A Study Of Capital Budgeting Presentation

| Introduction to Capital Budgeting | ||

|---|---|---|

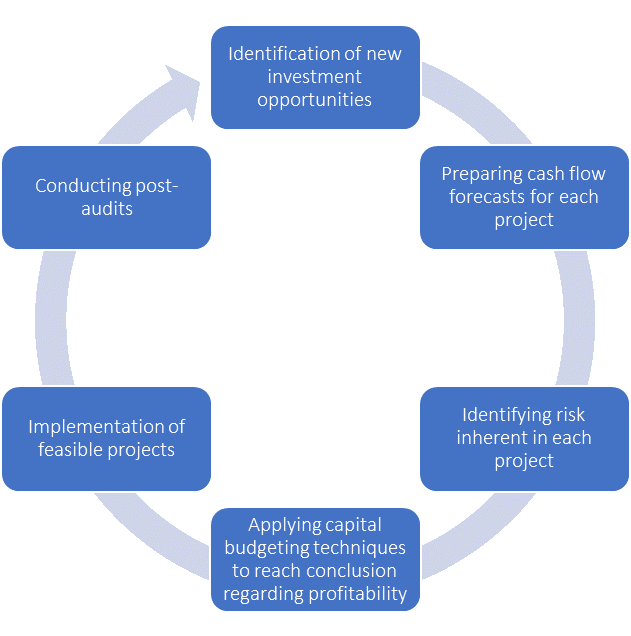

| Capital budgeting is the process of evaluating and selecting long-term investment projects. It involves analyzing potential cash flows, risks, and returns to determine the value of an investment. The goal of capital budgeting is to allocate resources efficiently and maximize shareholder wealth. | ||

| 1 | ||

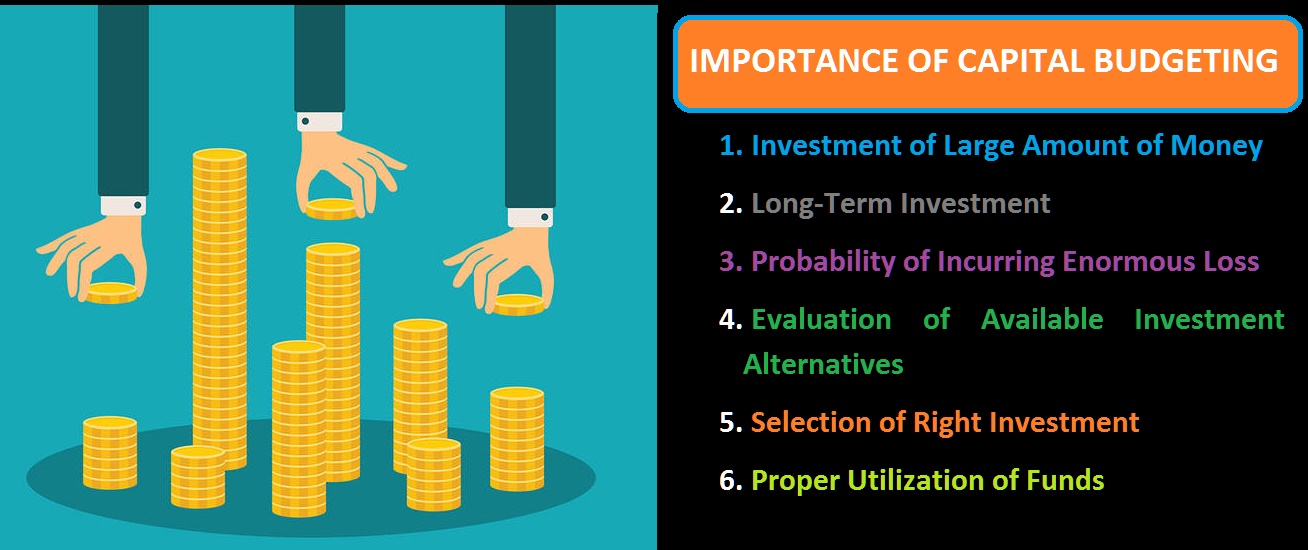

| Importance of Capital Budgeting | ||

|---|---|---|

| Capital budgeting helps organizations make informed investment decisions. It enables firms to prioritize projects based on their potential profitability and strategic fit. Effective capital budgeting ensures the allocation of resources to projects with the highest return on investment. | ||

| 2 | ||

| Methods of Capital Budgeting | ||

|---|---|---|

| The Payback Period method measures the time required to recoup the initial investment. The Net Present Value method calculates the present value of expected cash flows. The Internal Rate of Return method determines the discount rate at which the project's NPV is zero. | ||

| 3 | ||

| Payback Period Method | ||

|---|---|---|

| The Payback Period method focuses on the time it takes to recover the initial investment. Projects with shorter payback periods are typically considered less risky. It is a simple method but fails to consider the time value of money. | ||

| 4 | ||

| Net Present Value Method | ||

|---|---|---|

| The Net Present Value method discounts future cash flows to their present value. It considers the time value of money and provides a more accurate measure of project profitability. Projects with positive NPVs are considered financially viable. | ||

| 5 | ||

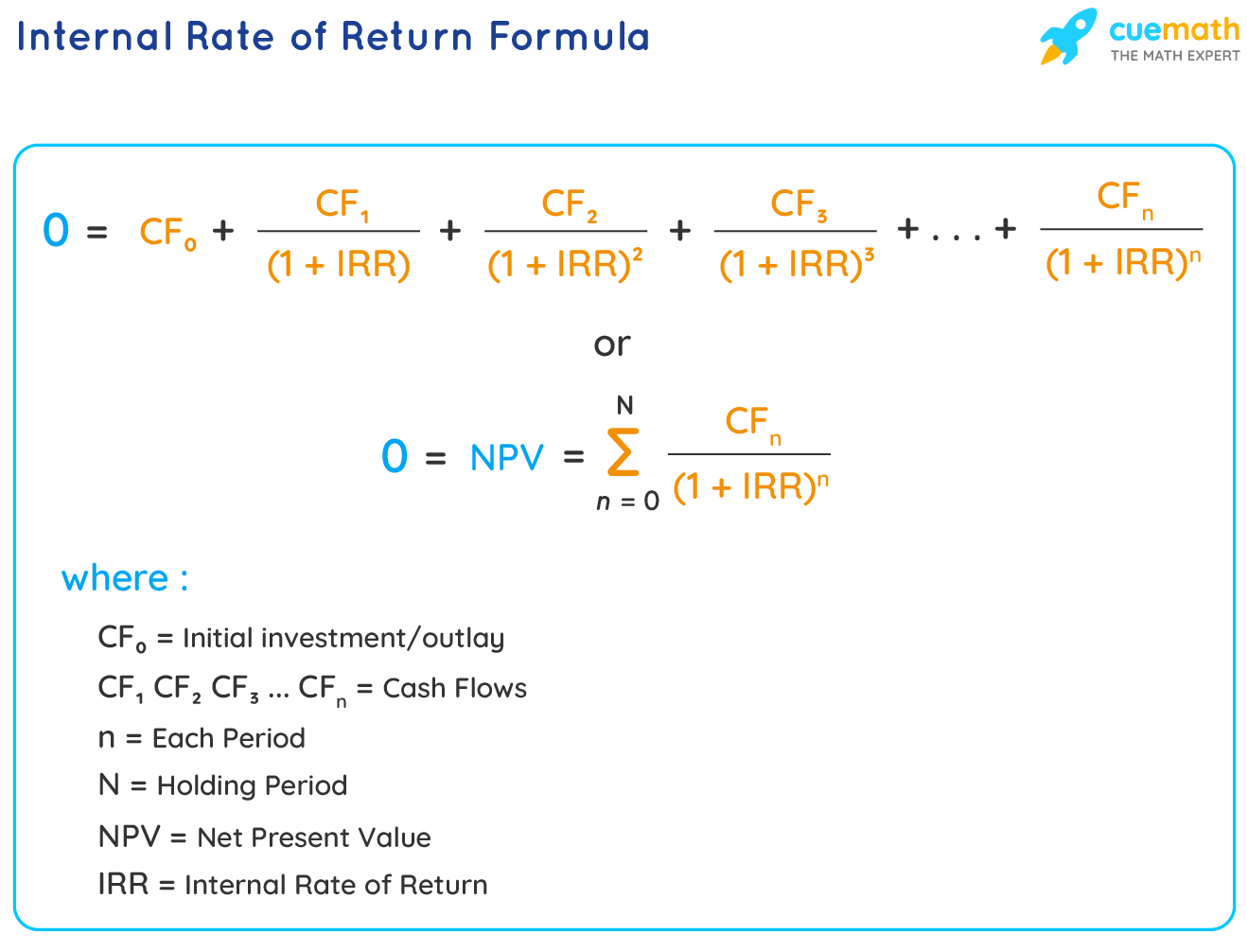

| Internal Rate of Return Method | ||

|---|---|---|

| The Internal Rate of Return method calculates the discount rate at which the project's NPV is zero. It measures the return generated by the project. Projects with higher IRRs are generally more desirable. | ||

| 6 | ||

| Capital Budgeting Challenges | ||

|---|---|---|

| Forecasting cash flows accurately can be challenging, leading to potential errors in decision-making. Estimating the appropriate discount rate is subjective and can impact the evaluation of projects. Capital budgeting decisions often involve uncertainty and risk, requiring careful analysis and consideration. | ||

| 7 | ||

| Real Options in Capital Budgeting | ||

|---|---|---|

| Real options refer to the flexibility to adapt or modify investment decisions in response to changing market conditions. Real options analysis can enhance traditional capital budgeting methods by considering future investment opportunities. It allows for more strategic decision-making in uncertain environments. | ||

| 8 | ||

| Capital Budgeting Best Practices | ||

|---|---|---|

| Make realistic cash flow projections based on thorough market research and analysis. Consider the time value of money by using an appropriate discount rate. Regularly review and update capital budgeting decisions to ensure alignment with changing business conditions. | ||

| 9 | ||

| Conclusion | ||

|---|---|---|

| Capital budgeting is a critical process for organizations to allocate resources effectively. It involves evaluating investment projects based on their potential cash flows, risks, and returns. By using best practices and considering real options, firms can make informed and strategic capital budgeting decisions. | ||

| 10 | ||

| References (download PPTX file for details) | ||

|---|---|---|

| Graham, J. R., Smart, S. B., & Megginson, W. ... Brealey, R. A., Myers, S. C., & Allen, F. (20... Ross, S. A., Westerfield, R. W., & Jordan, B.... |  | |

| 11 | ||