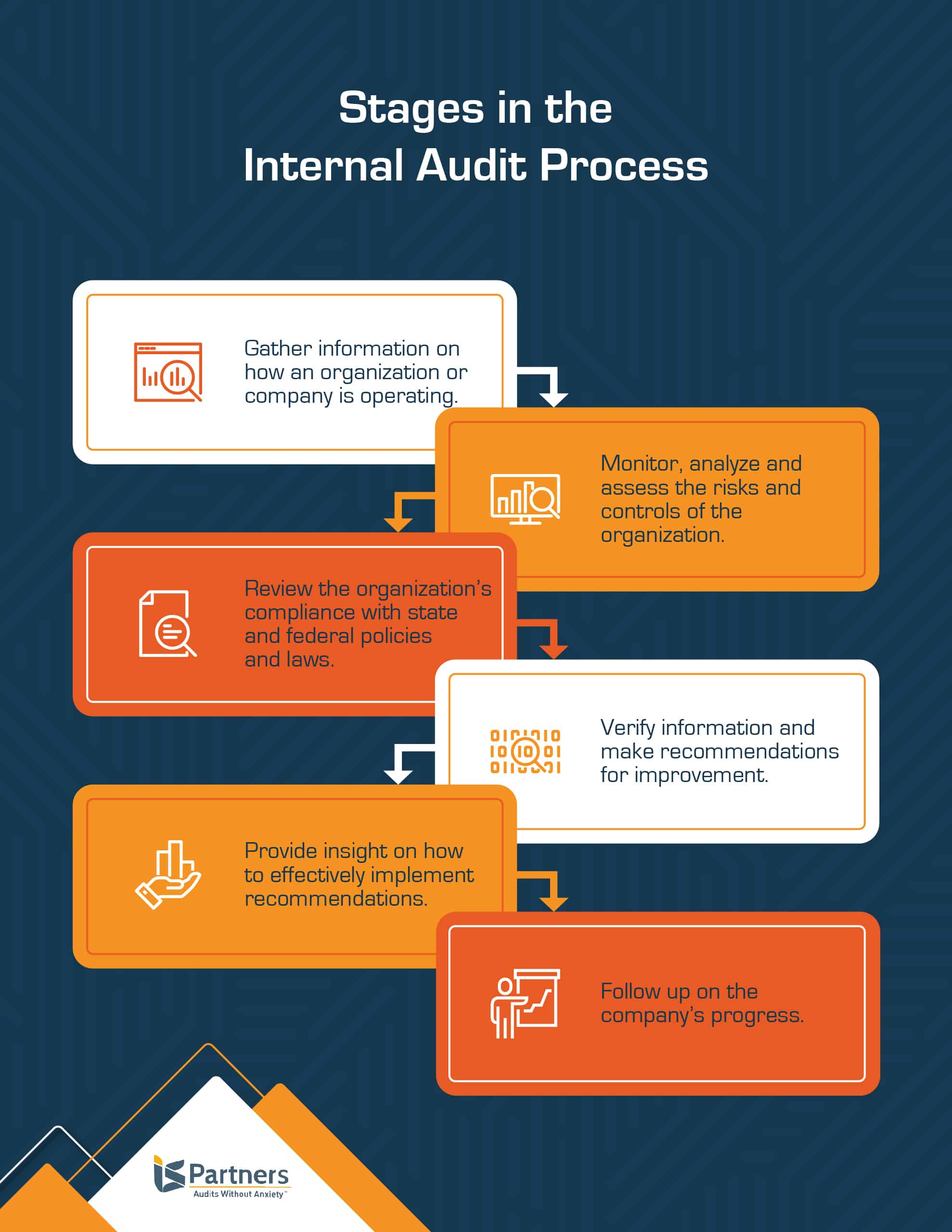

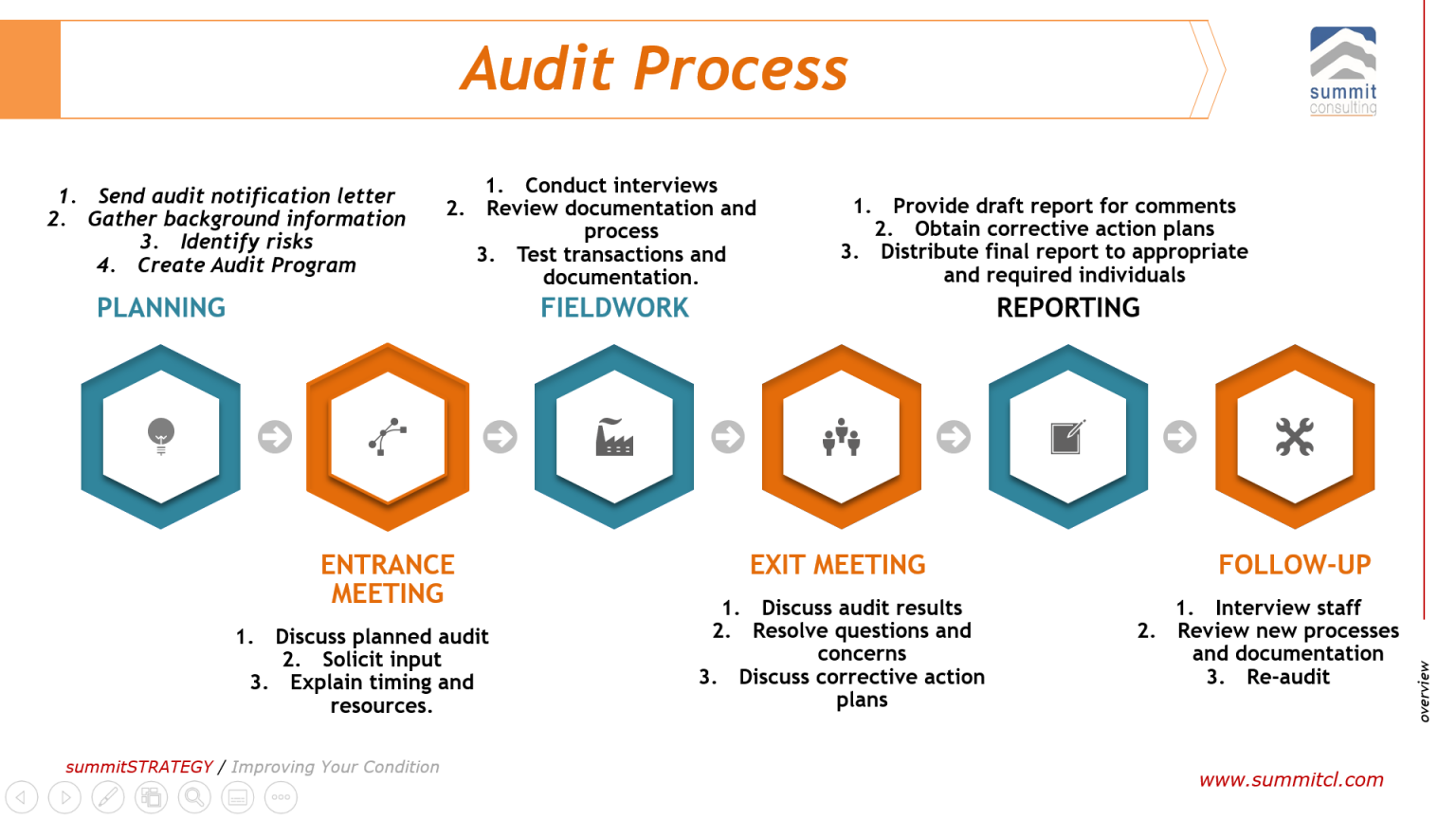

| Planning: Defining the scope, objectives, and resources required for the audit. Fieldwork: Collecting and analyzing data, conducting interviews, and testing controls. Reporting: Communicating findings, recommendations, and management responses to stakeholders. | ||

| 3 | ||

| Types of Internal Audit Procedures | ||

|---|---|---|

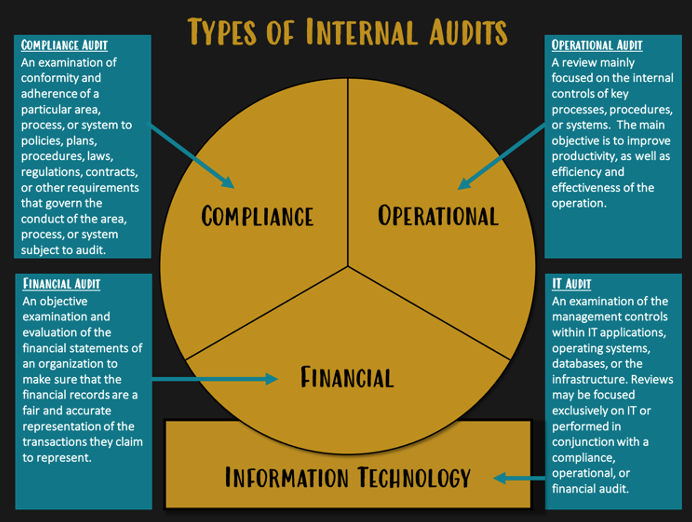

| Financial Audits: Focusing on financial statements, transactions, and internal controls. Operational Audits: Assessing the efficiency and effectiveness of operational processes. Compliance Audits: Evaluating adherence to laws, regulations, and internal policies. | ||

| 4 | ||

| Common Techniques Used in Internal Audit Procedures | ||

|---|---|---|

| Sampling: Selecting a representative portion of data for testing. Observation: Directly observing processes and controls in action. Documentation Review: Evaluating policies, procedures, and supporting documents. | ||

| 5 | ||

| Challenges in Conducting Internal Audit Procedures | ||

|---|---|---|

| Limited resources and time constraints may hinder comprehensive audits. Resistance from employees or management may impede access to necessary information. Constantly evolving regulations and industry practices require continuous learning and adaptation. | ||

| 6 | ||

| Best Practices in Internal Audit Procedures | ||

|---|---|---|

| Establishing strong communication and collaboration with management. Utilizing data analytics to identify patterns and anomalies. Conducting periodic risk assessments to prioritize audit activities. | ||

| 7 | ||

| Benefits of Effective Internal Audit Procedures | ||

|---|---|---|

| Enhanced corporate governance and risk management. Improved operational efficiency and effectiveness. Increased stakeholder confidence and trust in the organization. | ||

| 8 | ||

| Case Study: Successful Implementation of Internal Audit Procedures | ||

|---|---|---|

| Company X implemented robust internal audit procedures, resulting in better financial controls and reduced fraud instances. The company experienced improved operational efficiency, leading to cost savings and increased profitability. Stakeholders praised the transparency and reliability of financial statements, boosting investor confidence. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Internal audit procedures play a crucial role in ensuring organizational governance, risk management, and compliance. Understanding the key components, types, and techniques of internal audit procedures is essential for effective implementation. Continuous improvement and adaptation to evolving challenges and best practices are key for successful internal audit procedures. | ||

| 10 | ||